Cryptos Return to Gains Aided by Improved Sentiment

- Written by: Sam Coventry

-

Above: Investor sentiment has improved following a boost to Fed easing expectations. Image © Adobe Images.

Cryptocurrencies continue to recover from recent lows, helped by a renewed sense the Federal Reserve will cut interest rates in 2024.

Bitcoin and other cryptocurrencies came under pressure in April after markets suspected the next move at the Fed could be an interest rate hike, owing to persistently high inflation numbers, but last week's Fed update and softer-than-expected U.S. jobs data prompted markets to lower odds of a such a move.

In fact, the timing of the first rate cut has since been brought forward from December to September, which will ease financial market conditions and boost 'risk on' assets, such as crypto.

"Most cryptocurrencies are returning to gains, led by Bitcoin, which rose by 1% at 7:30 a.m. GMT, within the sideways path that the markets have been following since the weekend," says Samer Hasn, Market Analyst at XS.com.

"Most experts are confident that the growth of the BTC price will resume in the near future, and if some problems are solved, the growth can be impressively huge," says Linda Larsen, an analyst at Godex.

Looking ahead, sentiment will likely remain in the driving seat for the crypto market.

Image courtesy of Berenberg Bank.

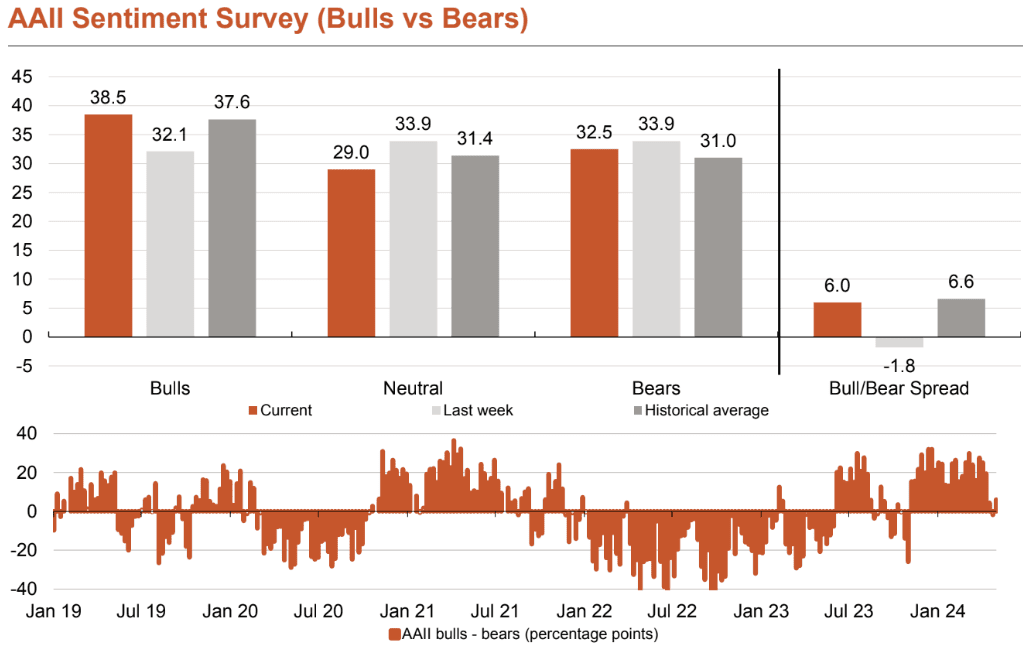

The American Association of Individual Investors's regular sentiment survey shows sentiment among US private investors is currently neither particularly optimistic nor particularly pessimistic.

"While the bears were still slightly in the majority last week, the bulls are now back, albeit to a much lesser extent than in recent months. Currently, the bull/bear spread is roughly in line with the historical average," says a note from Berenberg Bank.

"The economic environment appears fundamentally positive for risk assets. However, the markets had already priced in very favourable economic and earnings prospects at the end of March," adds the note.

Should optimism improve from here, cryptos can find themselves better supported.

The macroeconomic assessment related to Federal Reserve interest rates will likely remain the central driver of cryptocurrency valuations in the near term; however, regulatory pressures are also weighing.

Sentiment eased amid reports of possible enforcement moves by the Securities and Exchange Commission (SEC) against Robinhood's crypto arm.

This was in light of the recent disclosure issued by Robinhood, which spoke of the receipt of a Wells notices, which indicates that the authority is close to launching an investigation and possible enforcement measures against the company.

"Therefore, the markets still need more clarity of vision about the future path, especially after the violent fluctuations that we witnessed and the return of fears about the expanding scope of regulatory measures that the SEC is continuously taking against crypto companies," says Hasn.

Robinhood says the company had worked at length with the authority previously regarding its offers of cryptocurrencies.

Hasn notes the SEC has also delayed a decision to launch the Invesco Galaxy spot Ethereum ETF, while the SEC is expected to reject several other applications this month.

"However, it seems that the markets are already preparing for such steps, in light of the recent measures taken by the Authority in an apparent attempt to classify Ethereum as securities," he explains.