Bitcoin's Looming Supply Squeeze to Maintain Upside Pressure According to Swiss Bank

- Written by: Sam Coventry

-

Manuel Villegas, an economist at Julius Baer, unveils insights into the surging cryptocurrency market, highlighting the pivotal role of US-listed Bitcoin spot ETFs in driving unprecedented growth.

Villegas' research indicates that robust inflows into these ETFs have not only offset outflows from legacy wrappers but have also propelled prices to levels unseen since 2021.

In recent weeks, net inflows into U.S. spot ETFs approached staggering daily averages of USD 500 million, before stabilising around USD 180 million.

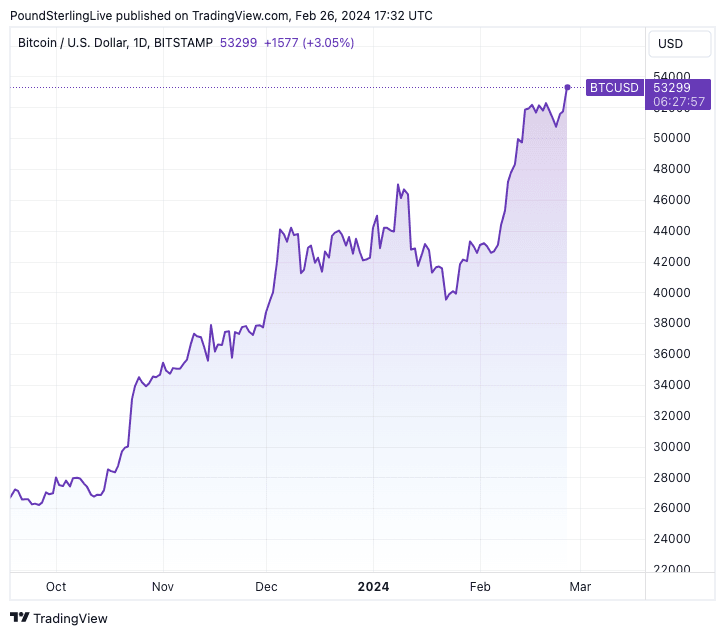

Above: Bitcoin price in USD at daily intervals.

The most significant impact of Bitcoin ETFs may be their role in bridging the gap between traditional financial markets and the cryptocurrency world. For many investors, direct investment in cryptocurrencies can seem daunting due to their volatility, the complexity of digital wallets, and security concerns. Bitcoin ETFs offer a familiar, regulated, and more accessible investment alternative," says Karina Alford, at crypto payment gateway NOWPayments.

Despite a recent decrease in net inflows, Villegas notes that these continue to far exceed outflows from legacy products, amassing a cumulative USD 5.7 billion. Moreover, the decreasing outflow rate from legacy products suggests a shifting market dynamic favouring ETFs.

The influx of funds into ETFs is particularly significant when juxtaposed with Bitcoin's daily supply growth, which currently stands at approximately 930 Bitcoins.

Villegas emphasises that the daily average inflow into ETFs over the past 20 days is five times higher than the average supply growth, indicating intense demand pressure.

This, coupled with growing accumulation and low market depth, sets the stage for a potential supply squeeze.

Villegas underscores the advantages of the ETF market, including reduced implicit costs driven by narrower spreads, lower slippage, and minimised tracking errors. Notably, spreads and slippage in ETFs are even lower than some centralised exchanges, offering substantial benefits to investors.

Looking ahead, Villegas highlights the imminent role of miners in Bitcoin's near-term future, particularly with the upcoming halving expected by April 22, 2024.

The halving, which will reduce the block reward from 6.25 to 3.125 Bitcoins, will significantly slow supply growth. Villegas predicts that this could exacerbate supply pressure, leading to a heightened supply squeeze and further denting market depth.

Despite these challenges, Villegas remains optimistic about Bitcoin's fundamental backdrop, citing its strengthening use case as a store of value.

He anticipates further upside potential, especially amid expectations for a more favourable US monetary policy and increasing US dollar liquidity.