Investor Confidence in BTC Rally Grows: XS.com

- Written by: Samer Hasn, Market Analyst at XS.com

-

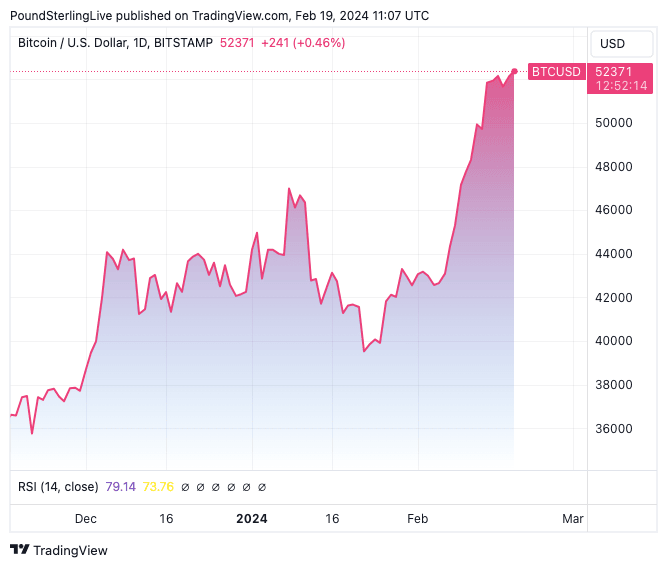

Bitcoin is trying to consolidate above the 52K level at the beginning of the new week, after recording the highest weekly close since November of 2021, which represents the fourth consecutive week of gains.

Bitcoin's gains came with positive net inflows of more than $2.2 billion during the past week, while outflows from GBTC continued to decline slightly to reach $624 million in the same period.

While the iShares Bitcoin Trust (IBIT) accounted for the largest share of these net flows, with $1.6 billion in positive net flows, it has recorded net flows of $5.2 billion since its launch, according to Bloomberg analysts.

In contrast, net outflows from the Grayscale Bitcoin Trust (GBTC) have reached more than 7 billion since the launch of the new ETFs. It recorded outflows of about $173 million on Friday alone, representing the highest level since the beginning of this February.

In conjunction with the improved performance of the new spot ETFs, Bitcoin was able to rush to the level of $52K for the first time since 2021, which may have led to the launch of waves of liquidations of long positions to take profits, of about $285 million over the last four days, according to data provided by CoinGlass.

Investors appear more confident that they can see further gains for cryptocurrencies, led by Bitcoin, with steadily increasing inflows into spot ETFs and relatively calm outflows from GBTC.

The approaching halving event, with the usual bullish implications, may also make investors more committed to their long positions.