Bitcoin Halving To Overshadow ETF Launch as Year's Biggest Price Event: XS.com

- Written by: Rania Gule, Market Analyst at XS.com.

-

Image © Adobe Stock

The Bitcoin ETF investment thesis has not played out as expected; Bitcoin has dropped by approximately 10% since the trading of ETFs started on January 11.

Could another major catalyst be coming this year, and is it possible for Bitcoin's price to reach new historical levels?

In my view, the disappointing part of the original Bitcoin ETF investment thesis is that the price did not rise in January.

While the new Bitcoin ETFs seem to have early success, all new purchases by Wall Street investors did not lift the Bitcoin price.

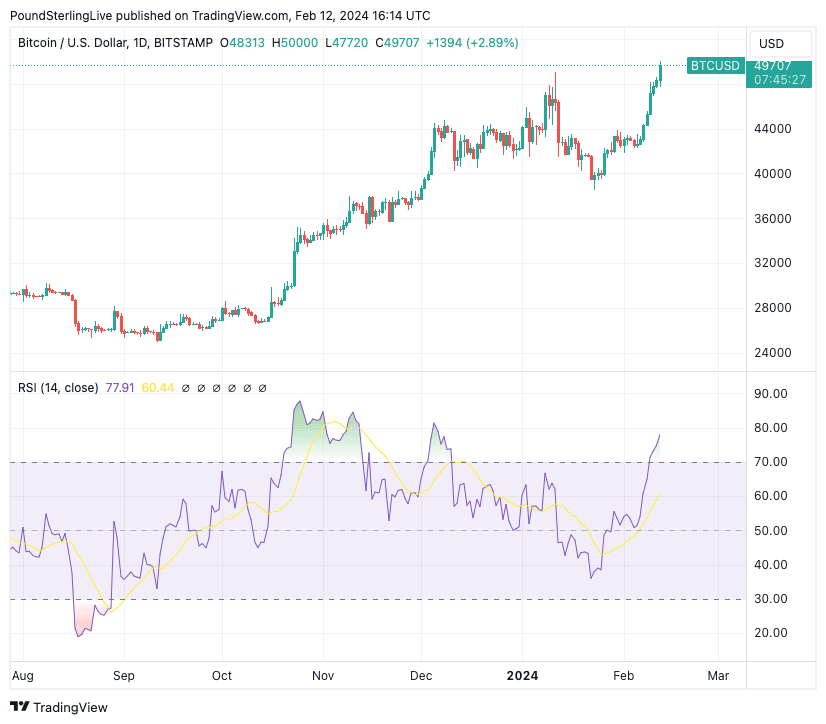

Above: Bitcoin is overbought short-term according to the Relative Strength Index (lower panel).

Investors seem to have shifted funds between investment products without a real change in their overall Bitcoin investment volume.

The extent of Bitcoin's rise this year depends significantly on the number of new investments in portfolios dedicated to cryptocurrencies. Assuming that 1% remains the general rule for most investors, reaching $100,000 may be harder than expected.

However, if markets are willing to flip things and shift this allocation percentage to 5%, 10%, or even 20%, Bitcoin could reach historical levels, although I consider this possibility less likely.

I believe the Bitcoin ETF story will not be the biggest event for Bitcoin this year. The long-awaited Bitcoin halving in April could bring a massive amount of liquidity to the cryptocurrency. Previous Bitcoin halving in 2012, 2016, and 2020 each led to significant price increases.

For example, the 2020 halving ultimately led Bitcoin to its all-time high of around $69,000.

So, will we see another all-time high for Bitcoin in 2024? Past historical performance does not guarantee future performance, so assuming that Bitcoin will rise again this time is risky. It may take 12 to 18 months for all gains from the halving event to materialize, meaning we might not see the true extent of Bitcoin's price increase until sometime in 2025, making long-term investment the safer option.

It seems highly logical to expect the Bitcoin price halving event to be extremely impactful. Cutting the mining reward paid by Bitcoin for adding a new block to the network in half, will have two important consequences. Firstly, it will enhance the relative scarcity of Bitcoin. Secondly, it will make Bitcoin more attractive over time. These two outcomes could make the Bitcoin price rise in the long term.

Based on the above, I expect Bitcoin's price to become less volatile over time. It will become more correlated with traditional asset classes, potentially leading to more stability in Bitcoin prices.

It could continue to rise in the long term, but I don't believe it has a chance of breaching the $100,000 level by the end of this year.