Two Scenarios Facing BTC Prices: XS.com

- Written by: Sam Coventry

-

Image © Adobe Images

There are two scenarios facing the price of Bitcoin (BTC) in the near-term, according to a new analysis from XS.com.

The developments come amidst a consolidation phase for the world's largest and most valuable cryptocurrency, with key drivers including a recent post-ETF approval selloff, an upcoming halving event and Federal Reserve interest rate policy.

"Market investors appear concerned because the Federal Reserve has not currently disclosed any plans to ease its monetary policy. In this scenario, Bitcoin and other risky assets may experience increased capital outflows in the medium and short term," says Rania Gule, Market Analyst at XS.com.

Bitcoin is now some 13.20% off its January 11 peak at $49048, but had been 21% lower on a peak-to-trough basis by January 23.

A significant portion of this selloff also relates to the FTX estate dumping its stake in Grayscale's Bitcoin ETF to compensate customers of the failed exchange.

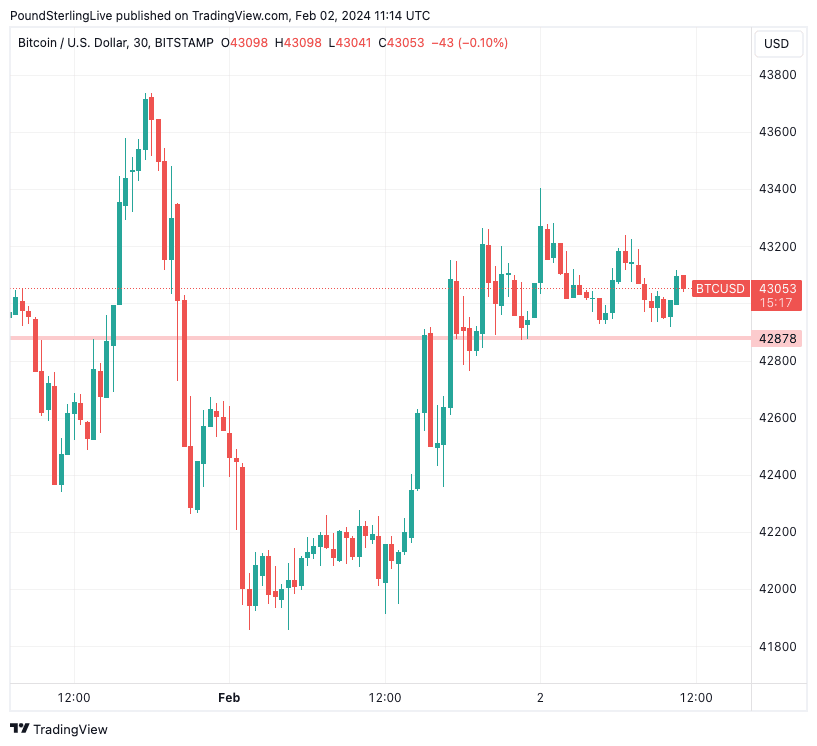

The price has since recovered to $43047 at the time of writing, suggesting the most significant impact of the redemptions has passed.

"Bitcoin is off the January lows as it attempts to consolidate the post-ETF approvement sell-off," says a note from MaxSwap, a crypto exchange in UK. "The Fed's reluctance to cut rates isn't helping."

Above: Bitcoin at daily intervals.

According to XS.com, Federal Reserve policy, coupled with the upcoming halving event and the approaching BTC on-chain metrics, are the key drivers of Bitcoin's short-term price.

"Due to the impact of 'sell the news' ahead of the expected halving event, Bitcoin's price currently does not show signs of a specific short-term bias, trading around $43,000," says Gule.

He explains there are two scenarios regarding the near-term direction of Bitcoin's price movement: either the upward trend continues after forming a strong support bottom at $38,505 on January 23, or a deep correction to a level between $36,000 and $34,000 occurs.

"The latter aims to form a peak at $48,662, coinciding with the halving event after approximately 90 days, followed by a reversal of the upward trend and the formation of new bottoms," says Gule.

In other cryptocurrency news, Ethereum developers successfully implemented the upgrade (Deneb-Cancun) on the second tenet of the system on January 17, resulting in a chain split within four hours.

The Securities and Exchange Commission could also approve Ethereum exchange-traded funds on May 23, "by which time the price of the second-largest cryptocurrency is expected to reach $4,000," says Gule.

He believes the regulatory body will follow the same strategy for Ethereum as it did with Bitcoin.

Elsewhere, Visa has entered into a partnership with Transak, a Web3 payment provider, to enable the conversion of cryptocurrencies into fiat money on bank cards.

"This service is available in more than 145 countries, supporting the development and strength of the cryptocurrency market and favouring a bullish scenario for Bitcoin in the medium and short term," says Gule.