Bitcoin In Fresh Advance on ETH ETF Hopes, Early-40Ks Potentially Next

- Written by: Sam Coventry

-

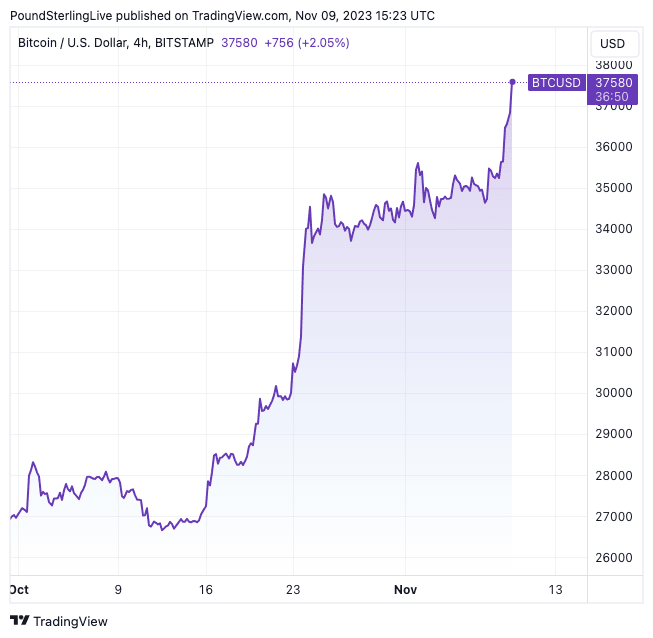

Above: BTC at four-hour intervals.

Bitcoin's value has increased 40% since mid-October, when a new buying impulse commenced, taking it to a new 18-month high on Thursday at $37361.

Driving the latest gains was news that the world's largest fund manager, Blackrock, was looking to launch another ETF product, this time for Ethereum.

The iShares Ethereum Trust was registered by Blackrock in Delaware; for context, the iShares Bitcoin Trust was registered in a similar manner 7 days before they filed the ETF application with the SEC.

Underscoring the advance are rising expectations for Federal Reserve interest rate cuts in 2024, bolstering risk sentiment and liquidity.

"Bitcoin prices have been picking up since markets saw a higher likelihood that the Federal Reserve has completed its rate hiking cycle," says a market note from Betpack.

`A new technical analysis meanwhile confirms the prospect of further advances, with gains potentially extending into the early 40Ks,

"Bitcoin has broken out of a long consolidation range and is approaching the next round level of $37K. The technical implementation of this pattern suggests a rise to $41-45K, depending on which point we choose as the start of the last impulse," says Alex Kuptsikevich, Senior Market Analyst at FxPro.

"The upper limit looks like a suitable target with a pivot point close to it," he adds.

Kuptsikevich notes that, despite Bitcoin's strong recovery since the beginning of the year, the supply of coins is extremely limited due to the actions of hoarders.

Many metrics that characterise "bitcoin inactivity" have reached historic highs, Glassnode noted.

Demand for the world's largest cryptocurrency continues to grow in anticipation of further institutional takeup.

"Heavyweight real-money managers such as Blackrock, Fidelity and Invesco have pressed ahead with filing SEC applications (and making preparations) for a spot bitcoin ETF, and Grayscale's GBTC is trading at a steadily diminishing discount in anticipation of it being allowed to transform itself into the same soon," says James Malcolm, an analyst at UBS.

"Little wonder some interest is re-emerging," he adds.

In new market developments, the European Banking Authority has launched a public consultation on capital and liquidity requirements for issuers of stablecoins and other digital tokens.

Elsewhere, Bloomberg reports that the USDC stablecoin issuer, Circle Internet Financial, is considering an IPO in early 2024.

Swiss cryptocurrency bank SEBA received a licence from the Hong Kong Securities and Futures Commission, allowing it to provide digital asset-related services to residents.

Exchange Binance announced the launch of Web3 Wallet, available to users via the platform's mobile app. The utility uses Multi-Party Computing technology, which splits private keys into three parts and stores them on different servers.