Bitcoin Leads the Field Higher as Crypto Market Capitalisation Surges

- Written by: Sam Coventry

-

Bitcoin and the broader cryptocurrency market experienced a notable surge in valuation over the past 24 hours, with Bitcoin driving the rally and altcoins following suit.

According to Alex Kuptsikevich, senior market analyst at FX Pro, the recent price action in Bitcoin indicates a bullish trend and provides insights into the market dynamics.

"The market capitalisation of cryptocurrencies rose 5.7% in the last 24 hours to 1,134 trillion. Bitcoin was the engine of growth, but buyers quickly expanded to some altcoins," says Kuptsikevich.

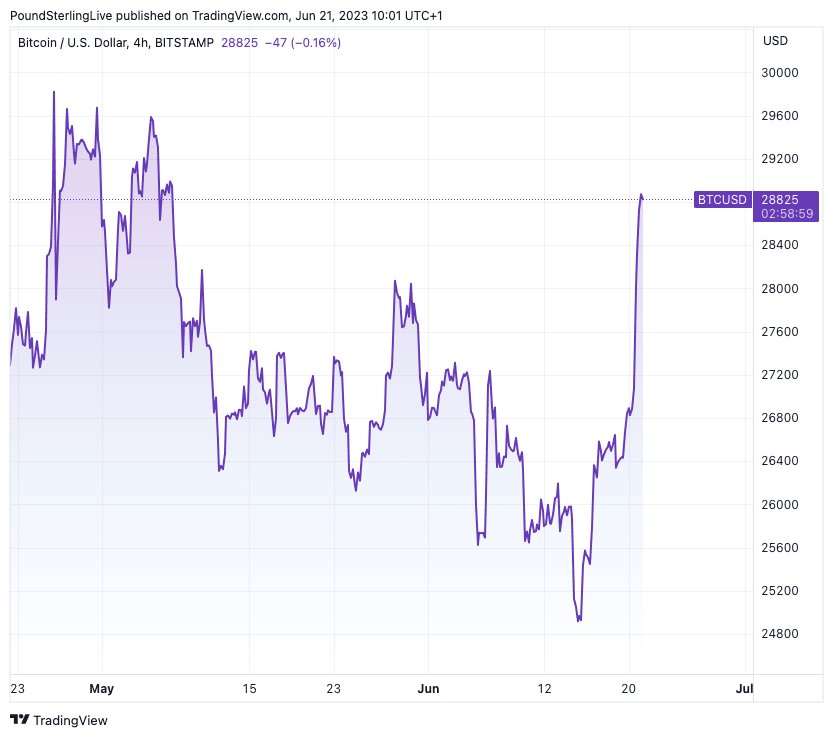

Above: Bitcoin at 4-hour intervals.

Bitcoin saw an impressive gain of 7.6% during this period, while Ethereum recorded a rise of 4.7%. Leading altcoins also experienced gains, ranging from 1.9% for XRP to 9.4% for Litecoin.

Kuptsikevich notes, "In terms of technical analysis, this is an important bullish signal as the price closed above its 50-day moving average and above previous local highs in a sharp move on Tuesday."

This breakthrough confirms the breakdown of the downtrend that persisted over the past two months. With this development, the next target for the bulls is the range between the April and May highs, estimated at $29,400 to $30,400.

The surge in Bitcoin's valuation coincides with significant developments within the cryptocurrency industry.

Kuptsikevich highlights BlackRock's intention to launch a spot ETF for Bitcoin, which has piqued institutional investor interest.

"BlackRock's plan to launch the crypto fund has boosted institutional investor interest in the cryptocurrency," states Kuptsikevich. Despite previous rejections by the Securities and Exchange Commission (SEC), this move signifies growing confidence in the crypto space.

Another factor influencing market dynamics is the anticipation of the upcoming halving event.

Kuptsikevich points out that hoarders are accumulating coins in preparation for this event, with the expectation that a return to Bitcoin's all-time high could occur within 8 to 18 months, based on historical data from previous halving cycles.

While positive sentiment surrounds the recent surge, experts remain cautious about predicting the impact of the next Bitcoin halving in 2024.

Coinbase acknowledges the potential positive influence on Bitcoin's value but emphasizes the speculative nature of such predictions.

Santiment's analysis reveals intensified Bitcoin outflows from exchanges throughout June, with the amount of BTC stored on exchanges reaching its lowest level since February 2018.

This trend reflects the growing preference among investors to store cryptocurrencies autonomously, reinforcing the shift towards self-custody.

Additionally, the run-up to the upcoming Litecoin halving, scheduled for August 4, 2023, has led to a significant increase in new Litecoin addresses.

Kuptsikevich highlights that "Between 10 and 17 June, the number of new Litecoin addresses increased by 55%," surpassing a record 200 million addresses.

This achievement positions Litecoin ahead of the Ethereum blockchain, which currently has approximately 180 million wallets created.