Crypto Market Capitalisation Dips Below $1 Trillion Level

- Written by: Sam Coventry

-

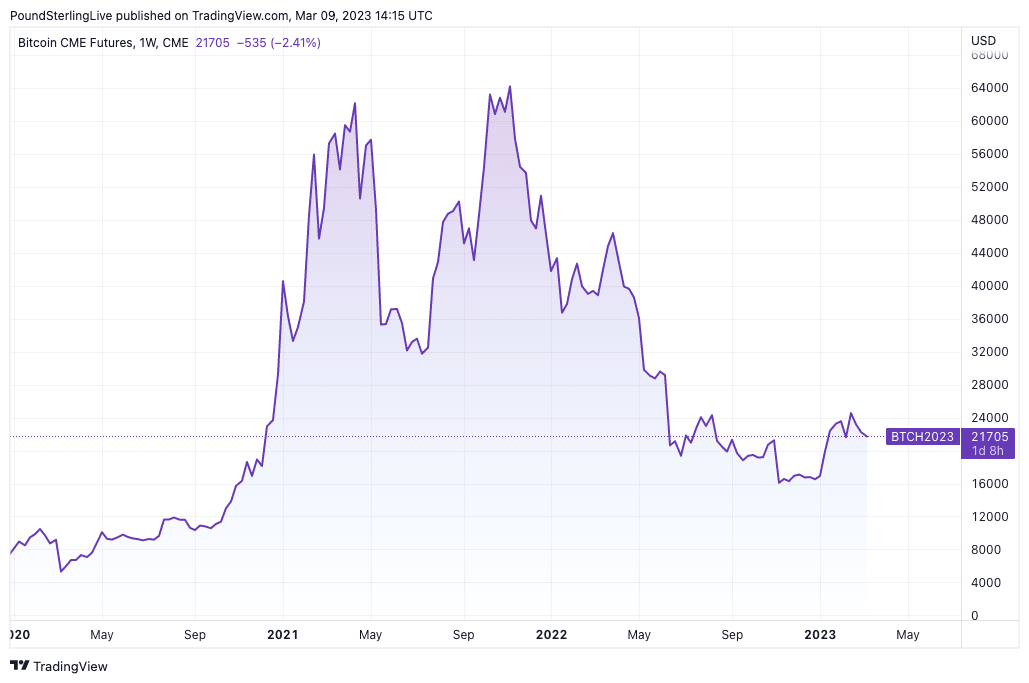

Above: the price of Bitcoin at one-week intervals.

A recent setback to the crypto space has meant the total capitalisation of the market is fallen back below the key $1TRN level.

The market's capitalisation is highly reactive to U.S. interest rates and interest rate expectations, ensuring the crypto space came under pressure after Federal Reserve Chair Jerome Powell warned rates would need to go higher than previously expected.

"We note that sellers drive the market during periods of reduced liquidity - in the early hours of the Asian session, as was the case today," says Alex Kuptsikevich, senior market analyst at FxPro.

Bitcoin lost $300 in a sharp move to $21.7K, approaching the February lows and the critical signal level of $21.5K.

"A break below this level would change the status of the current events from a 'typical correction' to a 'methodical sell-off,'" says Kuptsikevich.

Bitcoin is quoted at $21,712.94 at the time of writing and is down 8.1% over a one-week period. The headline coin is still some 69% below its 2021 peak, (read more about the volatile price history of BTC).

"The road to $18K for bitcoin is open, and the capitalisation of the entire crypto market could fall back to $820B, as the rally from the beginning of the year would look like a blip in a bear market, not the start of a long uptrend. Many, including ourselves, saw the latter scenario as the main one until the end of last week," says Kuptsikevich.

Ethereum is meanwhile quoted at $1,539.12, down 7.5% over the course of the past week.

Despite the recent turn lower, Eric Pearce, CEO of One River Digital Asset Management, believes that the fall in the crypto market is temporary and that bitcoin has the potential to rise again.

The key to the rally, he says, will be accelerating institutional adoption of crypto assets.

Elsewhere, a new Paxos survey, revealed 89% of U.S. crypto investors continue to entrust their funds to centralised exchanges, despite the collapse of several major companies in the cryptocurrency industry.

75% of US citizens are still interested in cryptocurrencies.