Latest Pound-Franc Forecast: Current Bounce Likely to be Short-Lived

Image © Adobe Images

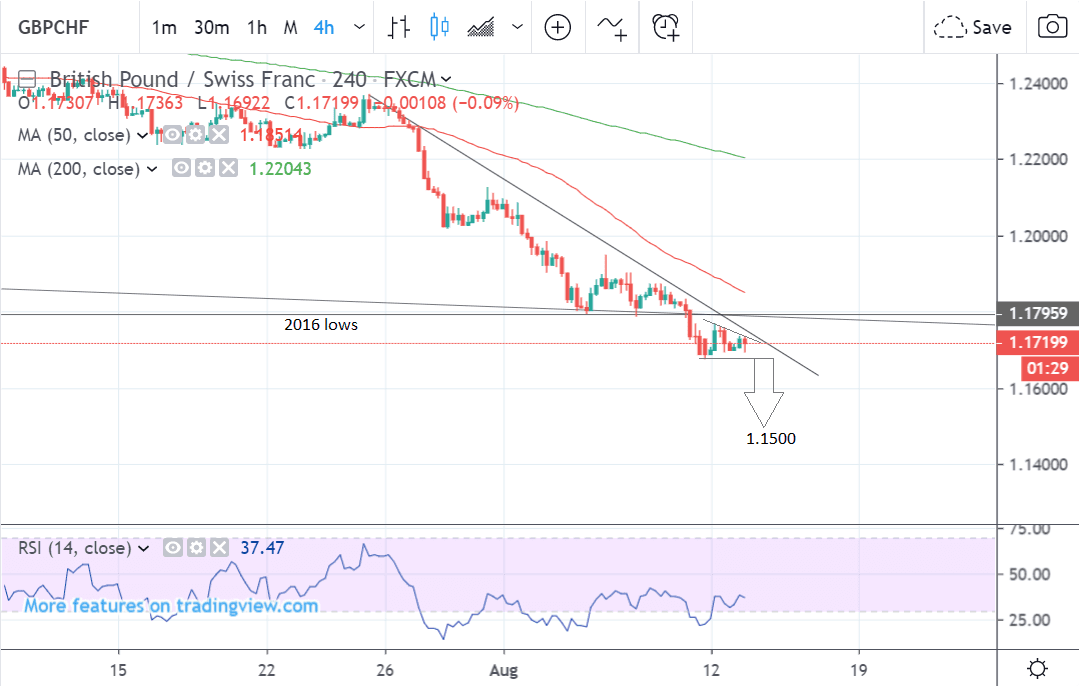

- GBP/CHF has broken below 2016 lows

- The established downtrend likely to extend

- Main driver of Swiss Franc is risk sentiment

The Pound has rebounded against the Swiss Franc on Tuesday as global risk trends shift against the safe-haven currency.

The Franc went lower across the board after the U.S. softened its stance on the next tariff barrier it intends to put up against Chinese goods.

The U.S. on May 17, announced a list of products imported from China that would be potentially subject to an additional 10 percent tariff.

Today the U.S. announced it was removing some goods from the list, while delaying the imposition of tariffs until December 15.

Markets have read this as an easing in the U.S.-China trade war, which is supportive of stock markets but negative for safe-haven assets such as the Japanese Yen and Swiss franc.

The Pound-to-Franc exchange rate is quoted at 1.1741 at the time of writing, having been as low as 1.1677 the day prior.

"The news of the delay of some US tariffs on certain Chinese goods (from September to December) is positive for risk sentiment, although the full details aren't yet known. You can see this by the initial reaction in FX markets with higher beta, high yielding FX such as AUD in the G10 FX space outperforming USD (due to the "risk-on factor") while the likes of EUR, CHF and JPY under-performing," says Petr Krpata, a currency strategist with ING Bank.

Regardless of the short-term blip, our latest technical studies suggest the Pound will likely remain biased to further losses against its Swiss counterpart.

The 4-hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair having broken below the key 2016 lows - a bearish sign for the pair.

The broader trend is down and likely to continue given the old adage that ‘the trend is your friend’.

The pair has pulled back in what might be a bearish pennant pattern which is a continuation pattern and suggests more downside eventually.

A break lower is likely, signalled by a move below the 1.1675 lows, and then to a target at 1.1500.

The daily chart shows the pair in a strong downtrend which has broken below the 2016 lows and a major trendline.

Because of the downtrend, the outlook continues to be bearish over the medium-term and a break below the 1.1675 lows would probably provide the green-light for a continuation down to a target at 1.1500, followed possibly by 1.1250.

Although the RSI momentum indicator is in the oversold zone below 30, which is a signal the pair may be oversold and due a bounce, it is not enough on its own to negate the downtrend.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

The weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows how the pair has broken through several key support levels and is heading lower.

The dominant downtrend is so steep and powerful it means the current is still pointing down and the bias remains for a bearish continuation lower.

The next major target to the downside is 1.1500, at which point there will probably be an increasing risk of a bounce.

After that, however, the trend may well fall even further over the long-term to a potential downside target of 1.1000.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

The Swiss Franc: Safe-Haven Status to Ensure a Strong Bid

The main driver of the Swiss Franc in the coming week is likely to global investor risk appetite since the currency is a safe-haven, which means it strengthens from increased inflows when investors grow fearful and weakens when they grow confident.

Another key driver of the Franc is potential intervention from the Swiss National Bank (SNB) who have a reputation for intervening when the Franc appreciates so as to weaken it in order to keep Swiss exports competitive.

Yet risk aversion remains the main driver and will probably continue to be over the short-term judging from the news.

Investors are growing fearful as a result of a mixture of factors including civil unrest in Hong Kong, heightened Brexit risks in the UK, political and economic uncertainty in Argentina, poor credit data from China and a lack of progress in trade negotiations between the U.S. and China.

These have led to a general rise in the Swiss Franc which is one of the best performing G10 currencies.

Hong Kong is a major source of risk due to increased civil unrest which now raises the risk that the Chinese government will intervene to restore order. If this happened it would probably strengthen the Franc.

Intervention by the Chinese is likely to result in geopolitical fallout and could trigger all sorts of repercussions, potentially exacerbating already tense relations between Beijing and the rest of the world, especially Washington.

Argentina is also a source of risk after President Macri saw his share of the vote fall by 15.5% in primaries held over the weekend.

Macri is now at risk of losing the elections scheduled for October and being replaced by a less market-friendly populist government. Argentine government bonds sold at such a discount following the vote, that they reflect a 75% probability of a default, which would also see a flight to safety and upside for the Swiss Franc.

Chinese credit growth and lending data added to the gloom and there are indications the U.S. may be demonised as a culprit of the slowdown.

"Chinese credit growth and lending data were much weaker than expected in July. And the editor of the Global Times, thought to be well-connected to the Chinese government, tweeted that the Chinese state-owned People’s Daily will soon publish an article 'vowing China can defeat any challenge and pressure of the US'," says Nick Smyth an analyst at BNZ Bank.

It is likely that the poor Chinese credit data will lead to an even greater focus on Chinese industrial production data out on Wednesday. If it undershoots the 5.8% forecast there is a chance investors will read into that that the Chinese economy is slowing because of the trade war with Washington. In such a scenario would support the Franc, of course.

Seasonal trends are also likely to support the Swiss Franc, overall as a backdrop, according to Investec, an international banking and asset management group.

“Typically global financial markets experience a sell in May-and-go-away phenomenon, namely the northern hemisphere summer vacation effect which tends to result in an exodus from riskier assets as many market players take time off, and are mostly out of the markets away on holiday,” says Annabel Bishop, an analyst at Investec.

The risk-averse seasonal backdrop is likely to last until the end of Q3, says the analyst.

The SNB’s sight deposits which are said to reflect central bank intervention increased last week leading to the inference that this was a sign the Swiss authorities were intervening in the market to weaken the Franc.

“Sight deposits rose by 2.77 billion Swiss francs (£2.36 billion) in the week to Aug. 9, suggesting the SNB had stepped up intervention on foreign exchange markets to rein in the safe-haven currency,” says Reuters. “Sight deposits held by commercial banks at the central bank – a proxy for currency interventions – had risen by 1.6 billion francs in the week ending Aug. 2 and by 1.7 billion francs the week before.”

If the SNB is indeed ramping up FX intervention it could slow GBP/CHF’s decline.

The threat of being branded a ‘currency manipulator’ by the U.S. and consequent sanctions may provide a counterweight to intervention.

The Swiss are already very close to meeting the criteria for being classed a currency manipulation.

They already have a large current account surplus versus both the U.S. and the world, and only a relatively modest amount of intervention would be required to meet the 3.0% of GDP level required to meet the final third criteria for being classed a manipulator.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement