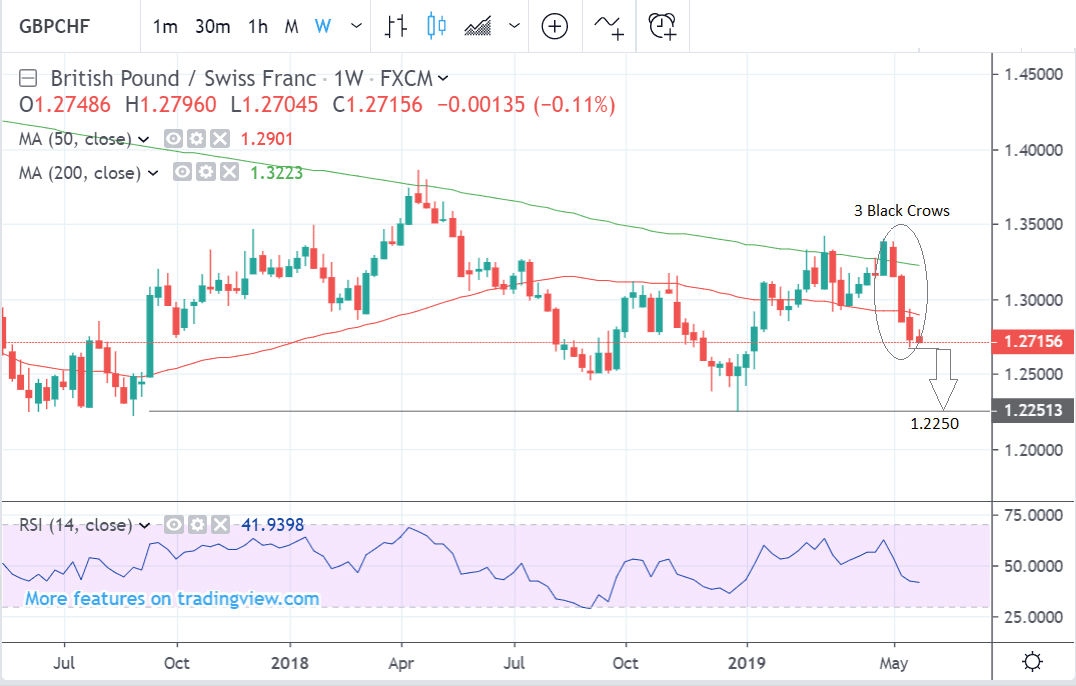

Pound-Franc Rate Outlook: 3-Black Crows Pattern Warns of Further Declines

- Written by: Gary Howes

-

Image © Albert Czyzewski, Adobe Images

- GBP/CHF now in established short-term downtrend

- 3-black crows pattern adds more bearish evidence

- Global risk trends to be key for the Franc

The Pound-to-Franc exchange rate is trading at 1.2730 at the time of writing, a cent lower than a week ago.

Losses have been driven by the Pound weakening on renewed Brexit uncertainty, and the Swiss Franc benefiting from safety flows as U.S. - China trade rhetoric becomes increasingly acrimonious.

Concerning the outlook for the pair, the technical picture is bearish following a long and protracted decline in Sterling's value since the early May highs were recorded.

The pair has now also formed a rare ‘three black crows’ bearish candlestick pattern on the weekly chart which indicates the market is biased to a continuation lower.

Three black crows happen after market peaks when the exchange rate falls in three long down bars in a row. The steeper the descent the more reliable the signal - this one is quite steep.

One proviso to the bearish outlook is that the RSI momentum indicator in the bottom panel has entered oversold territory (under 30) which means the pair could be ‘oversold’ and due a bounce.

In fact, over the last three days, the bear market has stalled and started going sideways, which suggests the RSI is correctly identifying an oversold market. There is a risk now that the pair could continue sideways but this is likely to be merely a temporary delay before bears push prices lower again.

Any gains during this temporary cessation in the downtrend are likely to be limited by resistance from the 200-day MA at 1.2893. This could act as a ceiling from where the exchange might start going down again.

A break above it, on the other hand, would bring into doubt the downtrend and start to indicate a possible reversal.

As it is, however, we don't see this happening and the bias remains with an eventual continuation lower, to a possible target at 1.2500 in 2-4 weeks, followed by 1.2250 in 1-3 months.

A break below the 1.2675 lows would provide confirmation for any continuations lower.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

The Swiss Franc: What to Watch this Week

From a fundamental perspective, the main driver of the Swiss Franc is probably global risk appetite as the currency is a favoured safe-haven alongside the Yen and Gold.

This means it strengthens from increased inflows in times of crisis, and as such tends to be one of the beneficiaries of any worsening in risk sentiment.

At the moment the outlook remains bleak for both trade tensions between the U.S. and China and global growth overall, so the Franc could rise.

Markets are currently quite pessimistic, according to Citibank, increasingly leaning towards the possibility of a more protracted trade dispute with “more US tariffs to come, therefore setting the stage for a more protracted risk aversion theme for Q3’2019,” which is likely to favour the safe-haven Franc.

It is not until the G20 summit on the 28-29 of June that tensions may ease, says Citi, as it is then that President’s Trump and Xi will finally meet and could feel pressure to reach an accord whilst on the world stage.

Another driver worth considering in relation to the Franc is the actions of the Swiss National Bank (SNB) who have a reputation for interfering in markets to devalue the Franc when it appreciates too much during times of crisis.

The Franc may now already be reaching levels where the SNB could at least be considering intervention. If it does it will weaken CHF, making GBP/CHF more bouyant. At 1.1239 EUR/CHF is not far off three-year lows of 1.1161 set in March 2019 and if these are breached there may be cause to think it possible the SNB might devalue the Franc.

From a domestic data perspective, Swiss GDP data out on Tuesday came out better-than-expected, showing growth up by 1.7% in Q1, compared to only 1.0% expected on a year-on-year basis - ie compared to Q1 in 2018.

On a quarterly basis is showed a 0.6% rise compared to the 0.3% forecast. These results are likely to underpin the currency even further, enhancing its safe status, if anything.

Other domestic data in the pipeline include the KOF leading indicators in May, out at 08.00 BST, which are expected to show a rise to 96.4 from 96.2, and retail sales data which is forecast to show a -0.8% fall in April, compared to a month ago when it fell -0.7%.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement