Pound-Franc Exchange Rate Forecast: March Highs in Cross-Hairs

Image © Adobe Images

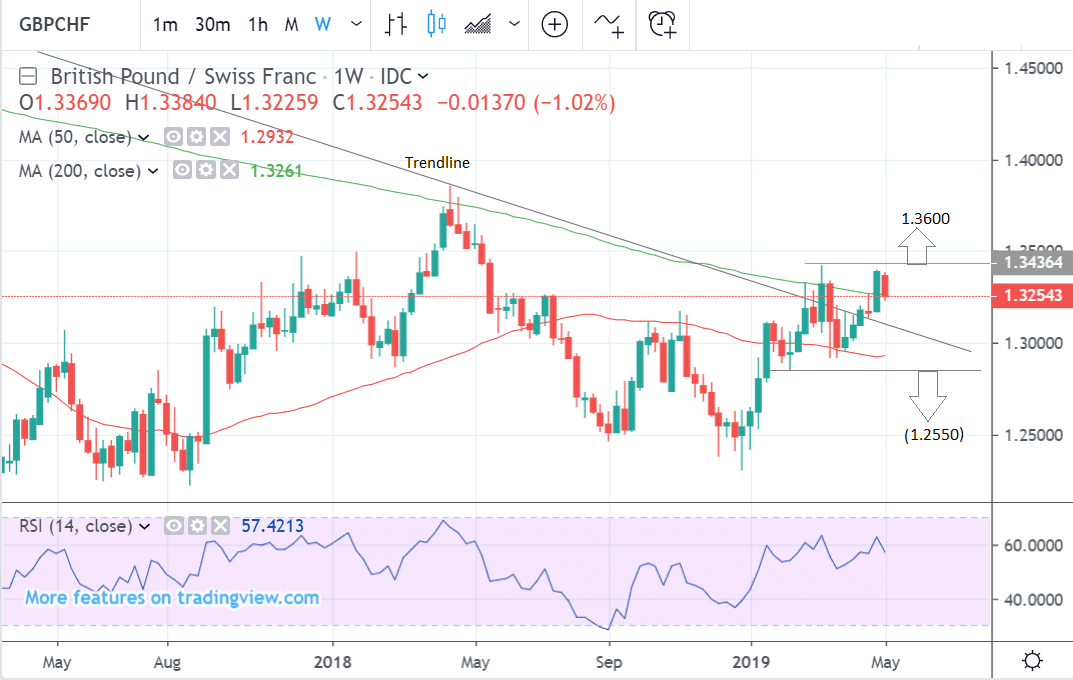

- GBP/CHF has broken more clearly above trendline

- Bearish H&S pattern looks much less credible

- Swiss Franc to take cue from risk trends

The Pound-to-Franc exchange rate is trading at 1.3254 at the time of writing after falling over a percentage point so far this week with the decline accelerating in mid-week trade on headlines suggesting cross-party Brexit negotiations are close to collapse.

Despite the declines, the technical picture is more bullish following last week’s surge which almost surpassed the key 1.3423 March highs, and broke above the 200-week moving average (MA) which was capping gains at 1.3274 and was seen as a major obstacle to an upside extension.

In the end the exchange rate reached 1.3399 before falling back down.

If it had broken above the March highs it would have opened the floodgates to even more gains and a rally up to the next target at 1.3600.

The pair has now fallen back down to just below the 200-week MA; if it closes below this major MA it will give a bearish signal.

As mentioned before a clear break above the March highs at 1.3423 would provide confirmation of a continuation up to a target at 1.3600 or higher, probably inside of 1-4 weeks now.

Alternatively, a break below the 1.2854 lows could signal a much more bearish outlook for the pair with a downside target at 1.2550, reachable within 3-6 weeks, however, the bearish case has lost credence somewhat as a result of the chart taking on a different look and feel.

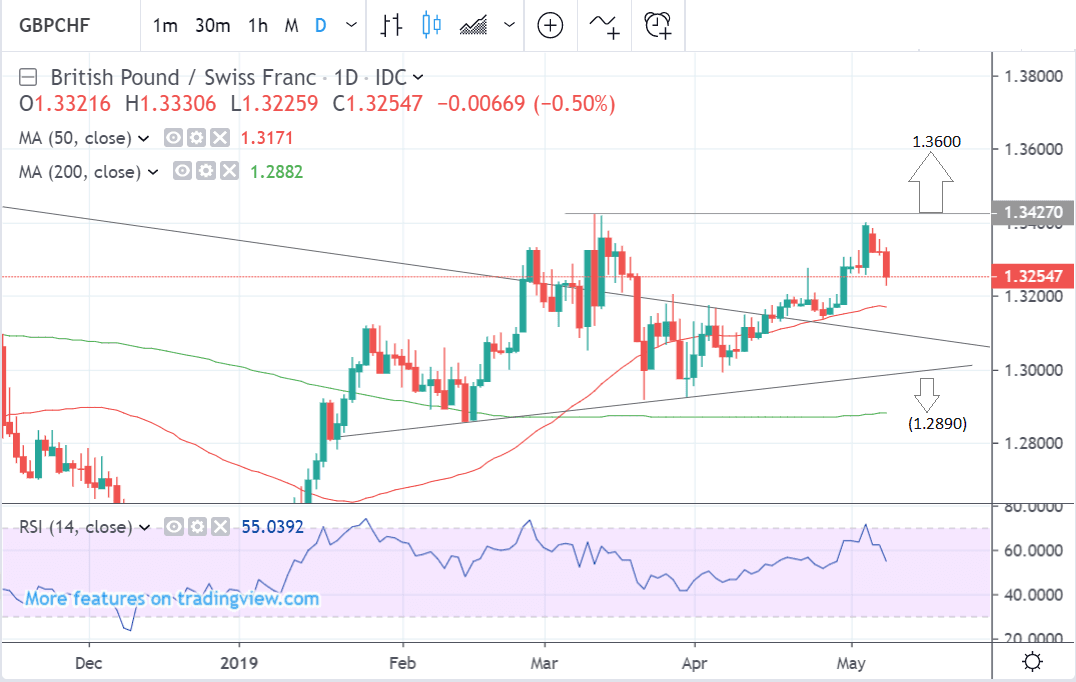

The main change in the exchange rate's outlook is that the possible head and shoulders (H&S) topping pattern which was forming on the daily chart now looks less credible.

Previously this was a bearish sign but since the rise over the last few weeks which has brought the right shoulder (S) within a few pips of the head (H) the pattern is starting to look lopsided and less believable.

If it proves not to be and H&S the bearish case falls apart. All that would be required for this would be a break above the March highs - the ‘head’ of the H&S.

If the market suddenly begins to capitulated from here and then descends all the way back down to the area of the trendline close to the pattern neckline at about 1.3000, there is a chance the H&S hypothesis may still stand.

A break then below the neckline would probably lead to a move down, initially to a target at 1.2890 and the 200-day MA, and then perhaps even lower. Such a move could unfold in the next 2-6 week timeframe.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

Deterioration in U.S.-China Trade Talks Would Provide a Big Boost to the Franc

Over coming days, risk trends are likely to be the main driver of the Swiss Franc, which is a safe-haven asset and so appreciates when investors get fearful.

The Franc was trading quite robustly on Wednesday as a result of investor fears about an escalation in the trade war between the U.S. and China.

According to a Reuters, China has backtracked on nearly all aspects of their trade negotiation with the U.S. In each of the seven chapters of the 150-page draft trade deal, China has deleted its comments regarding law changes addressing U.S. complaints.

This explains why over the weekend Trump tweeted a threat to allow higher tariffs on Chinese imports to begin as scheduled this Friday. China’s redaction was seen as undermining the “core architecture” of the trade deal.

If no compromise is reached a new round of tariffs will take effect at midnight on Friday.

"If there is no US-China deal and the US increases its tariff on imports from China to 25% in the days ahead, we would expect a sharp risk-off market correction to drive the FX market. We would expect higher FX vol, JPY to appreciate, most likely followed by CHF," says

Athanasios Vamvakidis, a FX Strategist with Bank of America Merrill Lynch Global Research.

There’s speculation that Liu could agree to scrap the latest proposed text changes and agree to making new laws. But at this point, it’s unsure what level of authority Liu has from President Xi Jinping Thus, no one knows what he could achieve.

There is still a chance of the deal could be salvaged, however, as Chinese Vice Premier Liu is expected to arrive in Washington on Thursday, for 11th hour talks.

Such a surprise would probably push markets higher and see the Franc go lower as investors cash out of the safe haven and put their money into higher yielding assets.