Pound-Franc Outlook: Short-Term Still Strong, Longer-Term Less Assured

Image © Pavel Ignatov, Adobe Images

- H&S pattern on weekly chart threatens downside

- Yet daily chart bullish due to repeated attempts higher

- Short-term gains followed by medium-term weakness possible

The Pound-to-Franc exchange ate is trading at 1.3165 at the time of writing; the pair is marginally up on the day, and half a percent higher on a week-on-week comparison.

Concerning the outlook, the pair is giving mixed signals from a technical perspective: on the one hand there are several topping patterns forming on the weekly chart with bearish connotations (over a 2-6 week time-scale), whilst on the other the most recent activity in the last few weeks has been bullish, and suggestive of more upside in the very near term (next 1-2 weeks).

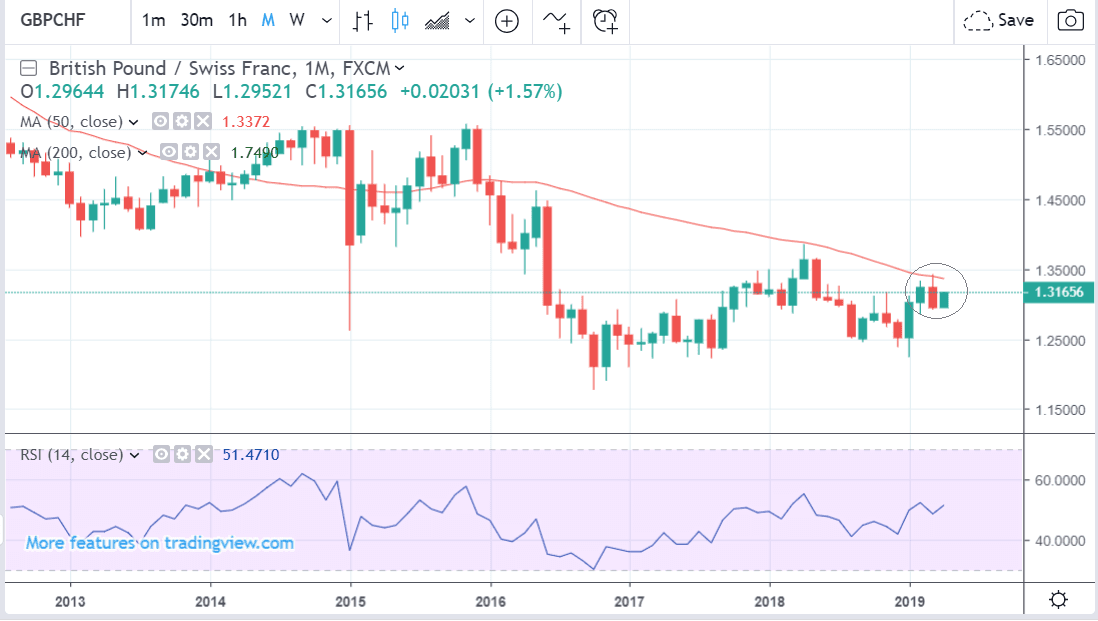

Starting with the longer-term charts, and we are forced to acknowledge a concentrated zone of resistance right above price action composed of the 50-month moving average (MA) and the 200-week MA. These are both tough resistance levels which have already successfully rejected the exchange rate.

The weekly chart shows the pair appears to be capped above and below by the 200 and 50-week MAs.

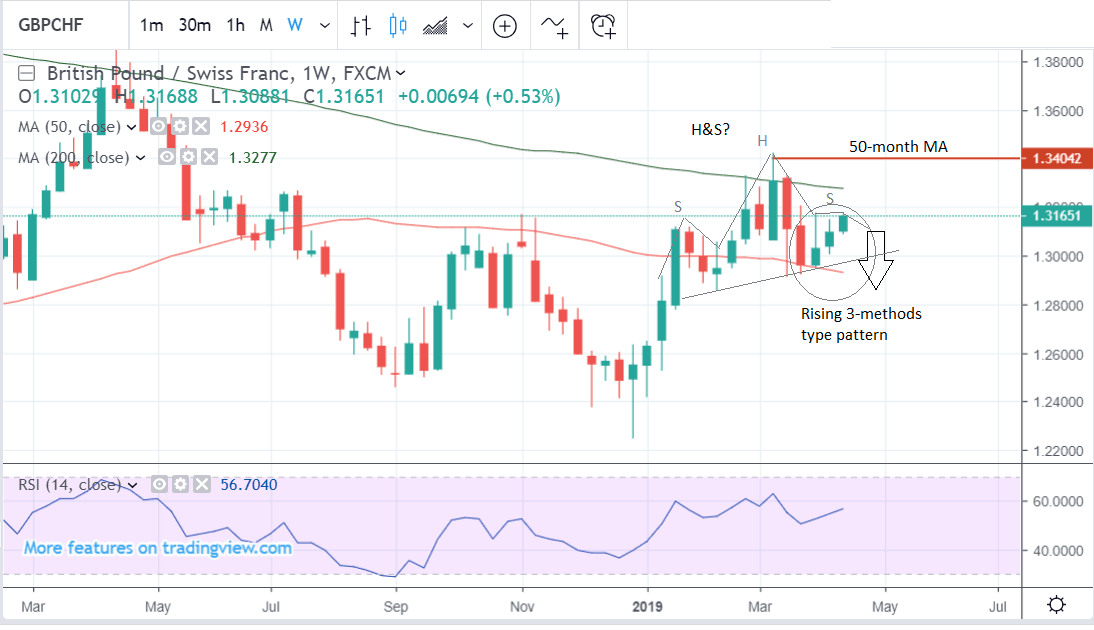

Another way of interpreting the weekly chart, however, is to see both the formation of a possible head and shoulders (H&S) topping pattern at the highs and a, sort of, falling 3-methods bearish candlestick pattern (circled) over the last 3 weeks.

A falling 3-methods forms when the market has been going down quite steeply and it bases and recovers in three small, equally-sized, candles in a row. It represents a lull before more downside.

The look and feel of the price action on the chart is also more suggestive of further declines than upside.

A break below the H&S’s neckline at around 1.3000 would supply the initial confirmatory signal of more downside. Strong support from moving averages just below the neckline, including the 50-week and 200-day, however, are likely to stymie follow-through lower even after confirmation, and the initial advance is likely to be repulsed. GBP/CHF is then likely to recover in a throw-back move back up to the neckline again.

Eventually, however, the overwhelming force of the bearish pattern will likely push GBP/CHF down again to its full potential. It will then break cleanly through the MAs and reach its downside target at around the 1.2550 mark.

The daily chart is more bullish and a close up of the recent activity shows why. The pair is currently undergoing its third attempt to break above the 1.3180 highs.

Although it was rejected on the two previous occasions, repeated attempts at breaking through a level are normally eventually successful. The successively higher lows on the most recent attempt is also a bullish sign.

If there is a breakthrough it could result in a short rally up to the next resistance level at 1.3275, however, after that there is an increasing risk of a fall back down as the H&S completes. Indeed the move up to 1.3275 could merely represent the formation of the right shoulder of the H&S.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement

Risk Trends are Key Fundamental Concern

Risk trends are the main fundamental driver for the Franc since it is a 'safe-haven' currency, meaning it rises when investors become risk-averse.

Optimism over a U.S.-China trade deal appears to be lifting investor risk appetite at the time of writing because a detente between the two superpowers would benefit the global economy. This may be responsible for the most recent weakness in the Franc which has in turned allowed GBP/CHF to make repeated attempts to break above the 1.3180 highs.

An announcement that talks had finally born fruit in the form a deal would almost certainly push GBP/CHF higher and this is the current market expectation given neither China nor the USA wants to continue losing economic growth because of tariffs.

Another key event on the horizon for global risk trends will be the release of Chinese GDP data out at 4.00 BST on Wednesday, April 17.

The data is expected to show a slightly slower 1.4% pace to Chinese growth in Q1, after 1.5% growth in Q4.

There is a risk it could surprise to the upside, however, as recent better-than-expected Chinese trade figures, could mean the GDP is slightly higher-than-forecast. If so this would be positive for global growth and investor risk appetite but negative for the safety-linked Franc.

“Given policymakers’ focus on global growth, without doubt, the official release of China’s Q1 GDP growth will be watched with interest,” says Henry Occleston, an analyst at Lloyds Bank. “It is forecast to be marginally weaker than prior, though with positive sounds from the IMF, and the stronger than expected trade data we saw this week, it could surprise on the upside.”

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement