Pound-Franc Rate Looking Poised to Break Higher

Image © Pavel Ignatov, Adobe Images

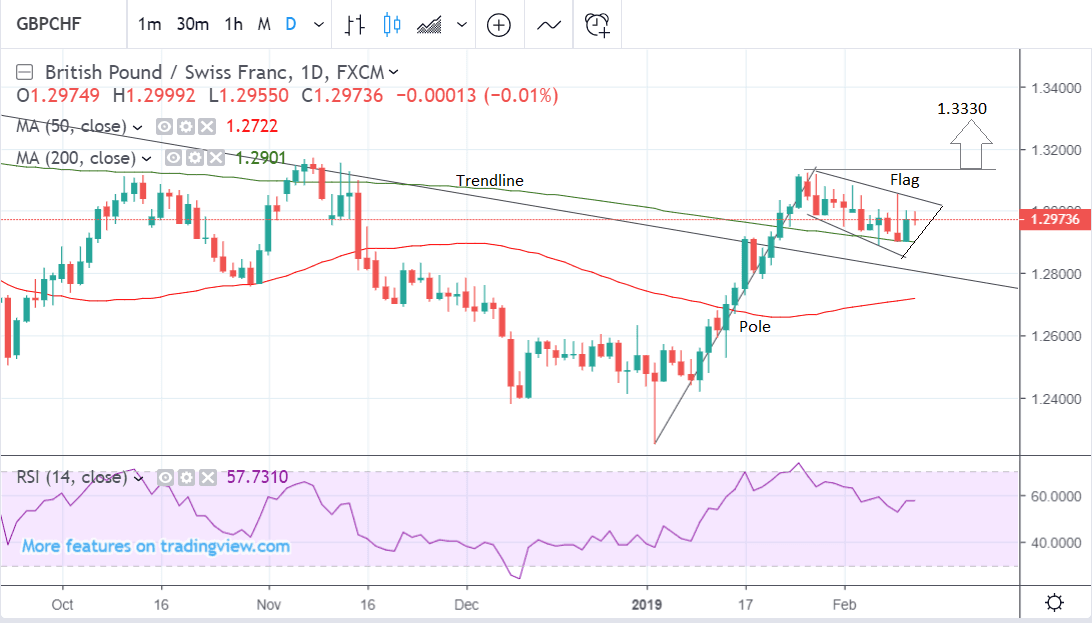

- GBP/CHF forms bull flag with upside expectations

- Break above 1.3121 key to extension higher

- Brexit breakthrough could be catalyst to move higher

The Pound-to-Swiss Franc exchange rate is trading in the mid-1.29s at the time of writing, after rising marginally from the previous week’s close.

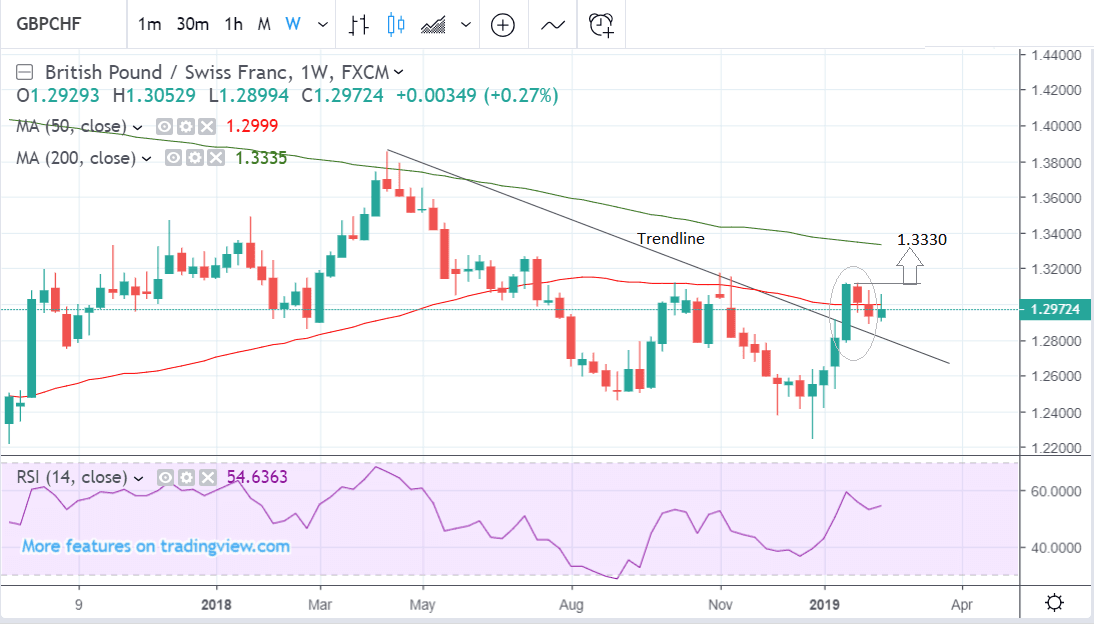

It has broken above a key trendline drawn from the April 16 highs and is consolidating before a probable extension higher.

Longer-term it is predisposed to more upside should Brexit tensions unwind, the chances of a no-deal scenario are still low so greater weakness is less likely than greater strength.

This also dovetails nicely with the bullish technical picture which shows that the pair has successfully broken above the trendline and, although it has pulled back recently, it has so in a shallow correction and the expectation is for the uptrend to eventually resume.

The pair has formed a bull flag continuation pattern. The steep rally higher in January formed the ‘pole’ whilst the sideways consolidation formed the ‘flag square’. Bull flags are extremely bullish patterns.

A break above the 1.3121 flag highs would confirm an extension up to at least 1.3330, at the level of the 200-week moving average (MA) as large MAs often provide tough resistance to trending prices. Yet this is the minimum expectation, and a move up all the way to the 1.3700 level is also quite possible using the length of the pole as a guide, which is the usual method for establishing the upside target.

Momentum on the weekly chart, as measured by the RSI indicator, is relatively strong and suggestive of a further upside too, as it is mostly higher than the peak which formed on Jan 21, even though that peak was higher than the current market level.

The weekly chart also shows a set-up which indicates the current week is probably likely to end on a positive note for the pair. The pattern formed by the last three weeks activity is indicative of a circa 60% chance this week will end higher than it started. This is due to the long, green, up, bar which formed three weeks ago and the fact it was followed by two much smaller, red, down, bars. This particular configuration suggests an increased chance this week will end on a high.

GBP/CHF is likely to be more sensitive than most pairs to a change in Brexit sentiment. The Swiss Franc is a safe-haven currency, which means it rises when markets are in turmoil. The current broad backdrop of uncertainty due to Brexit has probably strengthened the Franc as investors have favoured it as a safe place to entrust their capital.

One possible fundamental catalyst for any breakout higher would be for Prime Minister Theresa May to gain a concession from the EU on Irish backstop, by making it time-limited, for example.

Although Brussels has insisted the Irish backstop, if ever triggered, would only ever be temporary no game-changing official concessions have been forthcoming which could sway Brexiteers in her party to support her deal. Nevertheless, there is a chance this could happen and, if so, it might satisfy a majority of UK parliamentarians, leading to a win for her deal and a rise in GBP pairs.

The rise may be especially sharp in the GBP/CHF pair, because simultaneously as the Pound is rising, the Franc will probably be weakening as safe-haven flows reverse, and this would propel the pair even more rapidly higher than in a normal Sterling pair.

Most analysts think there is a very low probability of a 'no deal' Brexit. Since most Brexit scenarios involving a deal are expected to lead to an appreciation in Sterling, the outlook is generally held as bullish for the currency, and therefore even more bullish for GBP/CHF.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement