Pound-Franc Rate's Downtrend Intact Despite Bullish Signs

Image © Adobe Images

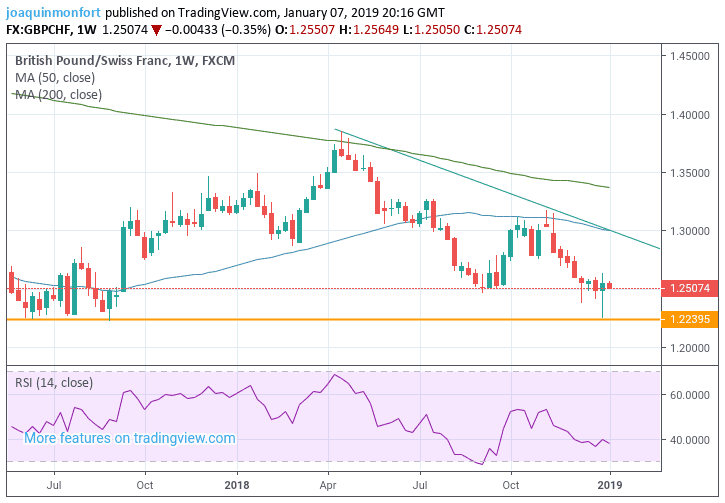

- GBP/CHF forms bullish reversal pattern

- Yet insufficient evidence so far to support a reversal

The Pound-to-Swiss Franc rate is trading at 1.2509 at the time of writing, after rebounding almost half a percent from last week's 1.2248 lows following a de-escalation in China slowdown fears.

The ‘safe’ Swiss Franc surged during the flash-crash because of its haven appeal, but as soon as markets calmed down Sterling recovered, supported by the release of better-than-expected services sector activity data.

This high volatility was reflected by the Japanese hammer candlestick which formed on both daily and weekly charts. This is a bullish pattern which suggests the possibility of more upside for the pair in the short-term.

The hammer candlestick on the daily chart was also succeeded by a relatively strong upday which provides added confirmation of a bullish signal, and is a further positive signal for the exchange rate.

The RSI momentum indicator in the lower pane is converging bullishly with the exchange rate. This occurs when price makes a new low but that low is not corroborated by a new low in momentum. This suggests waning downside momentum and the possibility of bounce.

These bullish signs, however, conflict with the overall medium-term trend, which is down. The exchange rate also remains below both the 50 and 200-day and week moving averages (MA), which is a bearish indicator.

Overall our forecast remains bearish, though it is conditional on the exchange rate breaking below the hammer's lows confirmed by a move below 1.2200.

Assuming such a break, the pair should sell off to a target at 1.2100 initially, and then probably 1.2000.

The Swiss Franc was overall the strongest currency at the start of the week. Several factors probably contributed to this, including safe-haven demand from a weak Dollar and much better-than-expected retail sales data from Europe.

The Dollar weakened as investors continued to reduce expectations of higher interest rates in the U.S. Previously they had expected the Federal Reserve (Fed), which is the body tasked with setting interest rates, to raise them at least three times in 2019. Now those expectations have been turned on their head

Interests rates are a major driver of currency appreciation because they influence net inflows of foreign capital which tend to rise when rates do because the higher return acts as a magnate for investment.

Fears the U.S. economy could slow, or the trade war could escalate and spark s global slowdown, are behind the lower investor expectations and the weakening Dollar. Being a safe-haven, these same conditions benefit the Franc.

Another driver of the Swiss currency was positive retail sales data from neighbouring Europe which showed a 0.6% rise compared to the 0.2% expected and 0.3% previously. The Franc may have risen due to its proximity and heavy dependence on the rest of Europe.

Looking ahead, the next key data release for the Franc is probably inflation, which is forecast to show a slower 0.8% rise in December from the 0.9% recorded in the previous month of November.

If inflation falls more than expected it could weigh on the Franc, alternatively a stronger result would have the opposite effect.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here