Carney Voices Brexit Concerns, Sterling Rebounds From Near 30-year Low

Sterling has had a very difficult time so far in 2016, with the EU referendum dominating national and international newswires.

On Tuesday Governor of the Bank of England Mark Carney warned that a Brexit poses the biggest risk to Britain’s financial position. Carney, somewhat criticised for his pro-EU stance, claimed that EU membership allows the UK economy to grow without risking monetary and financial stability.

By contrast, the decision of flamboyant and charismatic London Mayor Boris Johnson to join the ‘out’ campaign, in particular, has caused genuine worry among investors that Britain may conceivably vote to leave the European Union, come referendum day on 23 June.

The average of several recent polls indicates that the vote to stay in the EU has a small lead, although this appears to have widened somewhat since the announcement of the agreement with the EU. Bookmakers are now placing the odds of a Brexit at around 30%, with conviction that Britain will remain an EU member clearly fading.

The renewed focus on the possibility of a Brexit has led to a sharp downtrend in the Pound, which fell to a fresh seven-year low against the US Dollar in February after suffering from its largest one-day decline since David Cameron became Prime Minister in 2010 (Figure 1). Sterling has, however, stabilised since mid-February and has managed to rebound above 1.40.

Source: Thomson Reuters Datastream. Date: 07/03/2016.

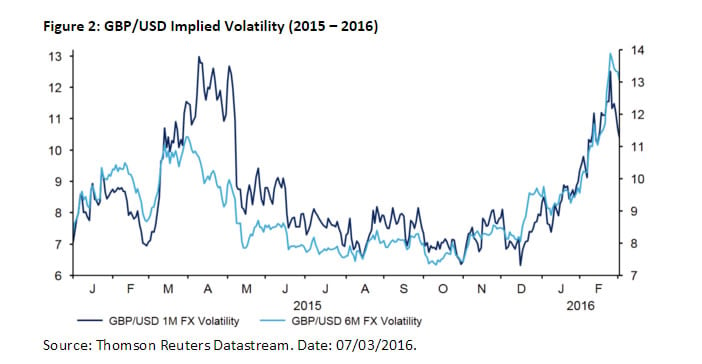

Sterling volatility has also spiked, with six-month implied volatility increasing to its highest level since October 2011 in February (Figure 2). Concern surrounding a Brexit has undoubtedly overshadowed the Bank of England as the main driver of the UK currency since the turn of the year.

Source: Thomson Reuters Datastream. Date: 07/03/2016.

While estimates regarding the impact of an EU exit are broad and wide-ranging, the general consensus points to a net negative for the UK economy in the short term.

Although strongly contested, UK unemployment would be at risk of increasing, while exporters would be under heavy pressure considering the EU accounts for 50% of the UK’s overall export revenue. Many analysts have suggested that a Brexit could even knock as much as 2% of UK GDP, lead to a snap recession and have a long-lasting effect on business investment, the housing market and consumer confidence.

Over the past few years currencies have been dominated by the relative stance of their central banks and clearly, if a Brexit does happen, we’ll see an immediate response from the Bank of England, possibly as soon as the day after the vote. An EU exit would all but rule out an interest rate increase by the Bank of England and we would expect the central bank to respond by cutting rates from their record-low 0.5%.

However, despite the closeness of the latest polls, we remain of the opinion that Britain will not leave the EU this year. As was the case with the Scottish referendum, we think that as the referendum draws near, the status quo will attract more support than the polls are currently giving credit, especially among those 15-20% or so that remain undecided.

In our view, the subsequent rally in the Pound following an ‘in’ result would make up for any depreciation suffered from uncertainty leading up to the referendum.

We therefore expect Sterling to end 2016 somewhat higher than current levels against the US Dollar.