Sterling Just Lost 3% of Value in a Month

The Pound has plunged against both the US Dollar and Euro since the beginning of December, losing around 3% of its value in trade-weighted terms since the turn of the year.

The decline in GBP/EUR was, until last week, the longest downward streak in the currency pair since the single currency was introduced in 1999 (Figure 1).

We believe that the recent Sterling sell-off has been overdone and is not in line with the economic fundamentals of the UK economy, which continue to perform relatively well compared to most of its major peers. We expect a modest rebound in the Pound from current levels, especially against the Euro with the ECB looking set to increase monetary stimulus over the coming months.

What drives the decline?

Sterling’s decline can be traced to recent developments both domestically and abroad, but its severity has clearly been amplified by the generalised sell-off in financial markets worldwide in the first weeks of 2016.

Firstly, the Bank of England has adopted a more dovish tone of late. Governor Mark Carney has all but ruled out an interest rate hike in the UK in the immediate future. He stated that a ‘powerful set of forces’ should ensure that the era of near-zero interest rates remains for a while yet and expressed concerns about financial market volatility.

Further Carney drew a clear contrast between economic conditions in the UK and the US, implying that the Bank of England feels no pressure from the hiking cycle started across the Atlantic.

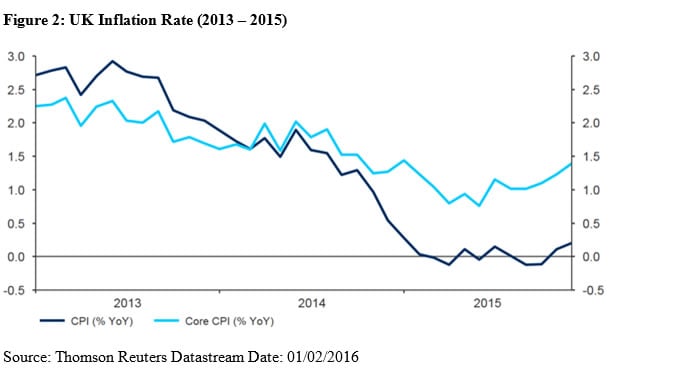

The China-centered global slowdown has increased downside risks to UK growth, while the latest sharp decline in oil prices, to below $30 a barrel, looks set to keep headline inflation low for longer (Figure 2).

Crucially, labour earnings growth is also slowing and would need to see a ‘sustained improvement’ for the rest of the monetary policy committee to join hawk Ian McCafferty and vote for an immediate rate increase.

The minutes from the latest monetary policy meeting were slightly less dovish than expected by the markets, although not enough to provide any sustained relief for Sterling. With the central bank clearly in no hurry to hike, economists and investors alike have continued to push back expectations for the first Bank of England lift-off in almost nine years.

After Carney’s speech, we no longer expect a rate hike in the UK until the fourth quarter of 2016.

Investors are also becoming increasingly concerned about the outcome of Britain’s EU referendum, which could take place as early as the summer. Uncertainty surrounding a possible ‘Brexit’ is unlikely to go away any time soon and could continue to weigh on the Pound in a similar way as the Scottish Referendum did in 2014, when the currency lost over 6% in two months.

Currencies around the world, including Sterling, continue to remain under pressure as a result of the Federal Reserve’s first interest rate hike in nine years in December. Similarly, the Euro received solid support over the Christmas and New Year period following the European Central Bank’s overwhelmingly disappointing lack of additional easing in December. (Figure 2).

Last week’s hints by President Draghi that further easing was coming, possibly in March, has only brought about a limited rebound in Sterling against the common currency.