The US Dollar in 2016

December 2015 saw the Federal Reserve finally end an unprecedented seven year period of near zero interest rates and what amounted to emergency monetary policy settings.

After months of speculation the Federal Open Market Committee (FOMC) announced it would be raising the US benchmark interest rate by 25 basis points to 0.50%.

This was in line with our and indeed the markets expectation, and the first of its kind since June 2006. Critically, the decision was a unanimous one, with all members of the committee voting for an immediate rate increase.

Policymakers judged that there has been “considerable improvement in the labour market” this year and, while inflation remains well below target, there is “reasonable confidence” that price growth will move higher over time.

Headline inflation, however, is expected to remain low for some time, only increasing back up towards its 2% target in 2018.

Future hikes to be gradual

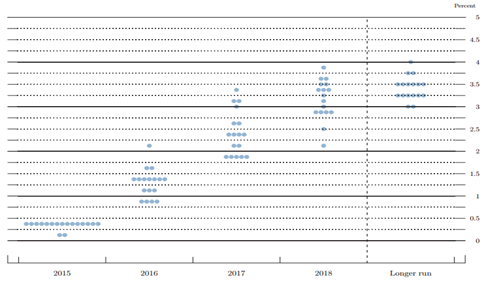

On the topic of future rate increases, the FOMC sent mixed signals. The statement suggested that the evolution of economic conditions would likely “warrant only gradual increases” in the future, but the “dot plot” of future hike expectations of FOMC members was unchanged from September - and considerably more hawkish than markets are pricing in.

Currency markets took the decision in their stride, with the emphasis on gradual rate hikes initially weighing on the US Dollar. This is unsurprising given the outcome was so widely expected, although the USD strengthened in the final two weeks of 2015 against Sterling to its strongest position since April.

US economy on track

The Federal Reserve’s first interest rate hike since 2006 does, however, provide a clear sign that the world’s largest economy is back on track following the most severe global recession in recent memory. Job creation and unemployment are improving, economic growth is robust, while inflation is on an upwards trend.

The key to the short term evolution of the US Dollar will likely be the timing, and more importantly pace, of future US rate increases in 2016.

The Fed’s “dot plot”, which represents where each member expects the funds rate to be at the end of each year, was more or less unchanged from the previous meeting.

December FOMC “Dot Plot” Chart

Source: Federal Reserve Date: 16/12/2015

Median calculation of policymakers’ expectations for this year suggest that the committee still expects to hike roughly once a quarter in 2016, the equivalent of every other meeting. This is in line with our expectations, although a faster pace than the market is currently pricing in, which at present stands at just two additional hikes next year.

What does the future hold for USD?

Gradually increasing interest rates in the US in 2016 should lead to an appreciation of the US Dollar against almost every major currency.

We see it very unlikely that the Fed announcement will have an impact on the Bank of England’s decision making, and still remain of the opinion that interest rates will go up in the UK at some point in the third quarter of 2016.

This would lead to only gradual gains for the US Dollar against Sterling this year.

The Dollar’s appreciation will likely be more severe against the Euro, given that the European Central Bank is moving its monetary policy in the opposite direction.