Pound Sterling Stuck in the Middle as Europe and the US Diverge

Sterling’s position as a half-way house between the Euro and the US Dollar looks set to come into sharp relief in the coming months in the wake of crucial central bank decisions in the Eurozone and the US in December.

The European Central Bank looks on course to increase its monetary easing at its next meeting in the first week of December, while the Federal Reserve approaches its first interest rate in nine years. These decisions come amid a moderate shift in stance from the Bank of England.

At its latest monetary policy meeting in November, the Bank of England was more dovish than the majority of the market anticipated. Policymakers appeared more cautious about downside risks from abroad, which were mentioned no fewer than four times in the latest statement.

The Bank of England is also clearly concerned about the effect of Sterling strength on the UK’s international competitiveness, especially since the Eurozone accounts for over 40% of total UK exports.

Governor of the Bank of England Mark Carney now sees it as likely that low interest rates will remain for some time. We therefore don’t expect rates in the UK to increase until well into 2016, likely in the third quarter of the year.

As a result, the Pound continues to travel a middle path, up against the Euro and down versus the US Dollar. This is unquestionably due to the stance of the Bank of England, pursuing a neutral path while the Fed tightens and the ECB eases.

Expect more monetary easing in the Eurozone

Over the past month, communications from European Central Bank President Mario Draghi have provided even more evidence that the Governing Council is all but certain to increase its monetary stimulus measures at its meeting on 3 December.

Eurozone policymakers are considering using every tool available to them. In our view, that includes increasing the size and duration of the current QE programme, expanding the range of instruments that the programme purchases and cutting the interest rate on bank excess reserves even further into negative territory.

This stark divergence has sent the Euro sharply lower against the US Dollar to below 1.06 for the first time since April, and close to an eight-year low versus Sterling (Figure 1).

Figure 1: EUR/GBP (September ’15 – November ‘15)

Source: Thomson Reuters Date: 30/11/2015

We believe this ECB dovishness is likely to send the Pound even higher against the Euro, with the single currency heading towards parity with the US Dollar at some point in early 2016.

US interest rate hike in December?

By contrast, last week’s Federal Reserve minutes continued to suggest that the US is edging closer to an interest rate hike in December. Ebury now sees this as all but guaranteed, barring a global financial meltdown or a disastrous figure in next month's job creation.

Markets also appear to be in agreement, with pricing for a December hike continuing to climb to just shy of 75% this month, with all eyes now on this week’s labour report.

Slow pace of rate changes

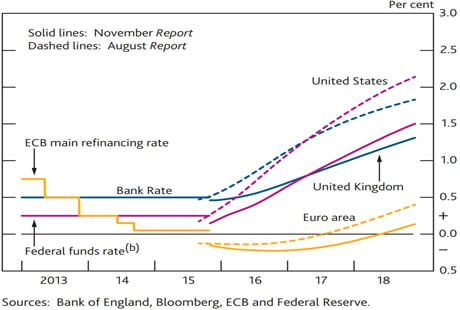

However, if the Bank of England’s projections are anything to go by, the pace of future rate increases among the major central banks looks set to be much more gradual than was anticipated only a matter of months ago (Figure 2).

Figure 2: International Forward Interest Rates (November 2015)

This is likely a direct result of the China-led global economic slowdown, which has dampened confidence and weighed on growth worldwide.

Gradual interest rate increases in the UK should lead to a slower appreciation of Sterling against the majority of G10 currencies, most of whose central banks remain overwhelmingly in easing mode.

The prospect of higher rates whether gradual or not, in the US, and to a lesser extent the UK, has continued to cause a sharp sell-off among most emerging market currencies.

Many, including the South African Rand and Brazilian Real, are now very cheap and the reward for holding them due to high real interest rates is substantial.