Looking Beyond the Fed’s Decision

The focal point in the global currency markets this month was undoubtedly the Federal Reserve’s decision to keep interest rates unchanged at its September meeting.

Solid economic growth, which rebounded strongly from its weather-induced slowdown in the first quarter, and a tightening labour market, underlined by robust job creation and low unemployment, suggested that the time for emergency monetary policy settings in the US may be over.

Economists and analysts were split down the middle over whether the Fed would hike rates for the first time in nine years in September, despite markets pricing in just 30% probability.

In the end only one committee member, Jeffrey Lacker, voted to increase rates this month.

Unsurprisingly, the US Dollar declined sharply immediately after the decision against almost all of its major peers, including Sterling (Figure 1).

However, much of these losses have since been reversed, especially against the Euro, as the Fed’s decision is likely to have increased the chances of more ECB QE before the end of 2015.

Figure 1: GBP/USD (14/09/15 – 21/09/15). Source: Thomson Reuters Date: 21/09/2015 Time: 15:45 BST

The accompanying commentary from the Fed was also moderately dovish.

While the Fed acknowledged that the domestic economy was healthy and performing well, downside risks from abroad continue to provide a drag.

The Fed is clearly more concerned about overseas risks than some had anticipated and now appears to be looking closely at the stock market; something that it hasn’t done for years.

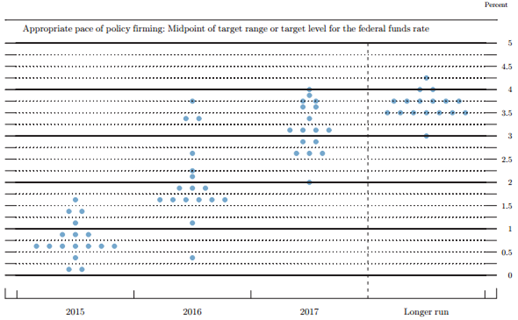

Critically, the Fed’s famous “dot plot”, which represents where each committee member expects interest rates to be in the near-term future, shows that 13 of the 17 FOMC members still expect a rate hike to occur in 2015.

Figure 2: September FOMC “dot plot” Source: Federal Reserve Date: 17/09/2015

Given this, and considering that Janet Yellen kept the door open for a rate hike next month by stating that it was very much a “live” meeting, we now see a 50/50 chance that the Federal Reserve will hike at either the October or December meeting, conditional on no negative surprises from financial markets.

While the Federal Reserve’s decision this month has clearly increased the risk of a delay by the Bank of England, a stalling Fed does not necessarily mean we won’t see a rate increase in the UK soon.

More from Enrique Diaz

- Which MPC Members Will Vote For a Rate Hike This Month

- Bank of England's First Interest Rate Rise in Spring 2016

- Why the Pound is Where it is

- Further GBP v USD Falls Will be Gradual

The Bank of England appears far less concerned about external factors than the Fed and, provided we continue to see a strong economic recovery in the UK, particularly in the labour market, the argument for higher rates in the UK will continue regardless of what the Federal Reserve decides.

Recent positive developments in the labour market, including real pay growth roughly 2% above core inflation, and a still buoyant housing market, lead us to maintain our call for a Bank of England rate hike in February 2016, much sooner than interest rate markets are currently pricing in.

Despite the lack of a September hike by the Fed, we continue to expect a modest long-term gradual depreciation of Sterling against the US Dollar. The market reaction has validated this view, as Sterling has given back all of its post-FOMC gains against the Greenback.

A rate hike in early 2016 from the Bank of England would, however, provide strong support for Sterling against almost every major currency, especially those of G10 countries, whose central banks remain overwhelmingly in easing mode.