Bank of England's First Interest Rate Rise in Spring 2016

The UK economy has had a somewhat disappointing performance in the past month or so, with economic growth printing an underwhelming 1.2% in the first quarter in annualised terms.

The previous strengthening of the Pound in trade weighted terms hurt exports and sent imports booming, so that the external sector more than offset a strong increase in domestic investment.

The service sector, of which accounts for three-quarters of overall output, also grew at its weakest rate since 2012.

As a result, quarter-on-quarter expansion in the UK was slower than that of its Eurozone peers for the first time in four years.

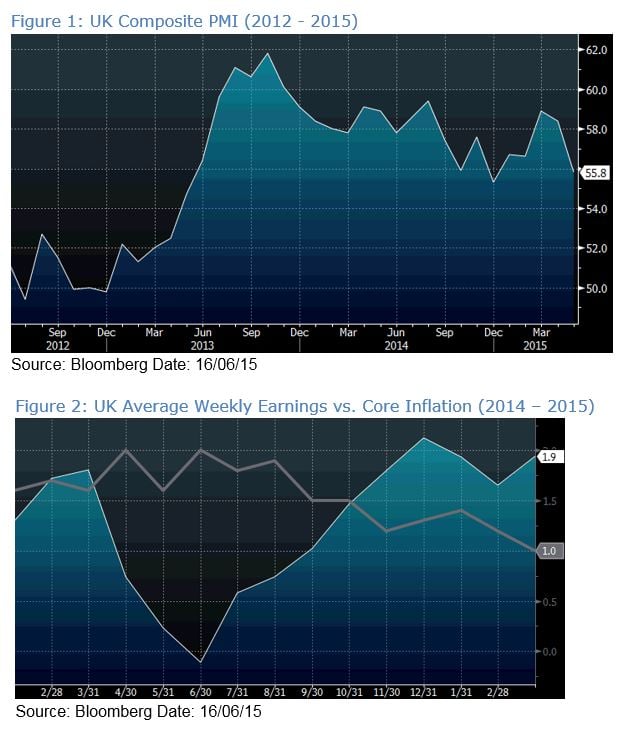

However, other growth indicators continue to tick upwards. Consumer confidence is high, while the latest PMI surveys (Figure 1) and industrial production figures are consistent with higher levels of overall economic growth.

In spite of the weakish first quarter report, leading economic indicators are consistent with a rebound in growth to the 3-3.5% range over the next couple of quarters.

More from Enrique Diaz

The main factor underlying UK relative strength continues to be the strong labour market.

Unemployment has kept up its downward trend, falling to a fresh seven year low of 5.5% in March.

Wage growth is also now strongly above the level of core inflation, and has been so for the past six months, continuing its modest acceleration we have seen since 2013 (Figure 2).

Importantly, the UK housing market is also beginning to heat up. We’ve seen a fresh surge in buyer inquiries while mortgage approvals have jumped to a level that is consistent with an acceleration of overall home prices.

I think this is not news that the Bank of England will be particularly happy to hear.

Given this, the steady levels of economic growth, an improving labour market and the absence of any political instability after the Conservative Party strolled to an election victory in May, I expect the Bank of England to begin hiking interest rates in the spring of 2016.

While the vote to keep rates unchanged has remained unanimous since January, hawkish comments from MPC member Ian McCafferty last week suggests this will not remain the case for too much longer.

There are few signs that the monetary policy committee is uncomfortable with current market expectations of a first rate hike in mid-2016.

As markets increasingly come to agree with this view, the prospect of higher rates in the UK should keep Sterling well supported against the Euro, but somewhat less so against the US Dollar, which we believe will start hiking at either the July or September FOMC meeting.