ISA Changes: Has Cash Just got More Attractive?

Those currently holding cash savings in a bank or building society will no doubt be pleased with the changes announced by the Chancellor in the Budget.

"It is possible to build a low risk portfolio, which invests in a mix of more stable assets, such as bonds and gilts, and less in equities."

However, before being persuaded to hold more cash, savers should carefully consider the opportunity cost of holding cash compared to holding other forms of investment.

The changes announced in the budget mean the first £1,000 of interest (for basic rate taxpayers) will no longer be subject to income tax (£500 interest for higher rate tax-payers).

This could mean a basic rate taxpayer could hold up to £100,000 in a cash account without paying tax on their interest, assuming an interest rate of 1%.

New Cash ISA flexibilities were also announced, allowing savers to take money out and then put it back in again.

Both of these changes have the potential to make cash holdings more attractive.

However, with interest rates at an all-time low, savers need to carefully consider whether this sweetener is enough to compensate for the potential higher returns available from stock market investments (stocks and shares ISAs).

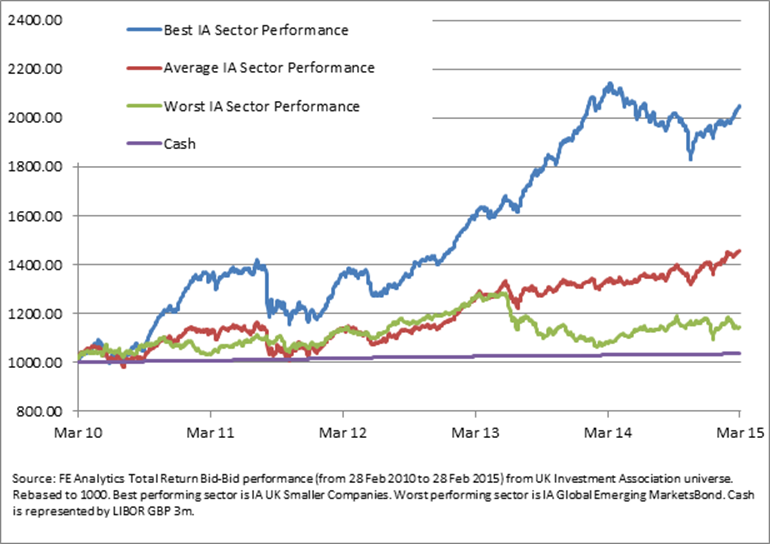

Performance data over the last 5 years shows all IA (The Investment Association, previously IMA) sectors (excluding cash sectors*) have outperformed cash (using the Libor 3m rate).

The difference between the top performing IA sector and cash is quite startling, and whilst past performance is not a guide to future performance, the fact that all IA sectors have performed better than cash should make people question the opportunity cost of holding cash.

A potential hurdle for many savers to overcome is the fear of losing money if they invest in the stock market.

This is why seeking professional advice is so important.

A professional adviser will be able to build an investment portfolio tailored specifically for the saver, taking into account the length of time they wish to save, how much money they have, and their level of risk tolerance.

It is possible to build a low risk portfolio, which invests in a mix of more stable assets, such as bonds and gilts, and less in equities.

Building a diverse portfolio also helps reduce overall risk; blending assets which behave differently under various economic circumstances can create more stability overall with less fluctuations.

For savers still cautious about the prospect of losing money in the stockmarket, they need to weigh up whether the security of cash is really worth it compared to the potential gains they could receive over the longer-term with stockmarket investments.

There is no doubt that building a robust and successful portfolio takes research, diligence, focus and time. Delegating the investment process to a professional can help ensure a sound investment process is followed and all pitfalls safely navigated.

* Excludes Money Market and Short Term Money Market IA sectors which delivered 1.23% return and 0.71% return respectively.

Please note, past performance is no guide to future performance. 105% return over 5 years does not reflect ‘normal’ growth projections; this exceptional growth reflects the recent stock market rally in both equities and bonds.