Pound-to-Canadian Dollar Rate 5-Day Forecast: Targeting August Lows

Image © Pavel Ignatov, Adobe Stock

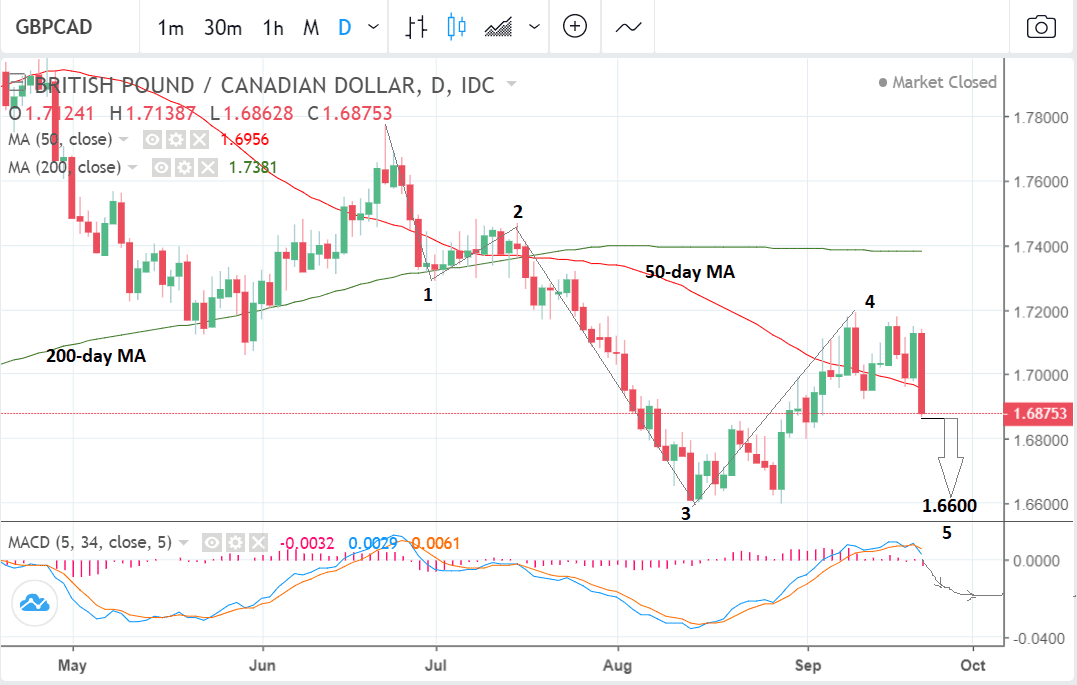

- GBP/CAD declines as 'no deal' Brexit risks grow

- Probabilities now favour more downside towards 1.66 lows

- Elliot wave analysis also backs up downside forecast

The Pound-to-Canadian Dollar exchange rate is seen trading at 1.6924 at the start of the week amidst a slight uptick in the broader Sterling complex following the deep falls suffered at the close of the previous week.

Sterling lost 2.5 cents of purchasing power against the Canadian Dollar at the end of last week after the prospect of a 'no deal' Brexit increased. Theresa May delivered a press conference at 10 Downing Street where she said talks had reached deadlock and the E.U. must now make proposals to move negotiations forward.

From a technical standpoint, Friday's sharp descent in GBP/CAD suggests a change in the short-term trend and a probable continuation lower for the pair.

So strong was the decline on Friday it is enough to indicate the bias is now to the downside for GBP and we expect a continuation lower in the week ahead.

A break below the 1.6850 level would probably provide confirmation of a continuation lower to a target at 1.6600 and the August lows.

The 'structure' of the market since the June highs also supports a bearish continuation to 1.66, as it bears all the hallmarks of a bearish Elliot wave pattern.

Elliot waves are five wave cycles of buying and selling interspersed by three wave corrections. Waves 1, 3 and 5 are in the direction of the trend and 2 and 4 are corrective.

Once a five wave pattern ends a correction composed of three waves labeled A, B and C unfolds in the opposite direction before the next 5-wave cycle begins.

On GBP/CAD a bearish Elliot wave looks like it started at the June highs. Within that larger wave, it looks as if component wave 4 probably ended on Friday when the market crashed. This probably signalled the start of wave 5 lower which is currently in the process of unfolding.

Normally wave 5s reach at least as low as the end of wave 3, which in this case is at the 1.66 August lows.

Once wave 5 is complete there will probably be a correction back up to the 1.70-72 region.

The MACD on 5,34,5 setting provides added insight to Elliot wave forecasters. The indicator has risen back above the zero line after troughing following the end of wave 3. This is normally a sign the pair has finished wave 4 and will start moving lower in wave 5.

The MACD is expected to mirror the decline in the exchange rate and form a second shallower trough at the end of wave 5 as indicated by the notation on the chart.

Advertisement

Lock in current GBP/CAD levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Canadian Dollar: What to Watch this Week

Fears Canada could end up without a NAFTA held back the Canadian Dollar in the previous week after Canada emphasised the importance of a good deal irrespective of looming deadlines.

However, markets appear sanguine to the risks of the U.S. and Canada failing to reach a deal.

"While US-China trade tensions are rising, our base case of a trilateral NAFTA agreement appears to be closer to materialising," says foreign exchange strategy note from Goldman Sachs dated September 21.

Goldman Sachs reckon the securing of a final deal could boost the Canadian Dollar by up to 3%.

"While much ofthe better news on NAFTA has been priced in, we think an announcement on a trilateral trade deal—a possibility in coming days—would clearly be positive for the MXN, and we estimate that USD/CAD could decline by as much as 3%," say strategists at the Wall Street bank.

The main release in the week ahead is GDP data for the July, which is forecast to show a 0.1% rise versus the 0.0% in the previous month of June.

A higher-than-expected result would be expected to support the Canadian Dollar (Loonie) and vice-versa for a lower result.

TD Securities, the Canadian investment bank, is a bit more pessimistic than average and forecast a below-consensus -0.1% decline in July.

"Industry-level GDP is set to post a modest 0.1% decline in July on weakness in the energy sector after power outages curtailed output from a large producer in the oil sands," says TD in a note on the week ahead.

The see 'Services' as supplying the main share of growth due to the energy outage affecting heavy industry and manufacturing proportionately more.

Despite the slight slowdown GDP is expected to bounce back in Q4 and TD think the Bank of Canada will "look through" the data and continue raising rates anyway. Since higher rates strengthen the Loonie a GDP undershoot is not likely to undermine CAD very much in the week ahead.

"We expect the BoC to look through such distortions ahead of the October meeting. The 1.5% forecast for Q3 from the July MPR indicates that they’ve already penciled in some downside for July and Senior Deputy Governor Wilkins recently said she expects growth to average 2% over H2, implying a rebound in Q4," say TD Securities.

The BOC governor Stephen Poloz gives a speech at in which he may mention the future path of monetary policy and, therefore, potentially impact on the Loonie, on Monday at 22.45.

The other main release for the Canadian Dollar in the week ahead is wholesale sales in July, out on Monday, which is forecast to show a 0.4% rise month-on-month when it is released at 13.30.

The Pound: What to Watch this Week

Currency markets are likely to continue to be affected by the shockwaves from the Brexit bombshell dropped by May at the end of last week and we will be looking for any new proposals from both the U.K. and E.U. aimed at unlocking the stalled process.

This week, further matters to consider on the political front include whether or not the Labour Party will back a second referendum on Brexit; something that is likely considering polling of Labour Party members suggests well over 80% are in favour of such an outcome. Reports suggest Labour leader Jeremy Corbyn will accept the will of his party on the matter.

Also of note is a report in the Sunday Times that Theresa May might be left with little choice but to call another general election in order to both shore up her own position and to deliver her desired Brexit plan.

Reports suggest her aides are suggesting an election might be called in November: We believe if this were to happen it will inject a significant amount of downside into Sterling which detests uncertainty.

Political developments are likely to dwarf the few economic data releases on the calendar, including industrial trends data from the Consortium of British Industry (CBI) (Monday 11.00 B.S.T), the Nationwide house price index (HPI) (Friday 7.00), business investment (Friday 9.30), current account data (ditto), Q2 GDP revisions (ditto) and gross mortgage approvals (Wednesday 9.30).

None of the above are major market moving releases unless they deviate hugely from their expected results.

Possibly of more importance for the Pound could be what Bank of England (BOE) officials say in their speeches in the week ahead about the current state of Brexit negotiations and associated risks - if they decide to comment, which they probably will.

BOE Monetary Policy Committee (MPC) member Gert Vlieghe speaks on Tuesday at 9.40, MPC member and BOE chief economist Andy Haldane at 11.45 on Thursday, and MPC member Sir Dave Ramsden speaks at 14.20 on Friday.

In addition, the week ahead also sees the release of the BOE's Financial Stability Report, at 4.30 on Monday, which will contain clues of the BOE's thinking on the outlook for the economy, although their assumptions about the outcome of Brexit may already be out-of-date following Friday's shock breakdown in negotiations.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here