Canadian Dollar Vulnerable to 4% Swings as NAFTA Deadline Approaches - Credit Suisse

- Written by: James Skinner

-CAD could see 4% swings ahead of May 01 NAFTA deadline.

-Strong economy and rising oil price mean April BoC meeting also key.

-BoC can support CAD in April but NAFTA deadline the real crunch point.

© kasto, Adobe Stock

The Canadian Dollar has continued its riposte against its developed world rivals into the final session of the week although, according to strategists at global investment bank Credit Suisse, it is now at a pivotal point that could soon prompt a sharp move in either direction.

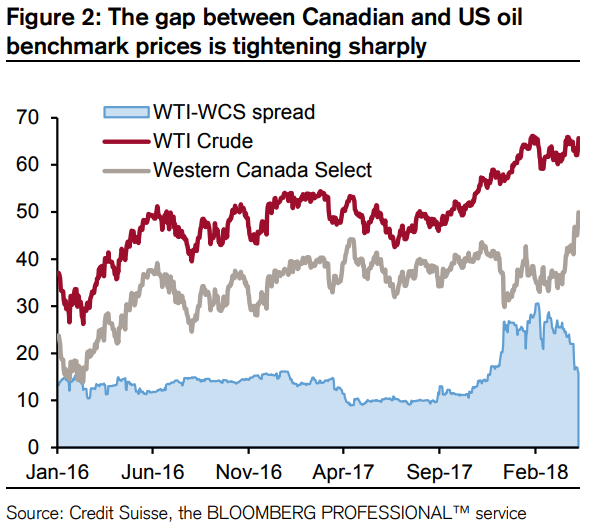

A range of factors have helped to buoy the Loonie higher in recent weeks, including an easing of fears over the future of the North American Free Trade Agreement and an ongoing recovery in oil prices, although there are also a number of prominent risks now littering the immediate path ahead. Events around NAFTA and oil markets will be key to the Loonie's trajectory over the coming weeks and months.

"Last month we called for an extension in USDCAD above 1.30 towards the upper end of the range, a view that has since been proven incorrect and ill-timed," says Alvise Marino, an FX strategist at Credit Suisse. "After printing a low of 1.2244 and trading subsequently as high as 1.3125, USDCAD is now back in the middle of the range, having broken through 50-, 100- and 200-day moving averages in rapid succession."

Marino flags that trading the Canadian Dollar has been challenging in 2018 given exchange rate volatility that has seen the Loonie whipsaw between the peak and trough of a wide range against its larger North American rival. The USD/CAD rate entered the 2018 year trading around 1.25 but since then, it has fallen to a low of 1.2260 in February before rising to a high of 1.3130 during March. Friday it traded at 1.2565 after having reversed more than half of this latter move.

Above: USD/CAD rate shown at daily intervals.

Similar is true of price action in the Pound-to-Canadian-Dollar rate although Sterling has managed to cling on to much more of its gains over the Loonie thanks to favourable developments on the Brexit front and market optimism about UK interest rates. The exchange rate is still up by 5.8% for the 2018 year to date despite having dropped nearly 3% since the beginning of March.

Above: Pound-to-Canadian-Dollar rate shown at daily intervals.

Much of this whipsawing gyration has been driven by rising and falling hopes of further interest rate rises from the Bank of Canada, which are themselves closely intertwined with developments around NAFTA. Market expectations for growth and interes rates have detriorated since late January when the BoC lifted its cash rate by 25 basis points to 1.25%.

At the time markets were happy betting the central bank would manage a total of three interest rate rises in 2018 as a whole, while interest rate derivatives markets assigned a 75% probability to another rate hike in April. Since then, those same markets have become less convinced and are now fully pricing just one more rate rise for 2018, while the implied probability of an April move has fallen to just 20%.

"We see scope for this to change in the coming days and weeks, and we now believe domestic factors could turn more supportive for the loonie," Marino writes, in a recent note, before highlighting two main factors that could drive a repricing of interest rate expectations and give the Loonie a lift.

For a start, the BoC's first quarter business survey flagged moribund conditions in the energy sector but this was carried out before crude oil prices really began to pick up in March and April, which means there could be some scope for the central bank to upgrade its outlook for the sector and broader economy at next week's meeting on April 18.

Above: Gragh taken from Credit Suisse research report.

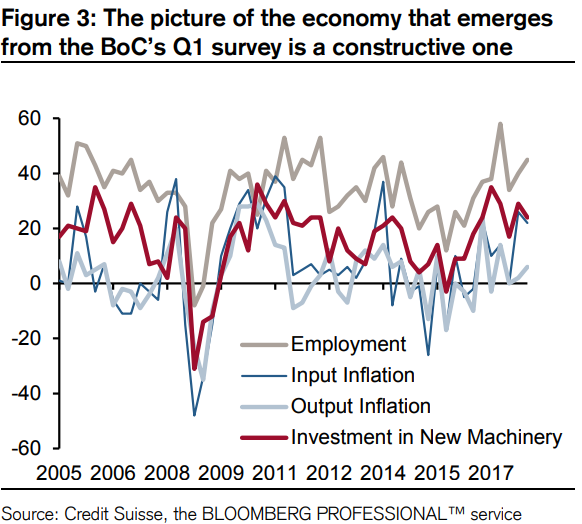

Secondly, the business survey painted a favourable picture of all other parts of Canada's economy, which also suggests the scope for the BoC to tweak its growth forecasts higher, particularly in light of recent developments that have shown NAFTA related risks to the economy diminishing.

Above: Gragh taken from Credit Suisse research report.

"We see scope for these factors to play out further in favour of the loonie, and would set our initial USDCAD target for the 1.2470-1.2415 area. This is an intentionally limited target. The main reason for our cautious approach is that the constructive risks that emerge from the domestic picture are still partially offset by international risks that are very hard to predict," Marino says.

Despite the potential for a BoC-related lift to the Loonie, as well as recent posititive signs on NAFTA, the ongoing negotiations remain a "live concern" for the Canadian Dollar as there is still scope for them to fail. In addition, the recent hostility between the US and China on international trade also poses a risk to the currency.

On this note, Marino flags how the US administration has pivoted back and forth between attacks on Chinese trade practices and aggressive rhetoric relating to NAFTA and suggests the easing of US-China tensions this week could mean a renewed pivot onto a more aggressive NAFTA stance is lurking just around the corner. This would be bad for the Loonie.

"The key deadline for NAFTA is 1 May, when the exemption on steel and aluminium tariffs is set to expire. Approving a deal in principle by then would prove constructive for both the Canadian dollar and the Mexican peso. In terms of CAD levels, we think the September 2017 low of 1.2062 would represent a valid near -term target," the strategist writes.

Above: USD/CAD shown at weekly intervals.

Once this lower level is reached, upside for the Canadian Dollar will be limited given the anticipated agreement would be "in principle" only, meaning a large amount of detail and some key terms would still need to be negotiated. In short, the risk of failure in the negotiations may be reduced by this point but it would still be a threat to the Canadian Dollar nonetheless.

What's more, if a "deal in principle" is not agreed ahead of the May 01 deadline, then the outlook for the Loonie could become decidedly bearish. Cue, more volatility among Canadian Dollar exchange rates.

"If no deal is approved by 1 May, the likelihood of negotiations slipping into Q4 or later will surge due to the impending Mexican election and the time requirement needed for national parliaments to ratify any new treaty. USDCAD will likely rally under these circumstances and, depending on where the cross is trading by the time of the announcement, has scope to perform a full retracement of the recent loonie rally back to 1.29 -1.30," Marino warns.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.