Canadian Dollar: Compilation of Major Bank Forecasts, Currency Views for 2018

Currency strategists from the world’s leading banks give their views below on what 2018 might bring for the Canadian Dollar, otherwise known as the Loonie.

The Loonie could come back down to earth in 2018 as Canadian growth comes off the boil and the Bank of Canada (BOC) lowers its interest rate trajectory.

In 2017 the BOC fuelled strong rallies in the currency after it started raising interest rates from the super low level of 0.50% they had been stuck at previously, taking them up to 1% by year-end.

Higher interest rates are a major driver of currency appreciation as they attract speculators and greater inflows of foreign capital, which is drawn by promise of higher returns.

The recovery in the price of Oil, which is Canada's premier export, further supported the currency although the correlation has broken down in the second-half, resulting in lesser upside for the Loonie from the most recent rise in oil prices.

Despite headwinds, however, the Canadian economy remains relatively robust and could be positively influenced by faster US growth in the year ahead as America gets a tax-reform-boost.

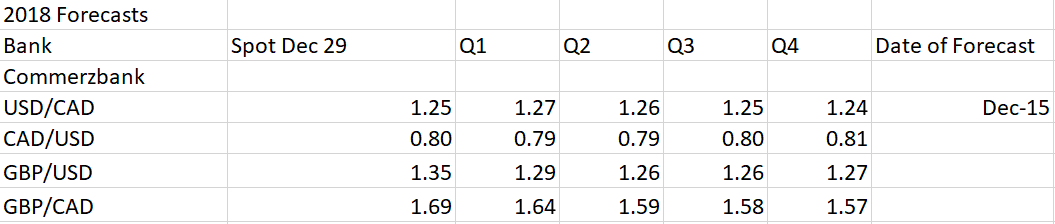

Thu Lan Nguyen, Analyst, Commerzbank

"The Bank of Canada (BoC) has become more cautious again after CAD appreciated heavily following two rate hikes. In view of numerous risks (inflation, oil price, NAFTA) the BoC does not want to be overly optimistic."

"We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD."

"The better growth outlook in Canada as well as the more stable political environment will, however, allow gradual CAD appreciation in the future."

Please note forecasts for GBP/CAD are implied by cross-currency triangulation rather than stated by the specific forecaster.

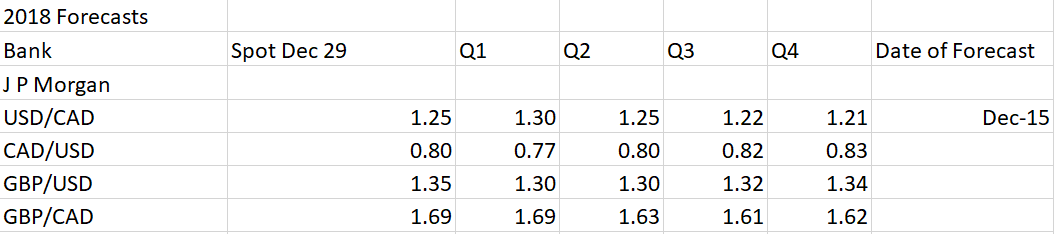

Paul Meggyessi, Head of Global FX Strategy, J.P. Morgan

"Low conviction on BoC which broadly matches lack of enthusiasm for the Fed; hence little pushback on a bounded sideways USD/CAD view."

"Especially in light of the most recent BoC meeting, there was low confidence in the timing or pace of the resumption of BoC rate normalization."

"And in fact our own economists this week pushed back their next BoC hike to the March meeting (see Dimino, We push our next rate hike from January to March, 14 Dec 2017) - also risk of NAFTA risk premium overlay in Q1."

Please note forecasts for GBP/CAD are implied by cross-currency triangulation rather than stated by the specific forecaster.

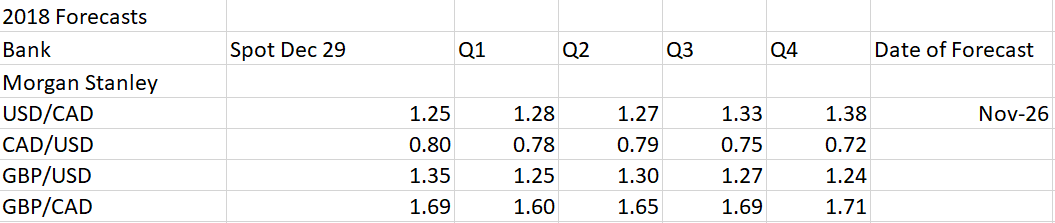

Hans Redeker and James K Lord , Strategists, Morgan Stanley

"High real returns and balance sheet clean-up make EM attractive – the opposite is true of our 'canaries in the coal mine', a club of the DM economies with stretched balance sheets, high leverage, and waning asset quality. Top of the list here include CAD, AUD, and NZD."

"The 'canaries' have seen years of economic growth outpacing income growth. The dominance of US rates in determining global funding costs resulted in local funding costs remaining inappropriately low, given the local needs of these economies, leading to a leverage boom."

"Now, as these economies are running out of balance sheet leverage space, which reduces their growth potential, the US is pushing nominal rates gradually higher, creating further headwinds."

"High real returns in EM and rising US rates mean that the yield advantage offered by these economies relative to G10 counterparts may no longer be sufficient to compensate investors for these growing risks."

Please note forecasts for GBP/CAD are implied by cross-currency triangulation rather than stated by the specific forecaster.

David Woo, Strategist, Bank of America Merrill Lynch

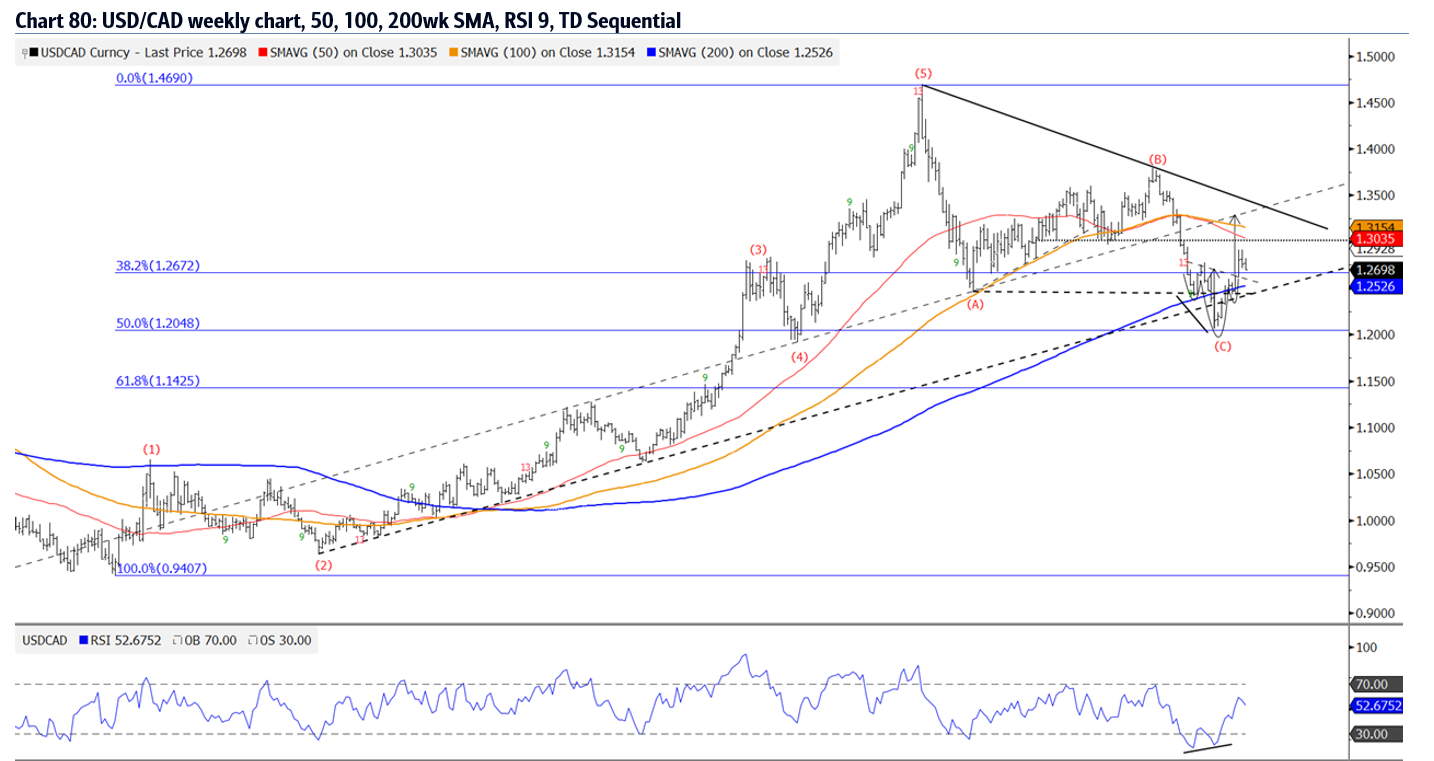

"(USD/CAD): We think the typical wave structure of 5 waves up (12345) and 3 waves down (ABC) since the 2011 low is complete. We think the corrective wave (C) decline ended at the 50% retracement. The low of wave (C) is also the low of the head of a head and shoulders bottom pattern. Also supportive of this bullish view is a small two troughed price vs RSI divergence into the lows of the decline."

"The head and shoulders bottom pattern suggests spot will rally to retest the moving averages at 1.3165 and possibly the interior trend line at about 1.32-1.33 in 2018 (See vertical arrow). A decline below the right shoulder would technically invalidate this, which is about 1.2460 and the low of wave (A). In this scenario, we would look to support one again at the 50% retracement and the wave (C) lows.

"Trade recommendation: buy 6m USD/CAD digital call. We recommend buying 6m USDCAD digital calls with a strike at 1.36 (spot ref 1.2725), costing 11% USD. This offers 9 to 1 payoff-to-cost and is long volatility, allowing the trade to provide a tail risk hedge for higher spot and higher vol if (NAFTA) negotiations unravel."

"Trade recommendation: Buy USD/CAD – target 1.3250, stop at 1.2450."

Please note forecasts for GBP/CAD are implied by cross-currency triangulation rather than stated by the specific forecaster.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.