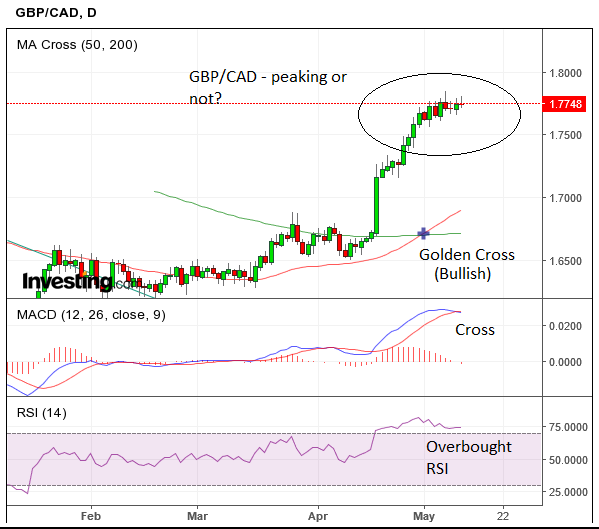

Has the GBP/CAD Peaked Just Below 1.8000?

The Pound may be peaking versus the Canadian Dollar as the exchange rate stalls for the fourth straight day below the 1.8000 ceiling.

This would seem like a natural place for the exchange rate to stall and pull-back especially after its rapid rise following the breakout in mid-April from the range it was in, in the 1.60s.

The RSI momentum indictor is also firmly in the overbought zone and therefore potentially likely to signal a correction if it turns lower.

The MACD indicator has crossed its signal providing a mild sell signal.

However, not all analysts are convinced the pair is peaking, or if it is, that it will lead to an extended pull-back.

A mixed view of the pair’s prospects is exemplified by Scotiabank’s Shaun Osborne who whilst entertaining the possibility the market may have peaked also sees scope for more upside too.

“We think Friday/Monday price action signaled a possible peak in the market—a little below the 1.79/1.80 area that we thought reachable on this move up—but the GBP remains quite well underpinned and net gains on the session so far for the cross suggests a risk of a renewed push higher,” said Osborne.

The GBP/CAD chart is also showing a rare bullish golden cross of the 50 and 200 day moving averages which is normally a 60% plus probability signal of substantially more upside.

Oil Slide at an End?

A potential bottom in the oil market may provide assistance to the Canadian Dollar which is heavily correlated with the commodity, its chief export.

The WTO Crude Oil chart looks susceptible to a reversal of the trend after its steep sell-off down to the 43.76 last Friday lows.

If Oil recovers it will be positive for CAD and negative for GBP/CAD, reinforcing the possibility the pair could be rolling over.

Overlaying the Oil chart with a Bollinger Band increases confidence that we may have seen a bottom in the market as it reveals that the recent low was well outside the outer band of the Bollinger.

These extra-long hammer candlesticks’ which pierce more than 50% outside the Bollinger band are strong reversal signals, and we now see a bullish bias for oil.

The OPEC meeting on May 25, or rumours in the run-up, could very well provide the fundamental driver to more upside.

As such, there does seem to be an increased risk that GBP/CAD may be seeing the end of its run of easy gains and although more upside is still probable, gains could be more hard fought for.

Save

Save