Pound Forecast to Decline Against Canadian Dollar into August

Our studies indicate that the coming week will most likely witness a decline in the GBP to CAD exchange rate.

Pound Sterling retains a positive bias against the Canadian Dollar and is now higher than the level of 1.7245 where the exchange rate opened at the start of July.

The pair is at 1.7273 at the time of writing, well off the lowest level recorded at 1.6694, largely thanks to a broad-based GBP rally which has coincided with a decline in oil prices.

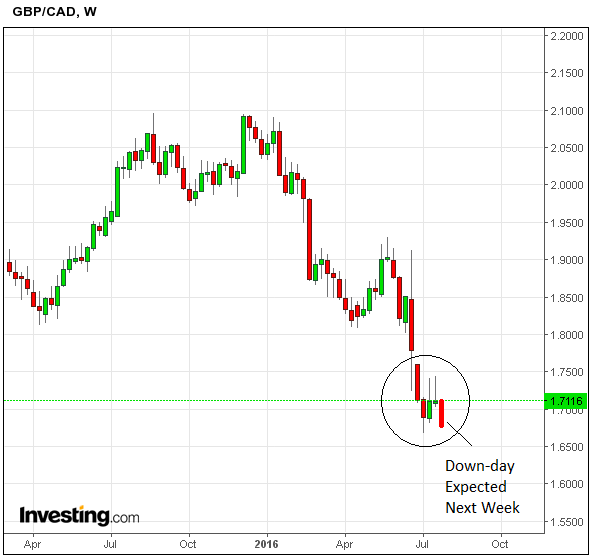

Looking ahead however, our interpretation of the weekly chart of GBP/CAD is indicating that the week starting 25th July will probably result in a down-week for the Pound to Canadian dollar exchange rate pair.

This is because the chart is showing a specific set-up, which is two consecutive up-weeks in the middle of a strong down-trend.

Whenever this occurs the pair tends to be a down-bar in the following week.

This set-up has about a 66%+ success rate (on EUR/USD anyway) - a roughly two-thirds probability.

It indicates the bias for the whole of the next week is to the downside.

The four-hour chart is also looking quite bearish now.

The triangle which formed broke to the upside eventually but only rose to 1.7450ish rather than all the way to 1.7500 as forecast.

After that it suddenly broke lower following the new that the UK July Services and Manufacturing PMI were in negative territory Canadian inflation and Retail Sales data rising.

As a consequence, the pair has now fallen down to the 1.7130s, which is back inside the triangle.

Ideally I would like to see a clear break below the 1.7000 level, potentially indicating a move down to 1.69, 68 and the 67 lows.

Oil Prices Could Hurt the Canadian Dollar

While our studies of GBP/CAD favour the Canadian unit, we note that the movements in oil prices could well prove to be our undoing.

The CAD is suffering notably against the USD owing to a sharp decline in crude oil prices which have witnessed the commodity hit three month lows.

Oil exports are the key foreign currency earner for Canada, and therefore any declines in the price of oil will likely weigh on the currency.

According to Nordea Bank’s Thine Margrethe Saltvedte, prices will probably not rise at the pumps this summer as is the normal seasonal effect.

“Crude oil prices are still under pressure as US shale producers have started to hire more rigs, weaker global economic growth and increasing geopolitical instability. Locked-in barrels from the wildfires in Canada and from pipeline attacks in Nigeria have returned to the market in almost full-scale. In addition, Libya is indicating that exports from two of the country’s biggest ports will soon resume after having been closed since 2014 after attacks by IS.” She said in a recent note.

Refinery stocks also still too high, keeping cap on gasoline prices:

“In fact, it is not only the crude, but also the refined oil products that may threaten a potential oil price recovery. US petrol stocks are close to 240m barrels, up almost 15% from last year and above the five year average. European petrol stocks were up by 2.4% by end of first quarter (last reading) and up almost 7% above the five year average. Despite the low prices lifting demand for petrol to levels higher than the 2007 peak in the US, the refineries have still produced more than the market can absorb.”

Increasing emerging market demand is likely to absorb supply in the longer-term, but that said Saltvedte says increased demand in India has not been enough to outweigh the fall in demand elsewhere this summer:

“A surprisingly sharp deceleration in China, a significant slowdown in Saudi Arabia following a cut in fuel subsidies this year and much slower-than-expected petrol demand growth in the US and Europe have more than counterbalanced a sharp upswing in India.”

Canadian Data Likely to Disappoint?

The most significant release for the Canadian Dollar in the week ahead is Canadian second quarter GDP, which is scheduled for release on Friday, and is expected to show 2.6% growth from 1.1% previously, and -0.5% mom in June from 0.1% previously.

According to Morgan Stanley’s Hans Redeker, there is little reason to expect further Canadian dollar weakness in the short-term, thus the risk for GBP/CAD remains that sterling will weaken and the pair will continue its trend to the downside:

“With the BoC sporting a hawkish tone at the most recent meeting, we expect little in the way of a catalyst to weaken CAD in the short term. If anything, CAD may strengthen in 3Q , though stretched positioning may limit gains.”

According to Jeremy Stretch at CIBC Capital Markets the USD will far outperform the Canadian dollar over coming days with both country’s Q2 GDP data set for release and therefore comparable, “differentials” will be “writ large”:

“Our colleagues in CIBC Capital Markets Economics anticipate headline sales falling 0.3%, we can expect the ESI downtrend to be further perpetuated. Indeed with retail spending likely depressed, (weighing upon GDP expectations), consumer prices subdued and relative GDP differentials between the US and Canada set to be writ large next week, these factors together help maintain our USD CAD topside bias.”