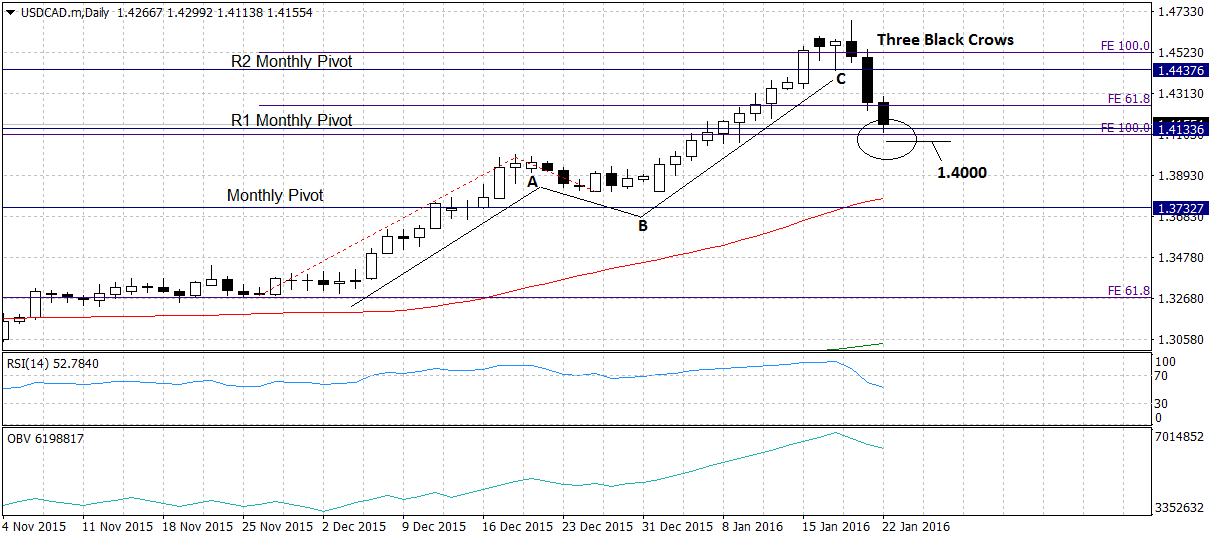

Canadian Dollar Bounces: 'Three Black Crows' Signal Warns of further gains

The Canadian Dollar (CAD) has recovered alongside improved commodity market conditions and a central bank that declined to cut interest rates.

A three wave measured move which ended on the 20th was followed by a three-black crows candlestick pattern – a combination of factors which - according to research produces a high probability of lower rates to come.

RSI has also produced a clear sell signal after moving out of overbought.

However, the picture is complicated by the existence of a cluster of support underpinning today’s lows which could produce a very short-term bounce.

Ideally I would want to see a break clearly below this double layer of support, and below 1.4065 to confirm an extension down to 1.4000.

Pound to Canada

For the pound to Canadian Dollar pair there is a similar configuration – bounce followed by downside.

The pair has been falling for six straight days now.

It has broken below a major multi-year trend-line at around 2.3000 and this has generated a short-term target lower at 2.0000.

MACD has crossed below its signal line and zero-line, giving a strong bearish signal.

However, this pair too has almost reached substantial support in the form of the 200-day MA, which will impede its move towards 2.0000.

I therefore foresee a probable short-term bounce on GBP/CAD as well, once the exchange rate touches the 200-day MA.

This bounce will probably take the exchange rate back up to the underside of the trend-line and the monthly pivot at 2.0400, where it will probably ‘air-kiss’ the trend-line goodbye before restarting its decline back down towards the aforesaid 2.0000 target.

If it continues straight through the 200-day MA, however, then a break below 2.0180 would probably confirm a move to 2.000.

Oil Stops Slipping and Sliding

A significant rebound in the price of oil is the main factor underpinning the currency’s recovery.

It is possible that oil has reached a major low as it is showing an exhaustion break below the lower border of its descending channel followed by a strong recovery move higher.

One fundamental driver for the rebound was the Canadian Central Bank’s decision to stand pat on interest rates at its last meeting.

Data out on Friday showed Retail Sales rocket higher, coming out at 1.7% in December versus the 0.2% expected, from 0.1% previously – an absolutely massive gain.

According to Societe Generale the Loonie “leapt like a sock-eye salmon” and was the best performing currency of the week:

“This week’s strongest currency is the Canadian dollar, boosted by the oil bounce, but also by the Bank of Canada keeping policy on hold and a host of stories about US shoppers flooding North (December retail sales were very strong).”

Inflation Down but Retail Sales Surge

Canadian Inflation data also out on Friday failed to hit expectations.

Whilst it gained on a yoy basis by 1.6% from 1.4% that was still below forecast, and mom it fell -0.5% when it had been forecast to fall -0.4% (from -0.1% in November).

According to National Bank of Canada who conducted an analysis of the CPI figures in greater detail:

“The surprise stemmed from the sharpest monthly drop on record for clothing prices.

“There is reason to believe that this is temporary due to warmer temperatures than usual in December.

“Retailers could have offered discounts to attract consumers.

“As expected, the food category was impacted by the weakness of the Canadian dollar via the import channel, rising 0.6% in December and 3.6% on a year-on-year basis (middle chart).

“We note that both fruits (+10.0%) and vegetables (+10.5%) have been rising at a double digit pace over the past year.”

It must be a concern, however, that the ultra-low exchange rate continues to fail to have more of an upwards impact on prices.