GBP/CAD Week Ahead Forecast: Back to 2018 Highs

- Written by: Gary Howes

Above: BoC Governor Macklem hits the airwaves this week.

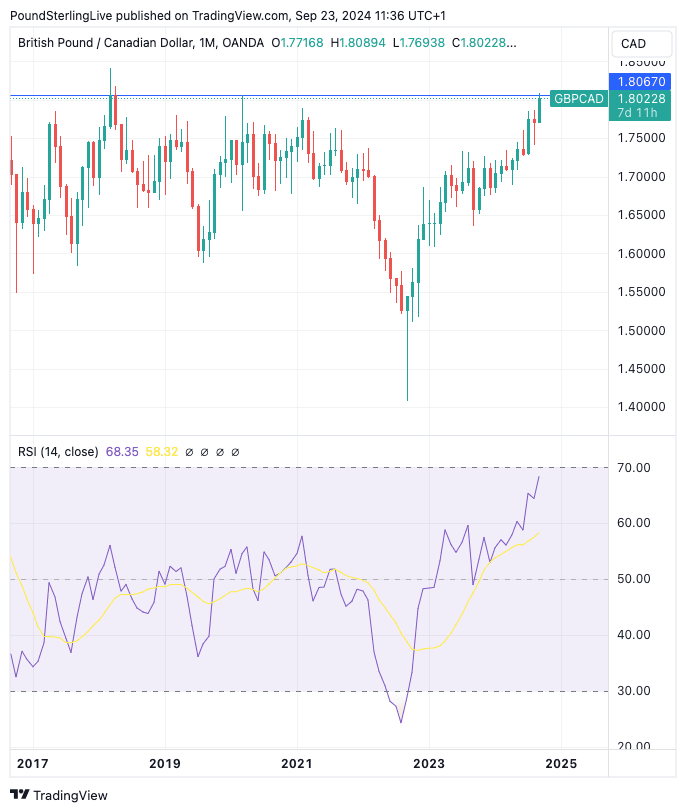

The British Pound could be looking to register its strongest monthly close against the Canadian Dollar since 2018 this week.

The Pound to Canadian Dollar exchange rate closed March 2018 at 1.8067 as a seven-month run of gains finally topped out and ultimately gave way to a multi-month decline that lasted for the next one-and-a-half years.

GBP/CAD is at 1.8029 on Monday, and the bulls will be holding that 2018 peak as an objective. Close above here, and the uptrend in the exchange rate remains intact. Recall that back in 2018 the UK was in the throes of Brexit negotiations and unstable domestic politics, which weighed heavily on the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

To be sure, the new week starts off with losses as Pound Sterling retraces some of last week's gains, but the backdrop is fundamentally different to that of 2018.

The oscillation of currency markets means any pullbacks are unremarkable and could even extend into the coming days. However, for now, the overarching assumption is that losses will remain limited and that March 2018 peak should be broken and held in the coming days or weeks.

Above; GBP/CAD at monthly intervals. Momentum has been higher since the Truss debacle of 2022.

In contrast to 2018. fundamentals are in the Pound's camp: the Bank of England has cut interest rates once and signalled last week it won't do so again until November. Friday's retail sales and Monday's PMI data show the economy is too robust to entertain a rapid pace of easing from the Bank.

Meanwhile, the Bank of Canada thinks it can afford to move faster, and markets see decent odds of a 50 basis point cut on October 23. The door to such a move was left ajar by the Federal Reserve, which lowered its policy rate band by 50bp last week.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets think Canada can now afford to entertain such a move given its most important trading partner has commenced its own cutting cycle.

Tuesday will see BoC Governor Tiff Macklem give "a fireside chat" to The Institute of International Finance (IIF) and The Canadian Bankers Association (CBA).

This audience will be keen to hear about the future path of Canada's interest rates and we think Macklem has a good opportunity to finesse expectations for the October decision in an appropriately dovish direction.

If he does, the Canadian Dollar can come under pressure and aid GBP/CAD higher.