Pound to Canadian Dollar Week Ahead Forecast: Why the Pullback Can Extend

- Written by: Gary Howes

Image © Adobe Images

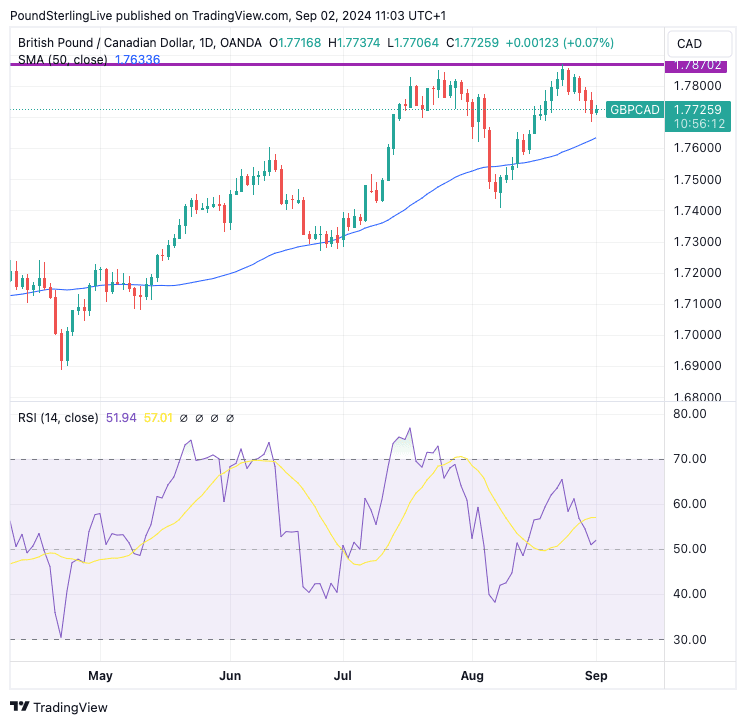

The Pound is undergoing a pullback against the Canadian Dollar, which we think can extend in the coming days.

However, the outcome of this week's Bank of Canada interest rate decision, the Canadian labour market release and the U.S. labour market report on Friday will all have a significant impact on FX trade and heighten volatility.

Heading into this action-packed North American calendar the technical theme gripping the Pound to Canadian Dollar exchange rate (GBP/CAD) is clear: downside can be expected in the short-term as the broader 2024 uptrend is put on pause.

This gives the green light to further weakness in the coming days, confirmed by the Relative Strength Index (RSI), which is pointed lower and looks ready to slip below the 50 level. Looking at the immediate technical levels to watch, the 50-day Moving Average (MA) at 1.7633 looks primed for a test.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The 50 DMA has proven itself useful in 2024 as a level that supports the uptrend. We note that the exchange rate can dip below here, but there has not yet been a decisive breakdown of note. Ultimately we think 1.76-1.7630 is the low to target ahead of the Bank of Canada's midweek decision.

The Bank looks set to cut interest rates again, with last Friday's GDP release pointing to ongoing weak fundamentals in the Canadian economy. Economists reacted to the data by saying interest rates remain restrictive and further loosening is warranted.

But a rate cut is 'in the price' of CAD and we don't think it would prove to be a game changer. Instead, Governor Tiff Macklem's guidance and management of expectations for future cuts will be important for currency markets.

Any sense that Macklem wants to get on with the job and deliver further cuts in order to protect the economy could weigh on CAD and underpin GBP/CAD.

Friday is the big day for CAD as the release of U.S. and Canadian labour market statistics will set the tone for future rate cuts at the Bank of Canada and U.S. Fed.

The market is looking for Canada to add 25K jobs, and anything below here risks undermining CAD's recent recovery as it bolsters the odds for more aggressive rate cuts.

The U.S. data will potentially be more important as it will impinge on broader risk sentiment and could hasten Canadian rate cuts if it comes in below consensus expectations. We have noted that CAD has acted as a proxy for the USD in recent months, as markets see the close linkages between the U.S. and Canadian economies.

If the USD rises following a stronger-than-expected U.S. payroll report, GBP/CAD would track GBP/USD lower.

The market expects a payroll print of 163K for August, up from 114K in July.

Capital Economics forecasts a healthier 170K gain in payrolls, alongside a small fall in the unemployment rate to 4.2%. Wage growth should remain at 3.6%.

"Together, that would be consistent with a 25bp rate cut by the Fed next month," says Thomas Ryan, North America Economist at Capital Economics.

This can boost USD and send GBP/CAD lower.

Lars Mouland, an analyst at Nordea Bank, says Hurrican Beryl, which swept through Texas on July 8th, might have been the main reason the July employment numbers looked so bad.

"We expect a rebound in next week's data will remove some of the recession fears," says Mouland.

He explains that economic activity was also impacted by Beryl as the entire 140K national drop in July housing starts can be traced back to the Southern states, with no discernible changes elsewhere.

"The incoming data this week has generally supported our view that the US is on track for a soft landing, and if we are right in thinking that payrolls growth will rebound a bit from the surprise weakness in July, the odds of a 50bp cut from the FOMC at its next policy meeting will probably recede further," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics.