GBP/CAD Forecast: Odds of a Correction Grow

- Written by: Gary Howes

-

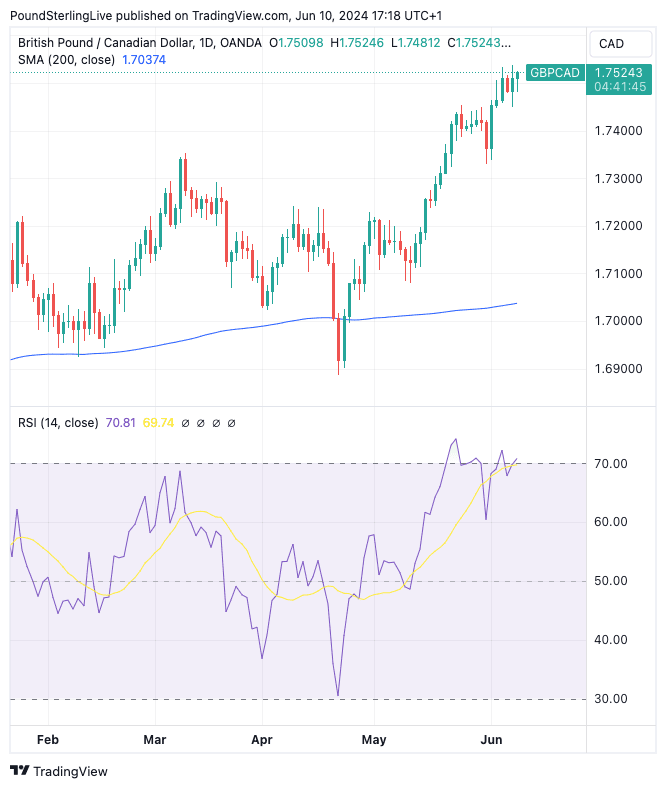

Momentum remains firmly in favour of further GBP/CAD strength, but the odds of a correction from overbought conditions are increasing.

The Pound to Canadian Dollar exchange rate hit 33-month highs last week following the Bank of Canada's decision to cut interest rates, but recent gains leave it looking overbought.

GBP/CAD rose to 1.7534 following the cut before stabilising. Pullbacks have been shallow and tend to attract strong buying interest, leaving the exchange rate on course to register its highest daily close in more than two years on Monday.

"The GBP retains a lot of bullish momentum on the daily, weekly and monthly DMI studies," says Shaun Osborne, Chief FX Strategist at Scotiabank.

He also notes the shorter-term oscillators are looking "a little stretched and some—modest—corrective losses in the GBP may develop in the short run".

The Relative Strength Index on the daily chart is at 70.75, a level that is consistent with overbought conditions. The RSI does tend to revert to lower levels and signals a pullback and consolidation is now long overdue. But the RSI has been hovering around overbought levels since mid-May, underscoring just how solid the uptrend is.

Above: GBP/CAD at daily intervals with the RSI in the lower panel. Track GBP/CAD with your own custom rate alerts. Set Up Here

"Positive broader trends (a sustained break above major trend resistance at 1.7305) plus solid longer-run DMI signals suggest modest GBP dips (to the mid/upper 1.73s) are a buy from a technical point of view," says Osborne.

Longer-term, the analyst says levels above 1.80 "may be reachable later this year".

Turning to the calendar, the highlight is an appearance by Bank of Canada Governor Tiff Macklem on Wednesday, where he will likely discuss the recent rate cut.

Market participants will be interested in hearing his views on the outlook for interest rates, and should he suggest further cuts are coming, CAD can continue to weaken.

Francesco Pesole, FX Strategist at ING Bank, says markets are seemingly turning a blind eye to Macklem's reluctance to rule out a July interest rate cut at the occasion of last week's policy decision.

Macklem said the Bank will take decisions "one meeting at a time". ING thinks "another fall in inflation may put them on the spot already in July," and sees three further rate cuts coming in 2024.

"We think CAD continues to look like the least attractive commodity currency in G10. NOK, AUD and NZD can all count on hawkish domestic central banks, are more undervalued, and should rally faster in a scenario where USD rates decline this summer," says Pesole.

"Overall, monetary policy divergence supports the downtrend in CAD versus AUD, NZD, and NOK. Unlike the BOC, the RBA, RBNZ and Norges Bank are in no rush to loosen policy," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.