Pound-Canadian Dollar Rate Hits Fresh Highs, CAD's Strong Jobs Report Not Enough

- Written by: Gary Howes

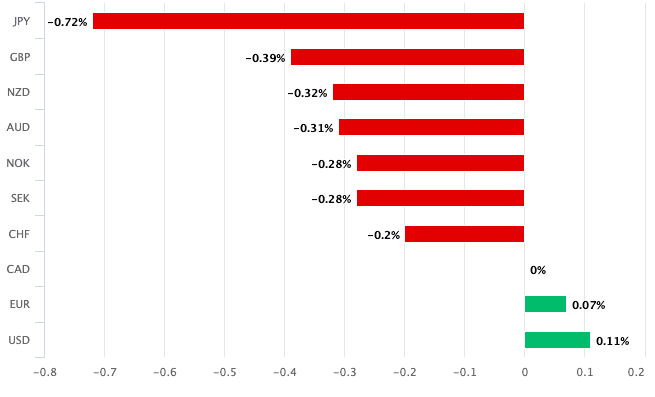

Above: CAD performance on March 08 following the Canadian and U.S. job reports.

A stronger-than-expected Canadian jobs report did not prevent the Pound to Canadian Dollar exchange rate from hitting a new 6-month high at 1.7314.

The Canadian Dollar is the day's joint second-biggest G10 loser despite Statistics Canada revealing employment rose by 41K in February, exceeding the 20K the market expected and January's 37.3K.

The unemployment rate ticked up to 5.8% from 5.7%, but this was in line with expectations. "The Bank of Canada appeared in no rush to start cutting interest rates earlier in this week, and today's data will do little to speed the process up," says Andrew Grantham, an economist at CIBC Capital Markets.

So if today's data doesn't bring forward Bank of Canada rate cut bets, then why is the Canadian Dollar lower?

The answer can be found in the currency's 'mini USD' status: CAD has been trading as a USD proxy for some time now, and the big USD selloff we are seeing in the wake of the U.S. non-farm payroll report is clearly having an effect.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The U.S. reported a strong payroll figure but a sharp slowdown in wages that hinted the jobs market was clearly heading in a direction that would allow the Federal Reserve the space to cut interest rates in June.

Markets bet this will provide ample cover for the Bank of Canada to follow suit. This synchronisation owes itself to the deep links between the U.S. and Canadian economies and financial systems.

So, the strong rise in the Pound-Canadian Dollar (which is repeated on other CAD crosses) is more a U.S. story than a Canadian one.

Yet, this was still a strong job report that cannot be ignored. Grantham points out that, unlike prior months, the hiring came in the form of full-time positions (+71K) at the expense of part-time jobs (-30K).

"There is still evidence from today's data that labour market conditions are loosening, but only gradually and not in a way that demands an imminent reduction in interest rates. We continue to forecast a first reduction at the June meeting," says Grantham.

However, he notes further weakness in paid private sector employment and wage growth for permanent employees decelerated more than expected to 4.9% from 5.3% (consensus 5.1%). So, these data are moving in a direction consistent with BoC rate cuts, albeit slowly.