Resilient Canadian Dollar and Softening Sterling Weigh on GBP/CAD

- Written by: James Skinner

"Yesterday's daily close below long-term trendline support at USD/CAD 1.3193 leaves little in the way of support until 50% retracement of the 2021-2022 rally" - RBC Capital Markets.

Image © Adobe Stock

The Canadian Dollar was mostly stronger in a resilient showing from the Loonie heading into the latter half of the week while Sterling was weaker in many parts ahead of a widely anticipated Bank of England (BoE) interest rate decision with the result being modest losses for GBP/CAD and uncertainty about the outlook.

Canada's Dollar rose against all major counterparts except for the Swiss Franc and Norwegian Krone in early trading on Thursday and soon after a summary of this month's Bank of Canada (BoC) deliberations revealed the Governing Council had discussed waiting for longer before raising the cash rate again.

But the resilient Canadian economy and an April tick higher in inflation did ultimately lead to an interruption of the earlier conditional pause in the BoC's monetary tightening cycle, while Wednesday's summary of deliberations suggested further action could yet raise the benchmark from its current 4.75%.

"Members felt that enough data had accumulated to convince them that more restrictive policy was needed. Therefore, it was preferable to take the required action and continue to assess economic developments to guide future actions," the meeting summary said.

"Governing Council agreed to increase the target for the overnight rate to 4¾% and assess the need for further policy rate increases based on the incoming data," it added.

Above: Pound to Canadian Dollar rate shown at 2-hour intervals alongside USD/CAD.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Canadian economic resilience was confirmed again earlier on Wednesday when Statistics Canada said retail sales had grown 1.1% to $65.9 billion in April, surpassing a consensus for a smaller 0.4% increase, and standing the economy in good stead at the opening of the second quarter.

"Yesterday's daily close below long-term trendline support at USD/CAD 1.3193 leaves little in the way of support until 50% retracement of the 2021-2022 rally at 1.2992, with resistance now located at 1.3195 and 1.3262," says Alvin Tan, Asia head of FX strategy at RBC Capital Markets.

April retail sales growth was even stronger when gasoline and motor vehicle sales are set aside in the data, having come in at 1.3% against a consensus looking for only a 0.5% increase but it's not clear if this, the BoC's cash rate commentary or both were behind the Canadian Dollar's resilience on Thursday.

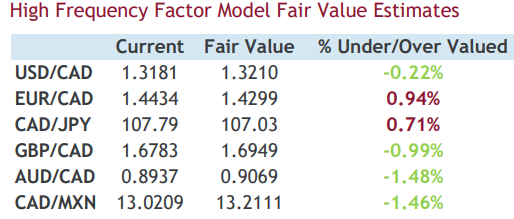

"For the CAD, one of the bigger valuation misalignments is against the AUD – where it is undervalued by about 1.5%. Outside of that, the CAD is also undervalued against the MXN and EUR," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

"USD sellers can still get better levels from here given the considerable two-way risk for incoming US data. We like fading rallies to the 1.3270-1.3320 range," he adds.

Source: CIBC Capital Markets.

Oil prices were modestly higher on Thursday but for GBP/CAD the outlook is clouded by recent UK inflation figures and uncertainty over an imminent interest rate decision from the Bank of England (BoE), which faces an exceptionally difficult choice this month with few, if any good options.

This is after the Office for National Statistics said on Wednesday that inflation remained unchanged at 8.7% in May while rising further from 6.8% to 7.1% when energy and food items are aside, in an outcome that has stoked uncertainty about how long it will be before the earlier disinflation process can be expected to continue.

"A 50bp hike would see GBP rally. But the inflation/growth trade-off is getting worse and worse and at some point, rate hikes ought to be bad for sterling rather than good," writes Kit Juckes, chief FX strategist at Societe Generale, in a Thursday market commentary.

Market-implied levels for the BoE Bank Rate at the turn of the year were as good as 6% on Thursday and higher than those that previously led to a miniature meltdown among small and medium-sized lenders in the U.S. when similar levels were priced in for the Federal Reserve (Fed) in March.

Many economists now look for policymakers to weigh the case for either a 0.25% or 0.50% increase lifting Bank Rate to either 4.75% or 5% on Thursday but with a 4.4% increase already implemented since December 2021 and inflation being where it is, it's far from clear how the BoE will actually respond or what it will mean for GBP/CAD.

Above: Pound to Canadian Dollar rate shown at daily intervals alongside USD/CAD.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes