Canadian Dollar: Look for Knee-jerk Weakness in Response to Bank of Canada says RBC Capital

- Written by: Gary Howes

Image © Bank of Canada

Economists at Royal Bank of Canada (RBC) expect the Bank of Canada to deliver a hawkish hold in their upcoming meeting, which might generate some near-term Canadian Dollar weakness, however, this will likely be short-lived.

While RBC joins a majority of economists surveyed by Bloomberg in not expecting a hike, RBC economists note that the strong run of data has placed significant pressure on the Bank of Canada (BoC), following their previous hawkish signals.

"Our base case for the BoC is to deliver a hawkish hold, which may result in a knee-jerk move lower in CAD," says Adam Cole, Head of FX Strategy at RBC Capital Markets.

He says it would be challenging for the market to substantially scale back rate hike expectations for July, given the prevailing data and previous indications from the central bank.

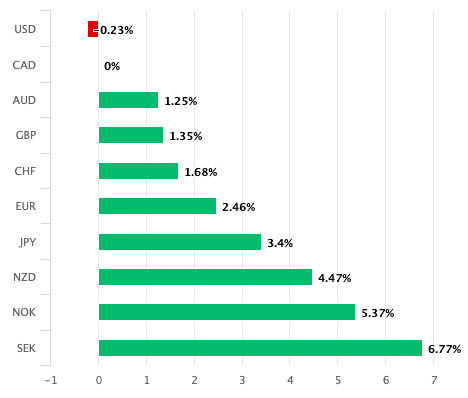

The Canadian Dollar has been one of the better-performing major currencies of the past week and month as it puts a period of underperformance behind it.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

To be sure, much of this strength reflects the CAD's tendency to latch onto its southern neighbour, the U.S. Dollar, which has been outperforming of late.

Further outperformance becomes possible if the BoC strikes the right notes on June 07.

Cole says the BoC could raise its hawkishness without actually hiking rates by emphasising the need for data to soften in the short inter-meeting period.

This approach would establish a July hike as the clear base case. The lag involved in monetary policy transmission is a compelling reason for the BoC to wait, as the full impact of previous rate hikes has yet to be seen.

Above: CAD has outperformed over the course of the past month.

Canadian GDP momentum slowed during Q1, with April's nowcast looking unusually strong despite the estimated impact of the PSAC strike.

RBC's base case aligns with the BoC's potential for a hawkish hold, which may initially drive a downward move in the Canadian dollar.

However, Cole suggests that it is unlikely the market will significantly reduce rate hike expectations for July.

In terms of technical levels for USD/CAD, Cole points out that the currency pair closed slightly below the support level at 1.3404 on Tuesday. This level will now serve as initial resistance, followed by 1.3462 and 1.3535. On the downside, market participants should keep an eye on the important trendline at 1.3332.

GBP/CAD has meanwhile been trending lower and the next technical test comes in at 1.6540, the April and March lows.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes