Canadian Dollar Forecast to Outperform in 2023 by Bank of America

- Written by: Gary Howes

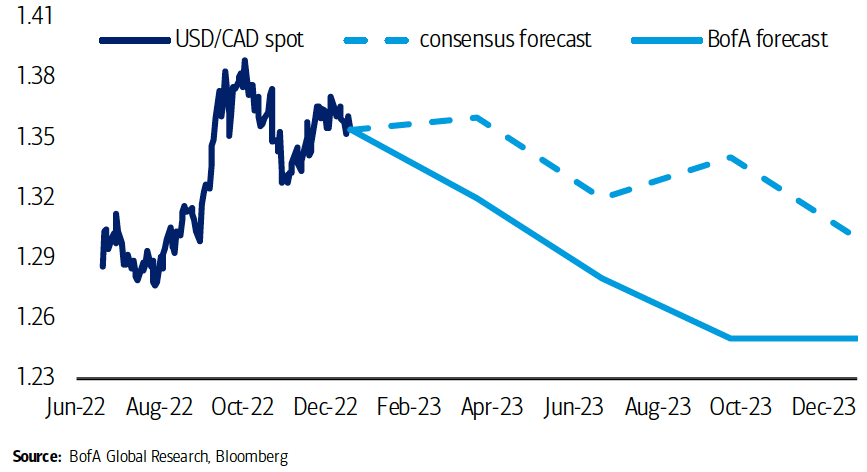

Bank of America says it holds a positive outlook on the Canadian Dollar in 2023 and is more bullish on the currency's prospects than implied by the consensus forecast (see above).

This is because the focus of the foreign exchange market will shift away from inflation to growth in the coming months; and on this metric, Canada is well poised.

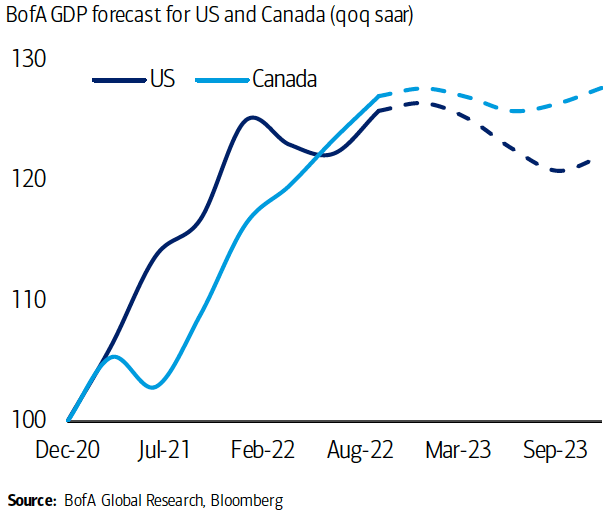

"We expect a shallower recession for Canada vs the US, and the relatively better growth prospect should support the CAD in 2023," says Howard Du, G10 FX Strategist at Bank of America.

"The CAD was resilient for most of 2022 but sold off after September as investors focused on the imminent rate hike pause from the Bank of Canada (BoC)," adds Du. "We expect the market to look past the CAD weakness from 2022."

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The BoC hiked interest rates aggressively in 2022 but expectations of a pause started to build by September, pressuring Canadian bond yields lower which in turn dragged on the Canadian Dollar.

"The Canadian dollar was resilient for most of 2022. However, it has been selling off aggressively since September," says Yu.

Bank of America expects the BoC to be amongst the first of the developed market central banks to pause the tightening cycle.

Oil prices - another key driver for the Canadian Dollar - peaked in June and trended lower into year-end, offering another narrative for CAD underperformance in the latter part of 2022.

But Bank of America does not expect the slide in oil to extend and this should boost the value of Canada's export basket and underpin foreign exchange earnings.

"Constructive equity and energy outlooks for 2023 should also support the CAD," says Yu.

Above: "USD/CAD sensitivity to crude oil is close to zero" - Bank of America.

Bank of America expects the United States to replenish its strategic petroleum reserves (SPR) from February 2023, which should drive the value of U.S. West Texas Intermediate (WTI) grade oil to $94/barrel.

The SPR was emptied in 2022 as President Joe Biden sought to cushion U.S. consumers from a global energy price spike, boosting the supply of high-quality WTI into the U.S. market which suppressed demand for Canadian grades.

"Our energy outlook would suggest a bullish outlook for CAD with more significant sensitivity to the rising crude oil price in 2023," says Yu.

A boost to the country's oil earnings is expected by economists to underpin Canada's economy in 2023 and guard against recession.

Where Europe, the UK and U.S. are expected to see recessions by the consensus, Canada is tipped by Bank of America to register positive growth of 0.5% for the year.

Above: "Our economists expect Canada to have a shallow recession than the US in 2023" - BofA.

If currencies are ultimately responsive to economic growth differentials then the CAD would naturally benefit.

"The relatively better growth prospect should support the CAD this year, in our view," says Yu.

A rally in global equities is another potential driver of Canadian Dollar upside as equities tend to rally after the final Fed rate hike in a disinflationary environment, says the analyst.

Bank of America forecasts USD/CAD to be at 1.32 by the end of the first quarter, down from the current spot price of 1.3391.

By the end of the second quarter, the pair is forecast at 1.28, and by the end of the third quarter at 1.25, which is a similar price target for the end of the year.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes