Canadian Dollar Undervalued in USD/CAD, GBP/CAD and EUR/CAD, CIBC Says

- Written by: James Skinner

"The Bank may have hiked by 50bps, but it also made it clear that the narrative should shift away from the size of the incremental hike and towards whether it should hike at all going forward" - CIBC Capital Markets.

Image © Adobe Stock

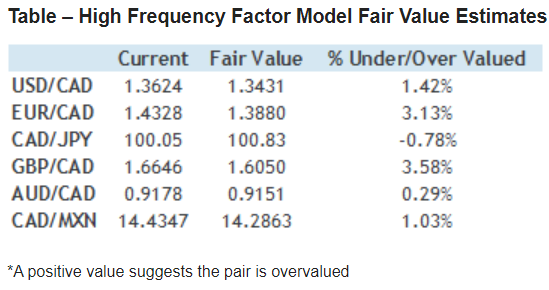

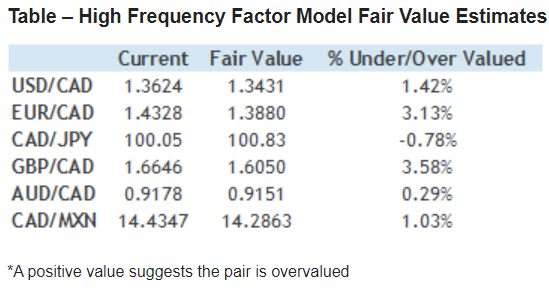

The Canadian Dollar rose broadly in the penultimate session of the week but remained undervalued against the Pound, U.S. Dollar, Euro and others, according to CIBC Capital Markets' estimates, although central bank decisions elsewhere in the world could soon see some of these discounts dissipate.

Canada's Dollar climbed against most currencies in the G10 basket on Thursday with the only exceptions being the Norwegian Krone, Australian Dollar and Russian Rouble while the Loonie's gains were the largest relative to the U.S. Dollar, Japanese Yen and Sterling.

The Canadian Dollar rose even further against counterparts in the G20 grouping including the Indian Rupee, Korean Won, Turkish Lira and Indonesian Rupiah though it's the Euro and Pound Sterling against which the Loonie has recently been the most undervalued.

"Our factor models suggest that the CAD is oversold here against the USD (and especially against the EUR & GBP)," says Bipan Rai, North American head of FX strategy, while writing in a Wednesday research briefing.

"We feel the appropriate range should be closer to 1.31-1.35 as we move into a more neutral environment for the USD. Domestic corporates that are receiving USD should look at exploring new hedges around the 1.38 mark," he adds.

Source: CIBC Capital Markets.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The main Canadian exchange rate, USD/CAD, tumbled on Thursday but Rai and the CIBC team say there is a risk of it pushing higher toward 1.38 heading into the new year after the Bank of Canada (BoC) warned on Wednesday that further increases in its cash rate can no longer be taken for granted.

This contrasts with the stance of the Federal Reserve (Fed), which is widely expected to match the BoC's half percentage point increase in borrowing costs next week and to signal that further increases in the Fed Funds rate are likely to be announced in the early months of next year.

"The Bank may have hiked by 50bps, but it also made it clear that the narrative should shift away from the size of the incremental hike and towards whether it should hike at all going forward," Rai writes in response to this Wednesday's policy decision from the BoC.

"Markets have shifted a bit with implied terminal moving higher to 4.45% for the April BoC. This is likely due to the sticker shock of a 50bps hike. But remember that the greater reliance on incoming data means that there’s more risk that ought to be priced into near dated OIS contracts relative to before," he adds.

The BoC recognised on Wednesday that Canada's own economy has outperformed expectations but also noted "growing evidence" that weakness in the global economy is beginning to hamper demand for Canadian exports with possible implications for the domestic economy going forward.

Above: GBP/CAD shown at daily intervals alongside USD/CAD and EUR/CAD. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: GBP/CAD shown at daily intervals alongside USD/CAD and EUR/CAD. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Weakening external demand and BoC interest rate policy are expected to see Canada's economy stall this quarter and in the first half of next year, effectively snuffing out domestic inflation pressures along the way.

"Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target," the BoC said in its Wednesday policy statement.

"Governing Council continues to assess how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding," it added.

Fed policy and the BoC's caution about the outlook in Canada are seen by CIBC as upside risks that could keep USD/CAD above its estimated fair value of 1.3431 up ahead but factors such as Bank of England (BoE) and European Central Bank (ECB) policy will also matter for GBP/CAD and EUR/CAD.

There is uncertainty about how the BoE and ECB will characterise their outlooks next week but given lofty market expectations, any replication of the BoC's stance could see GBP/CAD and EUR/CAD come under pressure that might go some way toward correcting the above referenced overvaluations.

Above: GBP/CAD shown at weekly intervals alongside USD/CAD and EUR/CAD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: GBP/CAD shown at weekly intervals alongside USD/CAD and EUR/CAD. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.