Canadian Dollar the Market's Most Traded Currency in Tuesday Sell-off

- Written by: James Skinner

"Flows like these very often start and end on round times because they either executed electronically, or include instructions something like: “Get it done before London close” or “Make sure we’re done by 3pm” etc," - Spectra Markets

Image © Adobe Images

The Canadian Dollar rose against a handful of peers in the final session of the week but remained a clear underperformer for the period as a whole following a sharp sell-off on Tuesday in which the Loonie and USD/CAD featured as the most actively traded on two of the interbank market's most popular platforms.

Canadian exchange rates were a mixed bag on Friday following a November employment report that matched market expectations and gave the market little new information, though for the week overall the Loonie was outdone on the downside by only the South African Rand and Russian Rouble.

This was after a steep Tuesday sell-off in which USD/CAD rose by more than one percent and many other Canadian Dollar exchange rates fell by near two percent or more, making for substantial losses by developed market currency standards, the cause of which remains something of a mystery.

"The bout of CAD weakness against the USD seemed a bit excessive, and it appeared even more excessive on crosses like AUDCAD and EURCAD. The move triggered our model into a short-USDCAD position on yesterday's close," says Greg Anderson, global head of FX strategy at BMO Capital Markets.

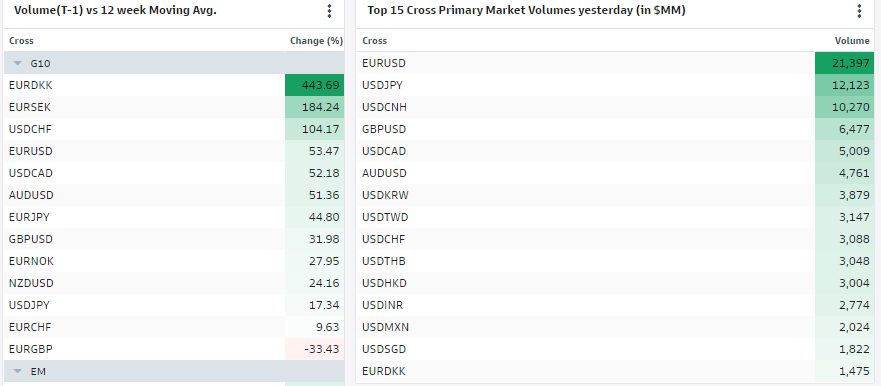

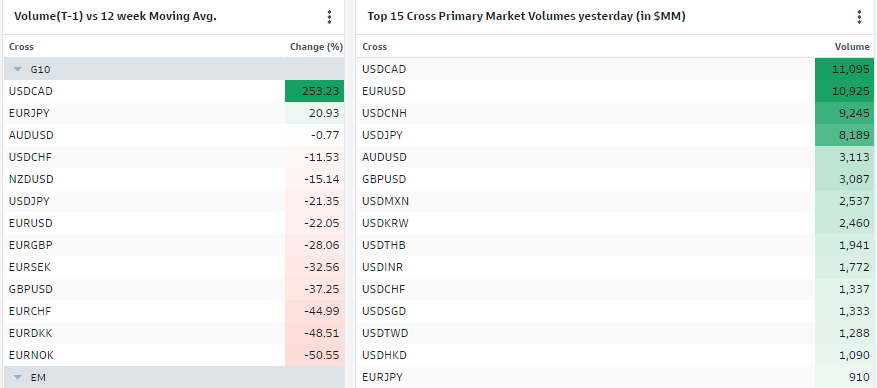

Data made available since then shows that trading turnover in USD/CAD rose by 253.23% when compared with its 12-week average to become the most actively traded currency pair on platforms covering a large portion of the interbank market, surpassing EUR/USD and a number of others along the way.

Above: FX spot turnover on EBS and RUT platforms from Tuesday, 29 November. Source: Goldman Sachs Marquee.

Above: FX spot turnover on EBS and RUT platforms from Tuesday, 29 November. Source: Goldman Sachs Marquee.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The above rank order covers FX spot transactions only and so does not include transactions in derivatives such as FX forwards and FX swaps for which trading volumes can be equally as significant, if not more significant at times.

These figures are based upon trades carried out through only two platforms, albeit two of the most significant, including the Electronic Broking System (EBS) platform recently acquired by CME Group from former owner TP ICAP.

The data is collected and displayed by Goldman Sachs Marquee, a digital marketplace for research and insights, investments, portfolio analytics and hedging solutions.

FX spot trading volume in USD/CAD was a much lesser USD 3.81 BN in the prior trading session on Monday.

Below is the same data set covering Wednesday when activity and volumes appeared to be normalising.

Above: FX spot turnover on EBS and RUT platforms from Wednesday, 30 November. Source: Goldman Sachs Marquee. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Tuesday's losses followed a September GDP report in which Canada's economy outperformed the economist consensus and the Bank of Canada (BoC) forecast for the third quarter but it also came alongside Royal Bank of Canada's announced acquisition of HSBC Bank Canada.

"I have no special insight into the flow, it’s just that the headline hit at 6:53 a.m. and USDCAD started ripping on 5X normal volume for the next five hours straight. So it’s a reasonable guess," says Brent Donnelly, CEO at Spectra Markets and a veteran trader with time spent at hedge funds and banks including Lehman Brothers and HSBC.

"Flows like these very often start and end on round times because they either executed electronically, or include instructions something like: “Get it done before London close” or “Make sure we’re done by 3pm” etc," Donnelly writes in Wednesday's edition of AM/FX.

The acquisition included a cash payment of around C$13.5bln and many speculated that an exchange for U.S. Dollars - the accounting and reporting currency of London-based HSBC - was behind the rip higher in USD/CAD.

"M&A flow rarely, if ever, leads to sustained gains in a DM pair like USD/CAD," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Above: USD/CAD shown at hourly intervals. Click image for closer inspection.

Above: USD/CAD shown at hourly intervals. Click image for closer inspection.