The Aussie and Canadian Dollars are a Sell on Fridays: BofA

- Written by: Gary Howes

Image © Bank of Canada

Bank of America have looked at the data and it would seem selling the Canadian Dollar and Australian Dollar on a Friday is offering consistent returns.

The findings, if replicated, could offer those watching either of the two currencies a strategic advantage ahead of the weekend.

Howard Du, G10 FX Strategist at Bank of America Merrill Lynch, says 2022 shows the U.S. Dollar tends to advance and U.S. equities tend to sell-off on Thursdays and Fridays.

Researchers find the USD has made most of its approximately 4.0% 2022 gain on Thursdays and Fridays; the cumulative USD return was respectively 1.9% and 2.2%.

Above: Cumulative return for the DXY by day of the week in 2022. "Most of the USD rally in 2022 has occurred on Thursdays and Fridays" - BofA Global Research.

Retracements have meanwhile occurred more on Wednesdays for the U.S. Dollar and Monday afternoon for U.S. equities.

It is noted the Wednesday pattern has a lot to do with Federal Reserve meetings that fall midweek once a month.

Extending the research into other currencies, Du finds the Canadian and Australian Dollars are the most exposed to the Thursday and Friday risk-off sentiment.

"Across major G10 and EM currencies, the CAD and AUD are the most highly correlated to the US equity market in 2022. These two currencies have also had the greatest loss against the USD on Thursdays and Fridays, coinciding with the bearish day-of-week seasonality for the US equity market," says Du.

The Canadian Dollar's cumulative year-to-date change was -1.2% and -2.5% on Thursdays and Fridays, while for the Aussie Dollar it was -2.5% and -5.3%, respectively.

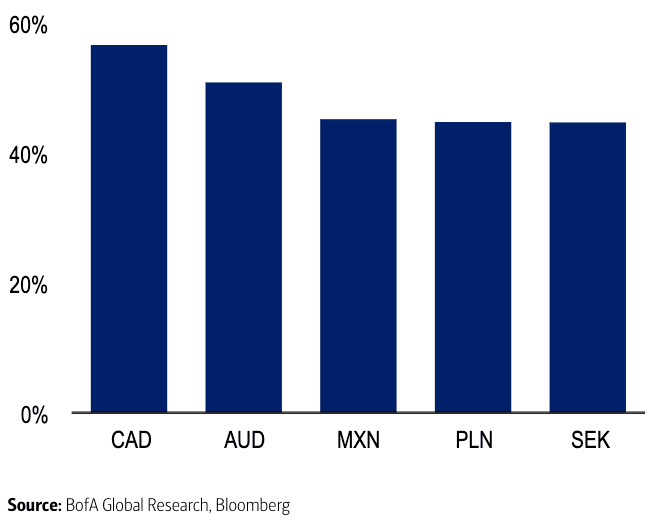

Above: Year-to-date top 5 correlations between major FX pairs and the SPX. "CAD and AUD are the most correlated pairs to equity in 2022" - BofA Global Research.

"Across major G10 and EM currencies, the CAD/USD and AUD/USD are the most correlated FX pairs to the US equity market in 2022. We find these two so-called "high-beta" currencies have also had the most year-to-date cumulative loss on Thursdays and Fridays," says Du.

Looking ahead, the analyst finds CAD and AUD are at risk of further Thursday and Friday U.S. equity routs.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes