Canadian Dollar to Hold Near-term Advantage over Pound

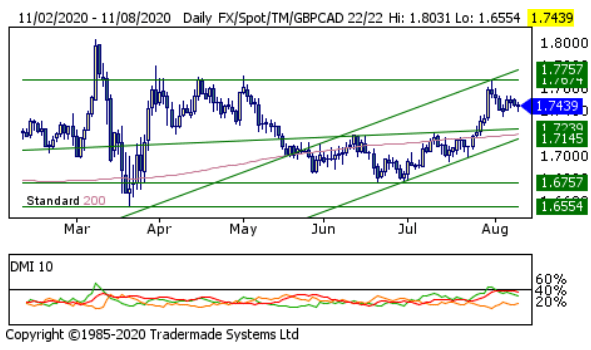

- GBP/CAD pausing within uptrend

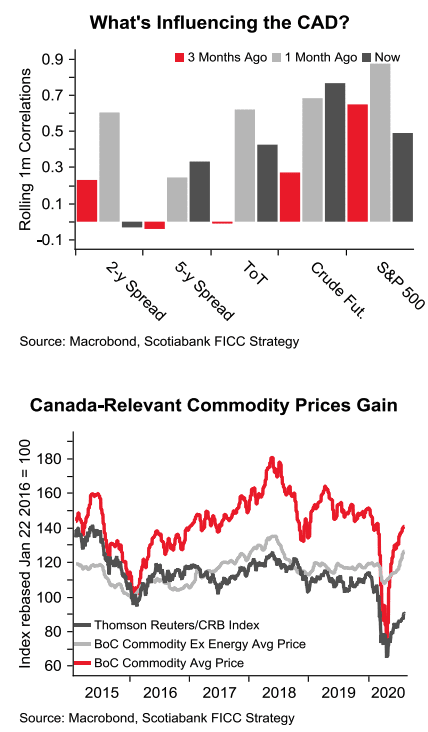

- CAD now more interested in oil than equity markets

- GBP to take guidance from EU-UK trade negotiations

Oil pump jack, Calgary, Alberta, Canada. Image © Adobe Stock

- GBP/CAD spot market rate at time of writing: 1.7340

- Bank tranfer rates (indicative guide): 1.6733-1.6854

- FX specialist rates (indicative guide): 1.6947-1.7180

- For more information on bank beating rates, please see here

The Canadian Dollar has rallied against its British counterpart for much of August, but gains are viewed as corrective by one analyst we follow who expects Sterling to ultimately resume its trend of appreciation.

The GBP/CAD exchange rate is quoted back at 1.7340 at the time of writing on Tuesday August 18, having fallen a little over half a percent in the prior week, which means the Pound has now fallen against its Canadian counterpart for two weeks in succession.

The declines do however come on the back of a solid run for Sterling that saw it push GBP/CAD from lows at 1.6751 in mid-June to 1.7675 in the final week of July. Therefore it is possible to view the August weakness as being merely a corrective reaction to that bullish multi-week push during the June-July period.

"GBP/CAD is consolidating. The GBP has slipped back from resistance around 1.77 — where the cross has struggled in the past few weeks — but the drop looks more like a pause in the broader uptrend than a reversal," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Image courtesy of Scotiabank

"The underlying trend here remains GBP constructive, with the June/July bull channel under no particular threat and broader trend signals aligned bullishly for the GBP. We look for the GBP to push higher again in the short run above 1.7450/60. Support is 1.7350," says Osborne.

How GBP/CAD progresses from here could well however rest with developments in the oil market as analysts are noting the Canadian Dollar to be increasingly responsive to moves in the commodity while an improving domestic economy is also adding an additional layer of fundamental support.

"Canada has regained about half of the jobs lost in the downturn, should help limit CAD losses. Rising commodity prices should also provide the CAD with some support," says Osborne. "We note that Canada-relevant commodity prices are strengthening and that the CAD’s tight linkage with the S&P 500 has been usurped by a strengthening, positive correlation with WTI, which reached its 200-day MA this week for the first time since January."

Image courtesy of Scotiabank

Francesco Pesole, FX Strategist at ING Bank has also noted oil market dynamics as having been recently constructive, saying oil prices are providing "substantial support" to the currency.

Canadian data due out over coming days is not expected to have a major bearing on the Canadian Dollar this week, as the numbers are unlikely to shift the dial at the Bank of Canada which is currently engaged in an aggressive easing policy aimed at supporting the economy.

For now, it looks like guidance must be sought from the performance of U.S. stock markets and oil prices.

ING are forecasting the USD/CAD exchange rate to maintain a range of 1.3150 - 1.3300 this week, and attain a one month target of 1.3300.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Brexit Trade Negotiations Back on Sterling's Radar

How the Pound ends the week will likely depend on Friday's briefing from EU and UK negotiators following this week's trade negotiations. The two sides meet on Tuesday in Brussels and are expected to attempt to iron out further differences between the two sides.

We don't expect any breakthrough on the major issues but instead the two sides to make further progress towards such an outcome. However, any unexpected successes or obvious break down in tone would likely inject some volatility into the pair.

For now, markets continue to assume a deal will be reached, which should ultimately keep Sterling somewhat supported.

Irish premier Micheál Martin said last week that Boris Johnson had shown a "genuine desire" to finalise a trade deal, and that the did not want to compound the coronavirus crisis with a "no deal" economic shock.

"Driven mostly by risk sentiment recently, the Pound enjoyed a wave of increased demand ... following optimistic comments by Ireland’s PM, Micheál Martin, regarding a Brexit deal after a meeting with UK PM Boris Johnson," says George Vessey, UK Currency Strategist at Western Union Business Solutions.

Martin added both the EU and UK had identified a "landing zone" for a deal to be agreed.

"This sparked a rush of demand for Sterling. Brexit talks resume (this) week and have the potential to increase Sterling volatility. If progress is made and hints of an agreement are unveiled, then sterling should strengthen, and this might be the catalyst to drive GBP/USD towards and beyond $1.32 and GBP/EUR towards €1.12," says Vessey.

UK chief negotiator David Frost meanwhile said last Thursday that a Brexit agreement can be reached with the European Union in September.

The suggestion by Frost that a deal is possible by September suggests the UK are looking to maintain pressure on the EU this week. However, most Brussels watchers are seeing a trade deal as only being likely in October as this is when the next scheduled European Council meeting of European leaders takes place.

The EU are notorious for tending to only reach big decisions at such summits, and hence why October is widely held to be the likely deadline for progress.

"The negotiations for a post-Brexit deal have apparently been more successful behind closed doors than on the main stage. Markets seem, however, quite relaxed for the time being. We do currently not see any Brexit obstacles on the horizon that could derail the GBP," says Thomas Flury, Strategist at UBS.

However, Vessey warns "if talks breakdown and the deadlock persists, :then sterling traders may take profit on the recent GBP/USD ascent, which could drag the pair back under".

Concerning headlines on Monday come in the form of a piece in the Sun where, Harry Cole, Political Editor at The Sun, says "there are growing whispers that the EU’s demand of so-called “level playing-field rules” — in reality, continued red tape and Britain bound to Brussels law for ever — could be too much to overcome."

Cole adds there is "rising talk of shelving trade deal hopes for now. But that’s better than being bounced into a deal that will stop Britain bouncing back."

We expect these kind of stories where anonymous officials are quoted, to become increasingly common over coming weeks as focus returns to the trade negotiations. While unofficial briefings can often be way off the mark, they can also carry some truth and report such as that from the Sun will serve as a firm reminder to markets that caution remains warranted.

Flash PMIs Dominate Economic Calendar

The main data release for the Pound in the week ahead ahead are the flash PMIs for August which will give a sense of how the recovery in the UK is progressing.

"Activity likely rose gradually through August as most countries continued to ease up COVID restrictions (local shutdowns excepted). We see upside risks and expect small gains across most key PMI measures, indicating recovery, but still at a relatively subdued pace," says a note from TD Securities.

The UK PMIs are out at 09:30 on Friday 21 and with relative economic performance being an increasingly important factor for foreign exchange markets to consider, a beat or miss of consensus forecasts could influence direction in the Euro and Pound.

The UK Services PMI is forecast at 57, up from the previous month's 56.5 while the Manufacturing PMI is forecast at 53.6, up from July's 53.3. The Composite PMI is expected at 56.6, down on the previous month's 57.

How the UK recovery compares to the recoveries of other economies matters when it comes to exchange rates, as we are in a world where economic outperformance is beginning to matter again.