Canadian Dollar Forecast 5% Higher by BMO Capital, Eyeing Tightening Correlation with Oil Prices

- Written by: James Skinner

© Pavel Ignatov, Adobe Stock

- 5% gains in CAD expected by BMO.

- Improving oil prices to aid Canadian Dollar going forward

- BoC to surprise markets and raise rates three times in 2019.

The Canadian Dollar will rise against the U.S. Dollar, Euro and Pound this year, according to forecasts from BMO Capital Markets, as oil prices stabilise and the Bank of Canada (BoC) lifts its interest rate on three occassions.

The Loonie's gains over the U.S. Dollar will be the largest but it'll also score well against a Euro that remains challenged by economic deficiencies, and a Sterling that's set to be dogged by the Brexit saga for longer than many once anticipated.

This means 2019 will be better than last year, which saw Canada's currency fall -8.1% iafter first being hampered by uncertainty over the future of the North American Free Trade (NAFTA) agreement, and then by a collapse of domestic and global oil prices.

That bust saw Brent crude futures prices finish 2018 some 20% lower, which piled more pressure onto an already-beleaguered Western Canadian Select price. Brent had traded with a near 20% 2018 gain as recently as October.

But domestic and international prices entered 2019 on the front foot, with Brent up 13% so far, which has already lifted the Canadian Dollar. BMO says an enduring recovery can drive the currency even higher over the coming months.

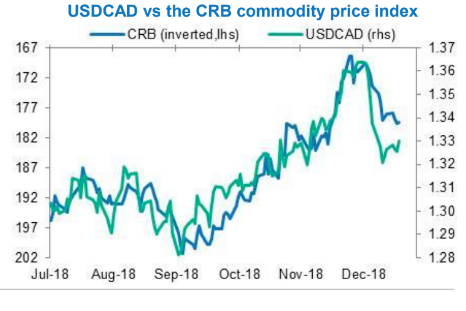

"The outlook for CAD has become highly dependent on one’s oil outlook as that correlation has accelerated," says Greg Anderson, head of FX strategy at BMO. "With as hard as crude fell in Q4, we think that aspect of the reflation trade may run longer and prove more durable than the tiny slide in the USD index. As a result, CAD should continue to outperform most other G10 currencies."

BMO Capital's forecasts suggest stability in oil prices ahead, with major benchmarks seen settling within a $50-$60 range. WTI crude futures were at $51 on Tuesday while Brent was $60.

If prices stabilise close to those improved levels, it could be enough to convince the BoC that an economic calamity is not in the pipeline and utlitmately persuade the bank that it's safe to resume its interest rate hiking cycle.

The Bank said earlier this month t will raise rates at a slower pace in 2019 than it did last year, because it wants time to observe what happens in oil markets, and how the economy responds to recent falls in prices as well as last year's three interest rate rises.

But Canada's central bank had previously said intended to lift its interest rate all the way up to the so-called neutral level in 2019 and 2020, which it estimates to be between 2.5% and 3.5%. The cash rate is currently at 1.75%.

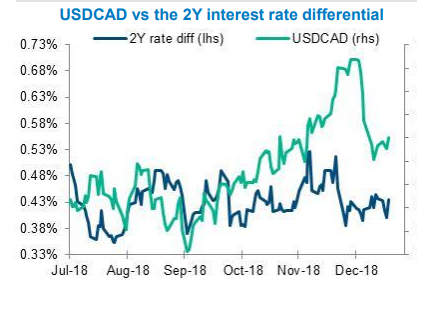

"The BoC has retained a tightening bias but emphasized that it will be cautious and data-dependent in its approach. Poloz has emphasized that he is closely watching the oil sector, which helps cement oil as the #1 factor for Q1," Anderson writes, in a note to clients Wednesday. "The relationship between USDCAD and interest rate differentials (of any tenor) is almost non-existent."

Oil is important for the Canadian economy not only because of the export revenue made from sales to the U.S. but also due to the number of jobs that depend on the industry, parlticularly in Alberta.

BMO's view is that stability will see markets to stop worrying about fluctuations in oil prices and instead focus on more traditional drivers like the gap between yields on Canadian government bonds and those of rival currencies.

"This is a big change from the first 9M of 2018, when relative interest rate movements dominated other USDCAD factors," Anderson says, of the broken correlation between the Loonie bond yield "spreads".

Bond spreads were the dominant driver of the Loonie all the while markets believed the BoC would continue to raise its interest rate, but since December, investors have been betting the BoC sits on its hands for much of 2019.

The market-implied Canadian interest rate for September 04, 2019 was just 1.87% on the day after the BoC's January meeting, suggesting markets saw only a miminal chance of one interest rate rise this year.

The implied rate was 1.92% Tuesday but Anderson and the BMO team forecast three interest rate rises over the course of 2019.

If the market eventually comes around to that view, and also begins to take note of differences in bond yields again, then it could provide the Loonie with a powerful shot in the arm over the coming months.

Anderson forecasts that oil and interest rate developments will push the USD/CAD rate down to 1.27 before year-end, from 1.33 Tuesday.

The same forces are projected to drive the Pound-to-Canadian-Dollar rate down to 1.67, from 1.72 Tuesday.

The EUR/CAD rate is projected to fall from 1.51 to 1.49 during the same time.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.