Canadian Dollar vs. Pound Week Ahead Forecast: GBP/CAD at Tough Resistance

Image © Goroden Kkoff, Adobe Stock

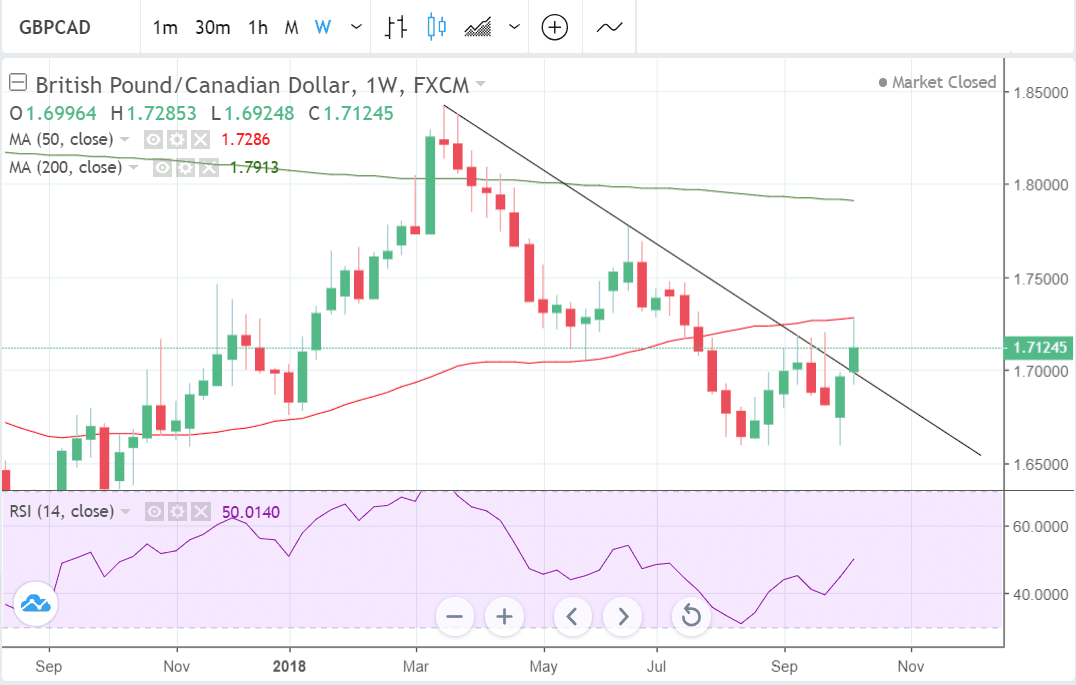

- GBP/CAD in short-term uptrend but reaches resistance at 50-week MA

- Any pull-back lower is expected to be short-lived

- Pound is expected to be influenced by Brexit headlines and Canadian Dollar by inflation data

The GBP/CAD exchange rate started the new week at 1.7068, close to where it closed the previous week and we find it constructive for Sterling that the pair has not gone materially lower in response to news of continued deadlock in Brexit negotiations.

While no Brexit breakthrough is expected this week markets remain confident a deal will still ultimately be clenched by November and while we don't see Sterling enjoying any major gains in such an environment, neither do we see the risk of substantial declines.

Technical considerations could well be in control of this pair over coming days.

Technical studies - studies that strip out the noise of fundamental noise and focus on the structure of the market - show the pair has pulled-back after touching the 50-week Moving Average due to heavy technical selling at that level.

Despite the correction we still expect the exchange rate to find support, rotate and resume its uptrend eventually. The 1.69 level at the previous trendline is one possible place where it may find support and turnaround if it weakens that far.

The 50-week MA is a very strong obstacle to the uptrend and it's possible it may take several attempts for price to break above it - if at all.

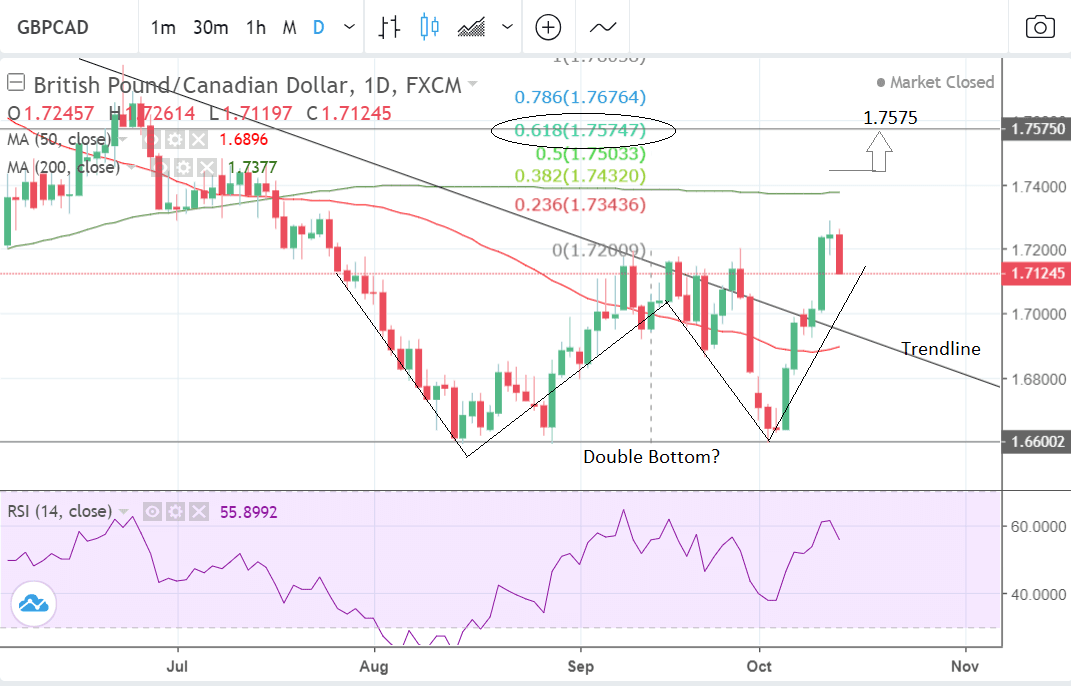

The 200-day MA is also situated not far above at 1.7377 and this too is likely to present a tough barrier to bulls.

There is a high chance of some deep corrections occurring due to selling at these two levels.

Only a clear break above both the MAs, confirmed by a break above the 1.7450, would provide us with confidence that the exchange rate was, indeed, heading higher. Such a break would confirm a move up to a target at 1.7575.

It is possible the exchange rate may have formed a bullish double-bottom reversal pattern at the lows, which would further support the case for more upside. The pattern looks similar to the capital letter 'W' and is composed of two consecutive trough lows at roughly the same level. This describes what has happened at the recent lows.

A break above the neckline of the pattern at the level of the intervening peak normally provides the green-light for an extension higher to a target based on the height of the double-bottom extrapolated higher. An extrapolation by a ratio of 0.618 generates a conservative target, in this case of 1.7575; a 100% extrapolation suggests a target above 1.76.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Canadian Dollar: What to Watch

The Bank of Canada's Business Outlook Survey will be published at 15:30 B.S.T ahead of the blackout period for the October meeting.

"We expect the BOS to reveal an upbeat tone on continued strength in foreign demand and a pickup in domestic conditions. Capacity pressures and inflation expectations should remain in the spotlight, which may give the report a slightly hawkish tilt," says a note on the matter released by TD Securities.

Meanwhile, any references to trade uncertainty should emphasise the need to "get on with it", and TD Securities do note that consultations would have preceded the breakthrough on NAFTA.

A robust message from the BoC would certainly give the Canadian Dollar a boost at the start of the new week.

The main release for the Canadian Dollar in the week ahead is however inflation data out at 13.30 B.S.T on Friday, October 19.

Inflation is expected to register a slight fall of -0.1% in September, the same as it did in August, and a 2.7% rise compared to a year ago. Core inflation is expected to show a 1.8% rise compared to a year ago, which is slightly higher than the 1.7% in 2017.

A lower-than-expected result would pressure the Canadian Dollar lower, and a vice-versa for a higher result.

Higher inflation would increase the chances of the Bank of Canada having to raise interest rates in 2019 and higher interest rates are a driver of currency appreciation because they attract greater inflows of foreign capital.

Currently the BOC is forecast to increase them by 0.25% at the next meeting on October 24 and by another 0.25% by January 2019, however, beyond then, the forecast is more subdued according to analysts. The current interest rates is 1.50%.

A fall in house prices caused by more restrictive lending practices and higher interest rates on mortgages is seen as placing a ceiling to the high point of interest rates.

Another limit is the price of Canadian oil which is substantially lower than the WTI crude variety used as an international benchmark. Canadian oil has declined in price to a new low of only 25 Dollars a barrel compared to WTI which is in the mid-70s per barrel - almost three times more.

The reason is a mixture of the poor quality of the oil and the lack of a pipeline out of Canada to the international market which means Canada is restricted to selling most of its oil to the US.

Recent attempts to build a pipeline were stopped by a court ruling which sided with environmentalists and residents who were opposed to the building of a pipeline through their land.

The Pound: What to Watch

Brexit headlines will continue to drive the Pound in the week ahead.

U.K. Brexit minister Dominic Raab will travel to Brussels on Monday for a meeting with E.U. chief negotiator Michel Barnier, probably to agree on the final proposals to put before E.U. leaders at their crunch summit on Wednesday, October 17-18.

The outcome of the summit is expected to be a key driver for the Pound in the week ahead. If there is concrete progress on a withdrawal deal Sterling is likely to surge higher; if, on the other hand, there is no progress the Pound will fall.

Analysts at FX broker XM are rather pessimistic about the possibility of a major breakthrough:

"As it is standard for all E.U. negotiations to last into the last minute, the remaining issues are unlikely to be resolved at the E.U. heads of government summit on October 17-18 and the talks will probably continue into November when a special summit is being planned."

XM adds that "a worst-case scenario would be for Prime Minister May to secure a deal that has little chance of getting approved by the British parliament."

Indeed, weekend headlines have been troubling for the Prime Minister with reports that the cabinet are being urged to stage a mutiny on May's plans.

The big problem lies with a backstop clause that would trigger if the E.U. and U.K. fail to reach a trade deal during the two year transition period. There is talk that the backstop could apply to the whole U.K. and not just Northern Ireland, as had been the original proposal.

It is believed that Prime Minister May is willing to allow this transition to last indefinitely; something fiercely opposed by Brexit supporting MPs in the Conservative party. Should a time limit be agreed the opposition to May might fade and she will be able to push legislation through parliament.

There are several major releases in the week ahead but probably the most important is broad inflation data in September, which is forecast to show a 2.6% rise compared to a year ago and a 0.2% rise compared to a month ago, when it is released on Wednesday at 9.30 B.S.T.

Core inflation, meanwhile, is forecast to show a 2.0% rise compared to a year ago.

Inflation informs central bank policy and, crucially for FX, whether they put up interest rates; these in turn impact on exchange rates. A higher-than-expected rise in inflation would increase pressure on the Bank of England to raise interest rates and support the Pound.

The other major release in the week ahead for the Pound is employment and wage data, out on Tuesday at 9.30.

The unemployment rate is expected to remain at 4.0% in August. Average pay excluding bonuses is expected to have climbed by 2.9%, and pay including bonuses to have increased by 2.6%.

Market participants will be particularly focused on whether pay has increased more than expected - if it has the Pound could rise - as this will raise the outlook for inflation.

The third major release for Sterling in the week ahead is retail sales out at 9.30 on Thursday.

Retail sales have been fairly resilient but in September they are forecast to show a -0.3% drop (from 0.3% in August) but, nevertheless, a 3.7% rise compared to September last year. A higher-than-expected result would probably support the Pound as it suggests greater growth, inflation, and higher interest rates which are usually favourable for a currency.

Finally the weekends with a speech by the governor of the Bank of England (BOE) Mark Carney on Friday, at 16.30, which has been earmarked by some as a possible time for the Uk authorities to announce progress on securing trade deal with the EU.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here