Pound sterling starts to feel the pressure as a lack of UK data starts to bite - Live coverage on 18/11

Where will momentum take the British pound sterling (GBP) this week? There is little by way of data or Bank of England event-risk; so technical considerations, sentiment and external drivers will decide on where the GBP is headed. We bring you the views of the very best minds in the world of FX to help better inform your currency market decisions.

Days summary: The GBP eked lower against the USD and EUR but significant losses were witnessed against a resurgent AUD, NZD and ZAR. With no data on tap for a while yet this scenario could well continue. For Tuesday's live coverage please see here.

Rates as of last update

- British pound to euro exchange rate: 0.3 pct lower at 1.1907.

- British pound to US dollar exchange rate is 0.04 pct lower at 1.6113.

- British pound to Australian dollar exchange rate: 0.35 pct lower at 1.7146.

- British pound to New Zealand dollar rate: 0.48 pct lower at 1.9250.

PS: All quotations are taken from the wholesale inter-bank market. Your bank will affix a spread at their discretion when delivering you FX. However, an independent provider will seek to undercut your bank's offer, thus delivering up to 5% more currency. Please learn more here.

16:37: GBPUSD short-term technicals: mixed

"As the MACD generates a buy signal but spot fails to sustain gains. For short-term traders there is better risk reward elsewhere. Support lies at the 50-day MA at 1.6043; resistance lies at recent congestion at 1.6142." - Camilla Sutton @ Scotiabank.

16:14: Sterling a passenger until Wednesday

The problem for GBP bulls at present is that there is little to drive the GBP higher and the currency will likely be on the back-foot until at least Wednesday.

Joe Manimbo, Senior Market Analyst at Western Union says:

"Underpinning the pound has been the upbeat tone of last week’s economic report from the BOE which sounded cautiously optimistic in the outlook for Britain’s job market. Watch for sterling to take coming cues from BOE minutes that come due on Wednesday, and the next day’s survey of U.K. manufacturing."

15:55: UniCredit warn of further EUR strength

UniCredit analyst Dr. Vasileios Gkionakis, Global Head of FX Strategy, tells us why we should expect further EUR strength:

UniCredit analyst Dr. Vasileios Gkionakis, Global Head of FX Strategy, tells us why we should expect further EUR strength:

"We find that EUR reserve accumulation (as a percentage of allocated reserves) fell notably in the years that the perception of sovereign risk in the periphery of Europe worsened.

"However, we think that as these risk premiums continue to normalise and re-price lower, reserve managers are likely to start increasing their demand for euros again, something that should provide meaningful support to the EUR exchange rate in the medium term."

14:36: Still backing GBP to gain vs EUR

Today has seen the inevitable comeback by the EUR. But, can it continue?

A couple of voices confirm they continue to favour GBP outperformance.

ICN Financial say:

"The pair remains under pressure hovering pushing towards 0.8357 low, where we continue to expect the bearish bias to remain dominant, eying a retest of 0.8300 low."

Ipek Ozkardeskaya at Swissquote Research says "we continue to keep our bearish view within the Jul-Nov downtrend channel (top at 0.8532 today) and place our next target to 0.8300 (range bottom). For days ahead, option barriers are placed below 0.8400/10, while stops are seen above 0.8450 (21 dam)."

13:42: Waiting for risk/reward on Cable to improve

"The GBP/USD peeked out to a new high above 1.6100 to start the week, but rates have recently reversed sharply to trade back at the 1.6100 handle. The pair carved out a large Bearish Engulfing Candle on the 4hr chart, showing a big shift from buying to selling pressure and suggesting the pair could drop toward 1.6050 in today’s North American session trade. More aggressive traders may want to look for sell trades today, but we will stay on the sidelines for now until an opportunity with a better risk/reward ratio emerges." - Matt Weller at GFT.

12:49: Systemic risks to UK financial system continue to wane

The Bank of England has reported that the perceived probabilities of a high-impact event in the UK financial system over both the short and medium term continue to fall.

The Bank of England has reported that the perceived probabilities of a high-impact event in the UK financial system over both the short and medium term continue to fall.

This is the best level of confidence witnessed since the survey began in 2008. 55% (+5 percentage points since May 2013) of respondents now consider the probability low or very low over the next year, 16% (+3 percentage points) between one and three years ahead.

Confidence in the UK financial system has also risen. 18% (+1 percentage point) were completely confident or very confident in the stability of the UK financial system as a whole over the next three years, 78% fairly confident (+8 percentage points) and only 4% not very confident (-9 percentage points).

* CLICK PDF ICON FOR MORE DETAILS.

11:21: Upside in GBP/USD likely to be limited in the longer term

Luc Luyet at MIG Bank reckons the GBP/USD has further to run; however the longer-term picture is confirmed as being challenging:

Luc Luyet at MIG Bank reckons the GBP/USD has further to run; however the longer-term picture is confirmed as being challenging:

"GBP/USD has broken the resistance at 1.6119, opening the way for a further rise towards the resistance at 1.6260. A short-term positive bias is favoured as long as the support at 1.6048 holds. Another support can be found at 1.5989.

"In the medium-term, prices are moving within the horizontal range defined by the support at 1.5894/1.5855 and the resistance at 1.6260 (01/10/2013 high).

"In the longer term, given the deep overbought conditions, we continue to see a limited upside

potential near the resistance at 1.6260 (01/10/2013 high). A decisive break of the support at 1.5894 is needed to deteriorate the long-term technical structure."

11:04: Indecision creeps back into GBP/USD

"Today’s candle currently looks like a doji, which typically indicates a reversal. That said, it’s worth noting that this only applies to the close candle. All it tells us at this stage is that there’s some indecision in the markets at this level, which may suggest the recent bullish move has run out of steam. If that’s the case and the pair does move lower from here, support should be found around 1.6115, 1.61, 1.6050 and 1.60." - Craig Erlam at Alpari UK.

10:31: Sentiment towards GBP remains healthy

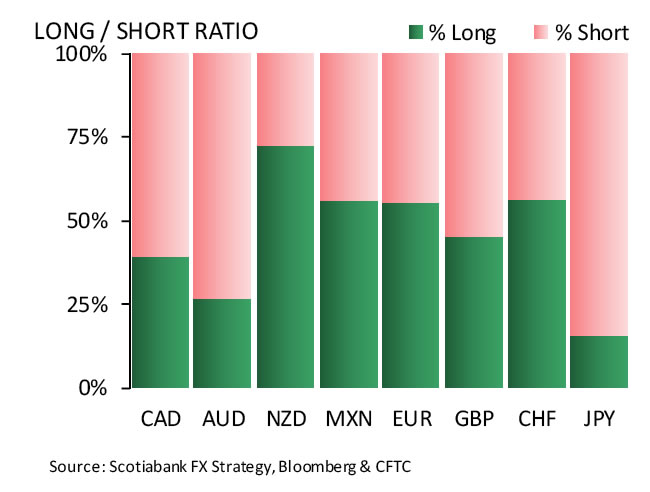

Speculative positioning on the GBP, according to the latest data supplied by the CFTC, shows those who are bullish and those who are bearish on the UK currency are split evenly. This is a positive state of affairs in that we are not likely to see the currency squeezed by those looking to cover positions after being caught out by unexpected movements in the FX market. ie. it will aid stability.

10:04: 1.61 won't hold say UniCredit

Perpetual GBP naysayers UniCredit, unsurprisingly, don't fancy GBP-USD's ability to hold onto recent gains:

"BoE’s Martin Weale said that the strong GBP lowered inflation while also expressing discomfort with the recent GBP rise "worsening his concerns about the balance of payments." Given the latest weaker UK

data, cable will unlikely hold the line above 1.61."

09:44: Bears losing control of the market

The pound dollar exchange rate is trading within the context of recent bearishness.

The pound dollar exchange rate is trading within the context of recent bearishness.

The charts do continue to suggest this state of affairs still exists, but that could be changing. Camilla Sutton at Scotiabank has taken a look at the charts and says:

"Most studies remain in bearish territory however some are showing early warnings of the bears losing control of the market. Spot is flirting with a near‐term break of the multi‐week downward trend line (currently comes in at 1.6091), a close above here would suggest near‐term buying pressure is building and would warn of a test up to 1.6200."

09:00: "We still favour GBP to the upside"

Lloyds Bank Research reaffirm a pro-Sterling stance this Monday morning:

Lloyds Bank Research reaffirm a pro-Sterling stance this Monday morning:

"GBP/USD broke above the 1.6120 level overnight despite some soft house price numbers. The November BoE MPC minutes will likely provide the highlight of the UK calendar this week. But with the Quarterly Inflation report last week largely detailing the Bank's current stance, these minutes are likely to attract less interest than usual.

"The minutes are likely to deliver a similar message to that of the QIR, including the latest shifts in the BoE's projections for GDP, inflation and unemployment, which should be supportive for GBP. We still favour GBP to the upside, but with few releases from the UK this week, GBP/USD looks likely to be mainly influenced by USD sentiment. 1.6160 should be the next area of resistance."

08:45: Pound sterling suffers vs Australian, New Zealand dollars

The GBP is seeing losses against the NZD and AUD on Monday morning.

The GBP is seeing losses against the NZD and AUD on Monday morning.

Key to the bullish tone in the AUD and NZD is China where the country has pledged to introduce the biggest expansion of economic freedoms since 1990s.

The measures will include more private investment in state-controlled industries and expansion of the farmers’ land rights. The emerging Asia stocks opened the week in the positive territories.

Ahead though we have RBA meeting minutes due tomorrow and Governor Stevens speaks on Thursday.

"Stevens and the minutes are likely to limit the upside in AUD-complex. Although the AUD-bears are still in charge, the bearish momentum loses pace on better risk sentiment post-Yellen and Chinese economic freedom promises," says Ipek Ozkardeskaya at Swissquote Bank.

08:37: GBP rally has further to go

Concerning the outlook for the GBP/USD, Ipek Ozkardeskaya at Swissquote Bank says:

"MACD 12, 26 day indicator turned positive, the bullish correction has further room to go. BoE will publish the meeting minutes this week, and hawkish bets are to give support to GBP, especially after Carney’s press conference on November 13th stating that the interest rates may increase sooner than previously planned."

08:15: UK house prices dip

Some third-tier UK data on tap for the British pound (GBP) from Rightmove. It was shown that house prices across the UK dipped 2.4 percent in November compared to October.

Some third-tier UK data on tap for the British pound (GBP) from Rightmove. It was shown that house prices across the UK dipped 2.4 percent in November compared to October.

It's worth noting that the series is not seasonally adjusted and typically dips before Christmas, this year's 2.4 percent fall is however less than the average 3 percent seen in the previous three years.