British Pound Sterling: GBP Takes Revenge Against the Euro

The British pound sterling (Currency:GBP) has found relief overnight as strong UK house prices confirm an improving situation for the all-important UK consumer. However; the outlook remains murky for GBP with technical indicators suggesting further losses are possible. We investigate!

For Friday's Live Coverage please visit the homepage!!!!

Latest rates:

- The pound euro exchange rate is 1 pct up on yesterday at 1.1791.

- The pound dollar exchange rate is 0.04 pct up at 1.6043.

- The pound Aus dollar exchange rate is 0.21 pct lower at 1.6880.

- The pound NZ dollar exchange rate is unchanged at 1.9575.

PS: The above are spot market quotes; your bank will affix a discretionary spread to the figures when passing on a retail FX rate. However, an independent FX provider will guarantee to undercut your bank's offer, thereby delivering up to 5% more FX. Please find out more here.

17:00: Can tomorrow's PMI's keep sterling supported?

Finally - a new month and some real data to get stuck into.

The first of the Markit PMI series for October are to be unveiled at 09:30.

Markit Manufacturing PMI (Oct) is predicted to read at 56.1. Lower than last month's 56.7.

There is a sense amongst market commentators that the UK recovery is easing back following a strong summer.

Therefore any upside surprises could help GBP edge up. See you tomorrow for our coverage of the event and sterling's Friday trading session!

15:42: A December taper? Beware a return to strength for the US dollar

An interesting point from Camilla Sutton at Scotiabank on the potential for a stronger US dollar into year end:

An interesting point from Camilla Sutton at Scotiabank on the potential for a stronger US dollar into year end:

"We would caution USD bears that with both the WSJ and FT out with articles suggesting that a December taper is a real possibility there is some added upside risk to the USD, particularly since the market is now positioned for a H1 2014 taper.

"The FOMC statement signalled that the Fed sees financial conditions having eased, a vague improvement in the labour market and noted a softening in the housing market. This was enough to generate a brief USD rally, which subsequently has been erased, with the exception of EUR."

15:06: A collapse by the euro

The pound euro exchange rate has really taken off - the rate is now 1% higher than it was yesterday.

We are nearly back at 1.18. Who would have ever have thought such a turnaround possible?!

13:50: GFT turn positive on sterling

What a difference 24 hours can make. We are seeing more commentators backing the sterling after a poor couple of weeks.

What a difference 24 hours can make. We are seeing more commentators backing the sterling after a poor couple of weeks.

Matt Weller at GFT is one of them:

"Compared to its mainland cousin, volatility in the GBP/USD was downright tame; rates did drift down to test support at 1.6000 in the wake of the Fed’s statement, but bears were unable to push the unit through that floor. At this point, more aggressive traders may want to consider near-term buy trades for a possible bounce back toward the 1.6100 handle ahead of the weekend.

"Specifically, traders could look to buy the GBP/USD below 1.6040 (near current market rates) with a stop at 1.5993 (below support at yesterday’s low and the central Monthly Pivot Point) and a target at 1.6092 (near a 38.2% Fibonacci retracement of the most recent pullback)."

13:08: This short squeeze on the euro has longer to run

A further explanation of the weakness we are seeing in the euro is the 'short squeeze' scenario.

"At the start of the week we noted a potential turn in risk reversals and the attractiveness of downside protection. That move has extended sharply toward stronger put pricing, suggesting the spot move in EUR/USD caught the market by surprise, and that there may be more shakeout of EUR/USD longs to come," says Shaun Osborne at TD Securities.

According to Osborne the message from short term rates still suggests EUR/USD would be more consistent near 1.32/33

11:00: Pound surges vs Euro

Some welcome relief for the pound euro exchange rate. Full story here.

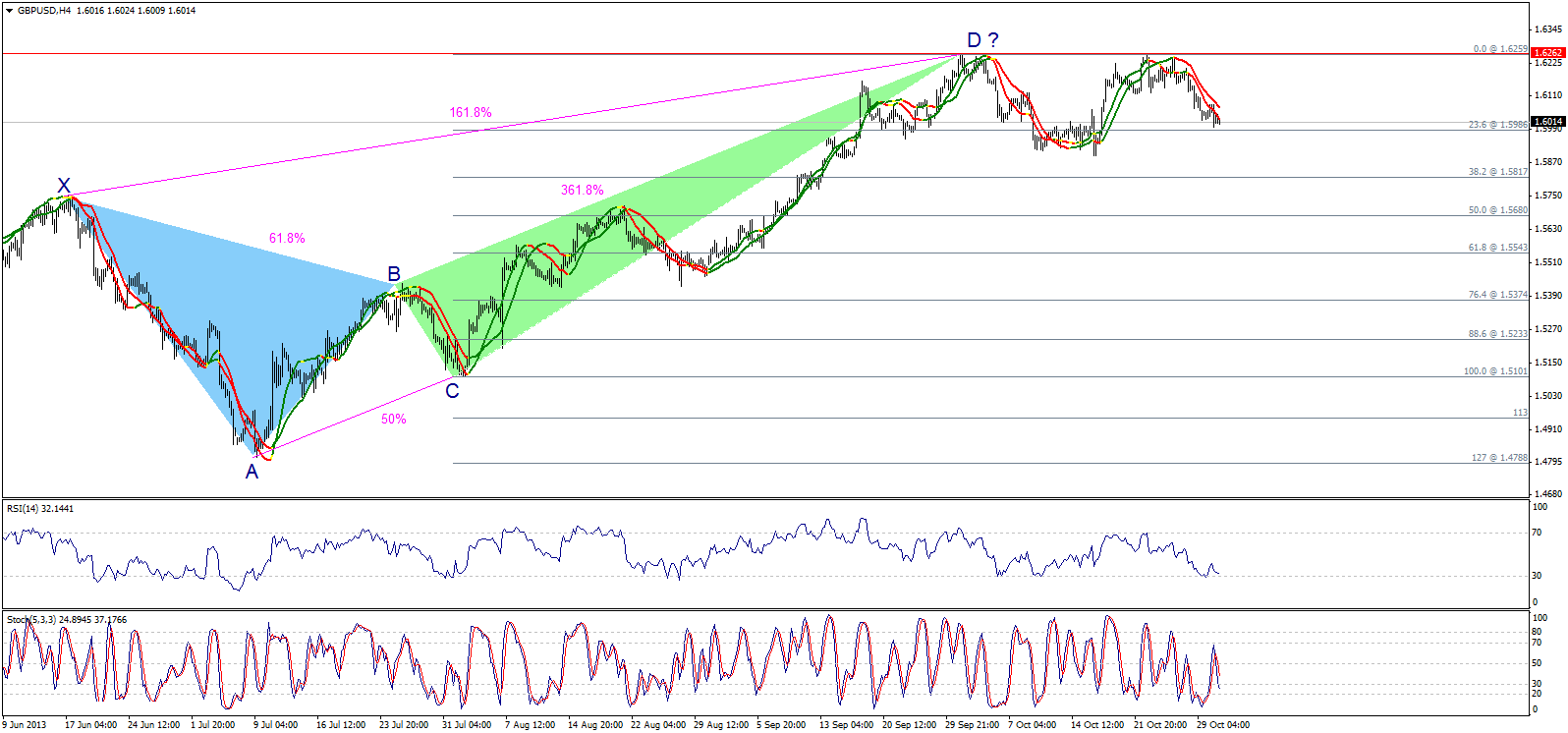

10:20: Why is GBPUSD lower? Blame the crab!

ICN Financial analysis bring crustaceans into the currency mix as they comment on the GBPUSD:

"The pair is trading to the downside affected by the bearish harmonic Crab Pattern. Trading below 1.6110 strengthened the bearish move and trading below that level today keeps the general downside move. Over intraday basis, stability below 1.6075 supports not having any bullish corrections."

Click below to enlarge.

09:54: US dollar in control

Following on from last night's US FOMC event, it is the US dollar that is dictating direction on global markets. Until tomorrow's release of the Markit Manufacturing PMI data the GBP will remain a back-seat passenger.

"There is a firmer dollar to start the morning after the Federal Reserve expressed a less dovish stance despite leaving interest rates and asset purchases unchanged. With unemployment claims due at 12:30, the dollar looks set to remain in control of EUR/USD and GBP/USD rates at least for today," says Sasha Nugent at Caxton FX.

08:56: GBP/USD outlook: Biased towards the upside today

"GBP/USD has struggled over the past week after failing to test the October high of 1.6260. We still favour GBP/USD to the upside. With little on the UK calendar today, we think USD sentiment will likely be the main driver for GBP/USD. Month end portfolio rebalancing flows today suggests GBP/USD will be biased to the upside. And any dip to the low 1.60s should be seen as a short term buying opportunity." - Lloyds Bank Research say in a morning exchange rate outlook note.

"GBP/USD has struggled over the past week after failing to test the October high of 1.6260. We still favour GBP/USD to the upside. With little on the UK calendar today, we think USD sentiment will likely be the main driver for GBP/USD. Month end portfolio rebalancing flows today suggests GBP/USD will be biased to the upside. And any dip to the low 1.60s should be seen as a short term buying opportunity." - Lloyds Bank Research say in a morning exchange rate outlook note.

08:45: Euro to continue advancing vs the pound

UniCredit Bank see no end to the euro advance vs sterling:

"Given the across-the-board strong euro performance, EUR-GBP is very likely to continue to approach 0.86 and should prevent cable from a close correlation with EUR-USD. As for today, we expect cable and EUR-GBP in relatively narrow trading ranges."

Key events overnight:

US Federal Reserve FOMC decision:

The FOMC kept the pace of asset purchases at USD 85bn per month. The press release acknowledged a slower housing recovery, but dropped the reference to tighter financial conditions.

"Yesterday's FOMC statement came in less dovish than expected, and markets now seem to adopt a wait-and-see attitude. For today, we expect all G10 majors to remain range-bound, waiting for tomorrow's ISM index." - UniCredit Bank.

Nationwide House prices:

Latest data from the housing market shows the UK housing boom is picking up pace:

Latest data from the housing market shows the UK housing boom is picking up pace:

YoY Oct: +5.8% vs expectations for +5.1%.

MoM Oct: +1% vs expectations for +0.7%.