Pound Sterling (GBP) on Tuesday: Outlook dominated by Charlie Bean, borrowing figures and non-farm payroll data

The pound sterling (GBP) sees the calendar start to pick up this Tuesday morning with Charlie Bean speaking and borrowing numbers due for release. Meanwhile, the US employment report for September will be the main catalyst for foreign exchange today. Higher-than-consensus payroll numbers could be USD positive, but will it be enough to fully reverse the USD's recent weakness?

Exchange rates as of last update

- The pound euro exchange rate is 0.12 pct down on last night's close at 1.1790.

- The pound dollar exchange rate is 0.28 pct higher at 1.6195.

- The pound South African rand exchange rate is 0.03 pct up at 15.9130.

- The GBP to Australian dollar is 0.22 pct lower at 1.6692.

- The GBP to New Zealand dollar is 0.35 pct lower at 1.9032.

Be Aware: The above are spot market quotations, your bank will charge a spread at their discretion which is reflected in a lesser exchange rate. However, an independent FX provider will actively seek to undercut your bank's offer, thus delivering more currency. Please find out more here.

16:35: The next hurdle for sterling = Bank of England minutes

Tomorrow brings with it the release of the Bank of England Minutes for October's meeting.

"Sentiment should also take direction from Bank of England minutes that are set for publication on Wednesday. Bank records that show a new round of monetary stimulus off the table for now should support the pound," says Joe Manimbo at Western Union.

15:11: Barclays pare back tapering expectations

In response to today's NFP data the US dollar is lower, equity markets and the euro are higher. Why? Because the Fed is likely to keep pumping money into the global economy for longer.

In response to today's NFP data the US dollar is lower, equity markets and the euro are higher. Why? Because the Fed is likely to keep pumping money into the global economy for longer.

Analyst Dean Maki at Barclays says his bank has pushed back expectations on tapering as a result of today's data:

"In light of the moderate tone of the September employment report, we have pushed out our expectation for the first Fed tapering in the pace of asset purchases to March 2014 from December 2013. We now expect the Fed to finish the asset purchase program in September 2014, later than our previous expectation of June 2014. We have not changed our expected timing of the first Fed rate hike in June 2015."

14:41: GBP/EUR - another day of war at 1.18

Sasha Nugent observes just how stubborn the pound to euro exchange rate remains:

Sasha Nugent observes just how stubborn the pound to euro exchange rate remains:

"It seems like every time sterling manages to direct the GBPEUR rate that bit higher, the euro makes a comeback and leaves the rate at pretty much the same level it was previously. Today is no exception, and although UK public borrowing data improved, the possibility it will result in a lasting impact on the rate is quite unlikely.

"Another day of war at the 1.18 level, at least until things get a little more interesting tomorrow."

14:02: One thing the market agrees on…

In the wake of today's NFP data, Marcus Bullus, trading director at MB Capital, says the prospect of the US Fed tapering their asset purchase programme anytime soon has receded:

"While these numbers paint a broadly "honours even" picture of the US economy, we all know the picture is already hopelessly out of date.

"Data from the month before the US government shutdown now seems so remote it might as well be antediluvian.

"They are next to useless when it comes to answering the big question - how badly has the Capitol Hill deadlock hurt the US recovery?

"The one thing the markets do seem to agree on is that the prospect of imminent tapering is receding once again.

"The full impact of the government shutdown is still unknown, and while that remains the case, don't expect the Federal Open Market Committee to start turning off America's QE taps when it meets later this month."

13:32: NFP data disappoints, unemployment rate beats expectations

Nonfarm Payrolls (Sep): @ 148K, forecasts were for 180K. Big miss.

Unemployment Rate (Sep): @ 7.2 pct, forecasts were for 7.3 pct.

Currency market reaction not massive but the US dollar is nevertheless selling off as a result. This is in turn driving euro strenth ensuring the pound / euro pairing is also suffering.

13:17: Are markets too negative on the USD?

Another quick note ahead of the NFP data release at the bottom of the hour. This from Shaun Osborne at TD Securities on his concern that markets are too aggressively positioned against the USD:

Another quick note ahead of the NFP data release at the bottom of the hour. This from Shaun Osborne at TD Securities on his concern that markets are too aggressively positioned against the USD:

"Market sentiment is almost universally negative on the USD outlook in the near-term at least, with the Fed expected to remain sidelined for some months. We have not seen any CFTC positioning data for some time but the last release (covering the week through late September) showed net EUR positioning rising to the biggest net long since early 2011; given the price action since then, net EUR long positioning is only likely to have increased.

"In the meantime, risk-reversals have continued to narrow, reflecting weaker demand for USD puts/higher demand for EUR calls, to the point that 3m R/Rs are showing the narrowest discount for EUR calls relative to similar delta EUR puts since January (around the time of the EUR peak being retested at the moment)—another indication of how positioning has shifted. Has market sentiment swung too far against the USD?"

13:30: Non-farm payrolls - how important will they be?

15 minutes to go before this month's main eco-data release. Will it provide fireworks or be a damp squib - many commentators are suggesting the latter.

Ipek Ozkardeskaya at Swissquote Bank has his say:

"There is nothing about this Tuesdays release of NFP that is normal and that is keeping FX traders cautious. EURUSD has been bouncing around 1.3665 to 1.3680 pausing only long enough at the highs and lows to sharply reverse.

"The US September nonfarm payrolls and unemployment numbers are due in the afternoon and the pre-data anxiety dominates the FX trading. Given that September jobs data was originally due on October 4th, the delay naturally generates agitation in FX prices as traders are in need of reference to sit their expectations on."

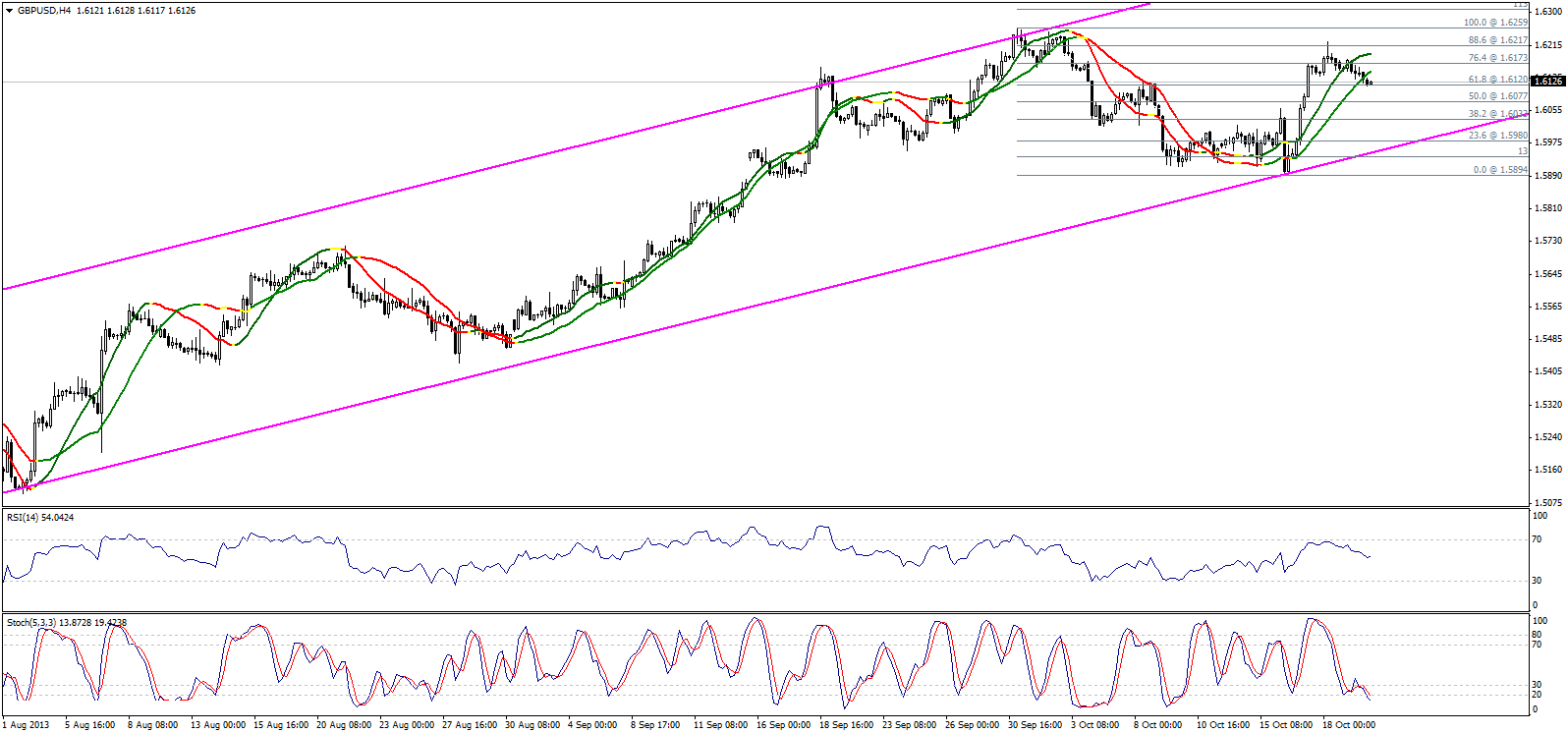

11:44: Hard to call the GBP/USD rate at this stage

More from ICN Financial, this time concerning GBP/USD:

"The bearish correctional wave was halted by 61.8% correction at 1.6120 levels, while the pair was stuck below Linear Regression Indicators. Trading again above 1.6175 might bring positivity back especially that Stochastic is showing over sold signals. We will depend on 1.6075 key level for our bullish expectations."

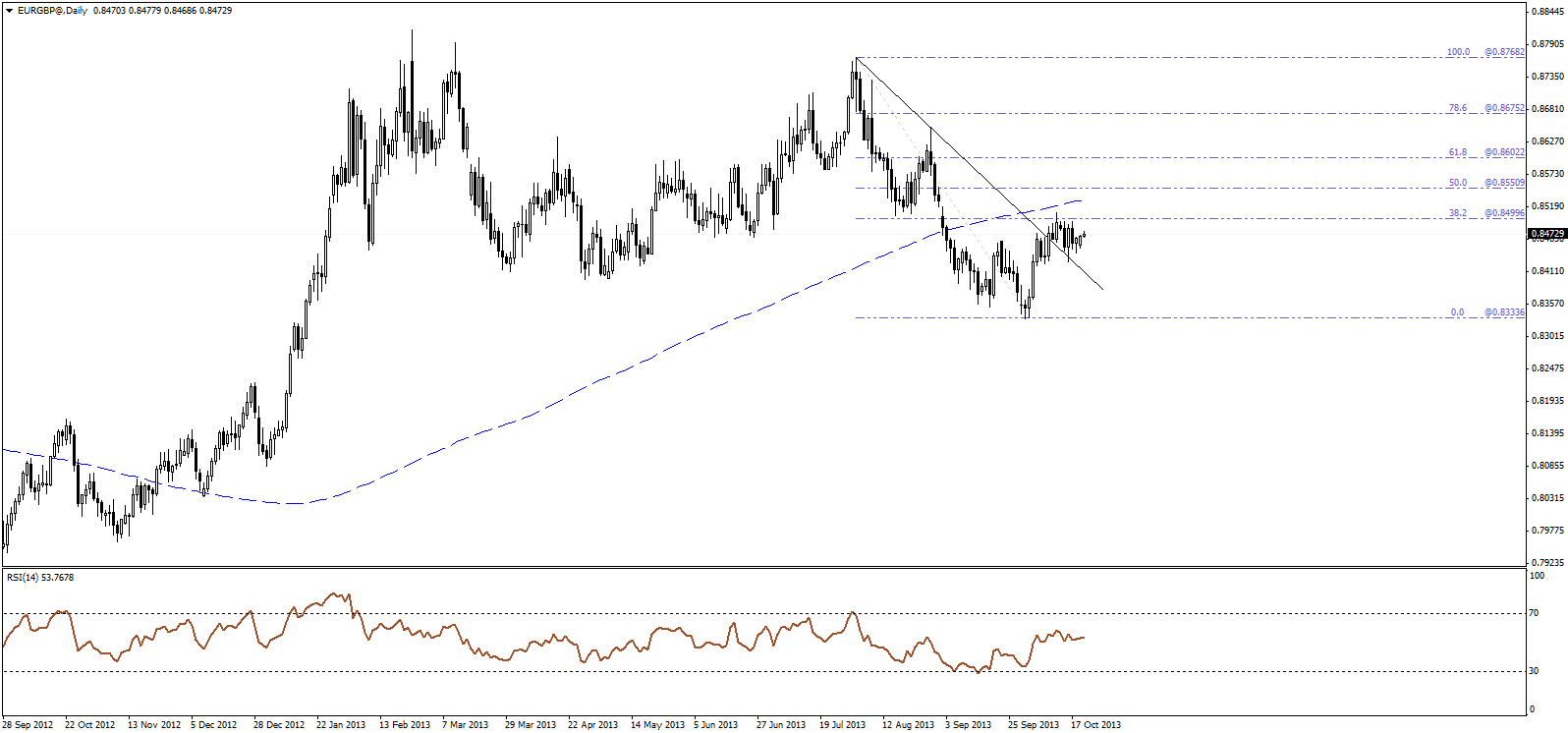

11:28: ICN Financial bullis on euro sterling

Latest forecasts for the euro sterling exchange rate from ICN Financial:

"The pair moved slightly higher yesterday, after completing a retest of the broken falling trend line, where it may head for another test of the 38.2 percent retracement level. Overall, we maintain our intraday bullish bias."

10:41: No asymmetrical response to NFP data warn Swissquote Bank

Mazen Salhab at Swissquote Bank gives us some food for thought ahead of today's all-important non-farm payroll data:

Mazen Salhab at Swissquote Bank gives us some food for thought ahead of today's all-important non-farm payroll data:

"Clearly the highlight of the day will be US payroll reports. Markets are expecting total nonfarm payrolls 180K and 175K for private jobs 180K.While the unemployment rate could hit a new trend low at 7.2%.

"This number will report on the situation prior to the government shut down but there is reason to skew expectations to the lower side. First was the ISM non-manufacturing which fell sharply in September and second is the decline in jobless claims which is more likely to have been cause by a computer error than any real fundamental changes.

"We don’t see the response to the read as asymmetrical as a downside read as it will lower tapering expectations and force the USD marginally lower. While a better than expected number will be discounted since it will encapsulate payroll pre government shutdown."

09:36: UK borrows less money than expected in September

Good news on the borrowing front.

Public Sector Net Borrowing (Sep): Comes in @ £9.368B, analysts had predicted a reading of £10.400B.

Last month the UK borrowed £10.808B.

08:35: 1.62 to provide solid resistance

Emmanuel Ng at OCBC Bank on the outlook for the British pound today:

Emmanuel Ng at OCBC Bank on the outlook for the British pound today:

"We continue to remain neutral on the GBP-USD in the near term and this week, look towards BOE MPC minutes on Wednesday and 3Q GDP numbers on Friday for domestic cues. In the interim expect the pair to be repelled by 1.6200 on the topside while risks may be for a further consolidation towards 1.6100 in the near term."

08:27: British pound predicted to fall today

UniCredit Bank today tell clients they predict GBP weakness today:

"Cable may fall below 1.61 on US data today, but although we see a lower sterling in the medium term, buying back cable ahead of Friday’s expected firmer UK 3Q13 GDP growth number may be favoured."

08:20: Today's agenda

- @09:00: Bank of England Deputy Governor Charlie Bean speaks.

- @09:30: Net Borrowing numbers are released by the National Statistics. £10.400B is expected to have been borrowed in September. Last month £11.452B was borrowed.

- @13:30: US Non-farm Payrolls data is finally released. Analysts are forecasting a figure of 180K, up from last month's 169K.

Unemployment Rate (Sep) is tipped to come in at 7.3%.