British Pound Sterling Live on Monday: GBP Exchange Rates Looking Top-Heavy, Technical Levels Key for Today's Trade

The British pound sterling (Currency:GBP) is holding onto levels seen at the close of last week. Tomorrow brings with it this month's all-important inflation data which could move the UK currency. Until then be aware of where the important technical levels for the British pound lie; this will be the ultimate driver over the course of the next 24 hours. We will also be keeping an eye on Washington politics as this will be a broad market mover.

Latest FX quotes:

- The pound to euro exchange rate is unchanged on Friday's closing level at 1.1782.

- The pound to US dollar exchange rate is 0.14 pct higher at 1.5977.

- The pound to Australian dollar rate is 0.12 pct higher at 1.6873.

- The pound to New Zealand dollar is 0.45 pct lower at 1.9083.

NB: Please be aware that the above are spot market quotes to which your bank will affix their own discretionary spread. Please note, an independent FX provider will guarantee to undercut your bank's offer, thus delivering more currency. Please learn more here.

16:40: What to watch out for tomorrow

Tomorrow we get a stack of data to digest.

But there are three headline releases that traders will be watching out for:

Consumer Price Index (MoM) (Sep). Consensus estimates are for +0.3%, lower than last month's +0.4%.

Consumer Price Index (YoY) (Sep). Consensus estimates are for +2.6%, lower than last month's +2.7%.

Core Consumer Price Index (YoY) (Sep). Last month this came in at 2%. Consensus estimates pending.

Generally, a high reading for the above is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

16:15: Let the GBP/EUR correction run its course

Leander Dreyer at Jyske Bank says he is in favour of letting the correction lower in the GBP/EUR run its course:

"A few important fundamentals will be announced this week. Wednesday will see employment figures, and Thursday retail sales. Last month, retail sales fell by 1.0% m/m against the estimate of 0.0% and GBP weakened by 0.5% on the day and by further 0.4% the following day. A similar negative deviation for retail sales this week (estimate: +0.30) is not expected to give a similar reaction, but it may be close.

"Recommendation: For the long term, we have a positive view of GBP, but we recommend that the correction should take place.

"We expect that EURGBP will trade up to the red, shaded field 85.30-86.20 (see the chart). This will be an attractive level to sell at."

15:04: GBP has lost steam, particularly against the Euro

Matt Boyle at Currency Index on the likelihood of further GBP/EUR declines:

"Some analysts now feel the pound has run out of steam and that given we have already seen much of the positive news from the UK recently, it is likely we could see the Pound continue to lose ground particularly against the Euro which some argue is beginning to show the green shoots of recovery."

14:02: Pound finds little buying support

Luc Luyet at MIG Bank reflects on the lack of buying interest currently being shown towards Sterling:

Luc Luyet at MIG Bank reflects on the lack of buying interest currently being shown towards Sterling:

"GBP/USD has bounced near the support implied by the rising trendline. However, the inability to move above its previous support at 1.6006 (see also the declining channel) indicates a weak buying interest. Monitor the support area between 1.5914 (10/10/2013 low) and 1.5886.

Another resistance can be found at 1.6124 (08/10/2013 high)

"GBP/USD has bounced near the support implied by the rising trendline. However, the

inability to move above its previous support at 1.6006 (see also the declining channel) indicates a weak buying interest. Monitor the support area between 1.5914 (10/10/2013 low) and 1.5886. Another resistance can be found at 1.6124 (08/10/2013 high)."

13:00: What else to expect this week

Ipek Ozkardeskaya at Swissquote Research on what hard data to keep an eye on this week:

"This will be a data-full week for the British pound. Due on Tuesday and Wednesday respectively, the CPI and jobs data will play an important role in GBP-direction. The markets expect slower price inflation and lower jobless claims in September.

"In the context of BoE’s policy framework (forward guidance/ inflation knock-out/unemployment target) the above-stated data are key. Given the recent weakness in economic data (led by last week IP & MP disappointment), softer CPI should convince some players to line up with Carney on the short side of the play.

"The option bets however are leaned to positive with buying interest seen above 1.6025."

12:16: What are the implications of the US missing a coupon payment?

The US could default in coming days. What are the FX implications?

The US could default in coming days. What are the FX implications?

Stephen Gallo at BMO Capital Markets says:

"Because the prevailing consensus is that the actual probability of Treasury missing a coupon payment is extremely low, like last week we are still content to sell USD on rallies above 1.3500, 1.5900 and 0.9050 in EUR/USD, GBP/USD and USD/CHF respectively.

"The potential spillover of a US default from money markets to FX is incalculable, as the USD would have the ability to both rise and fall over the coming 4-5 trading sessions. On the one hand, demand for cash USD holdings could rise sharply, especially if ‘risk assets’ fall.

"On the other hand, some USD exposure from the closing out of riskier positions may be immediately swapped, and financial institutions might also scramble to hold non-USD, high-quality collateral."

10:26: GBP/USD must crack 1.6 for more gains to be realised

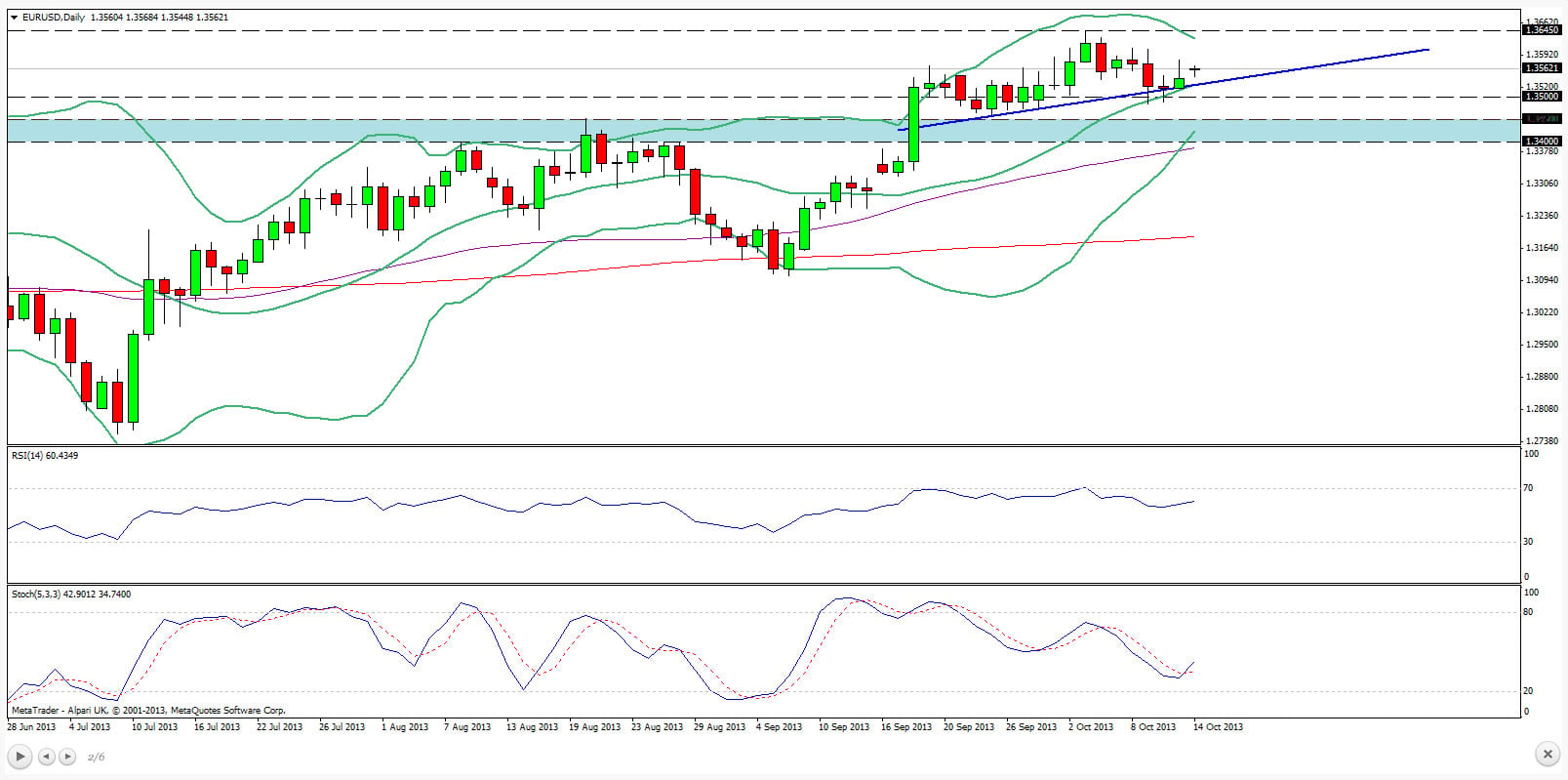

Craig Erlam at Alpari UK says 1.6 remains a critical level for the headline pound vs US dollar exchange rate, and thus broader GBP moves in general:

"Sterling is trading higher this morning, after finding support last week, around 1.5910, from the ascending trend line, dating back to 9 July lows. A break of that trend line could have been viewed as a change in bias in the markets. Traders have been clearly bullish over the last few months and that looks set to continue in the short term.

"The next level of resistance should come around 1.60, a previous level of support and a key psychological level, followed by 1.6025, 1.6055 and 1.6120. Some may view the break of 1.60 last week as a sign that the bias has already turned more bearish and that could be the case. Especially if the pair fails to break back above this level in the coming days.

"A failure to do so would act as confirmation of the original break, prompting further pressure on the ascending trend line that has providing so much support so far. Below here, further support would be found around 1.5910, 1.5890, 1.5826, 1.5780 (50-day SMA) and 1.5750."

09:22: UBS remain GBP bulls

There is no shortage of currency market commentators predicting further GBP falls, let's hear from someone who is backing the UK currency.

Gareth Berry at UBS says he is bullish on GBP/USD:

"The recent weakness is viewed as correction within the bullish trend. Any further downside will find support at 1.5845. Resistance is at 1.6088 ahead of 1.6260."

The pro-GBP view extends to EUR/GBP:

"As long as strong resistance at 0.8500 holds on closing basis potential is for the resumption of downside. Support is at 0.8421 ahead of 0.8333."

09:15: Warnings that GBP is looking top heavy

Emmanuel Ng at OCBC Bank hints at the downside potential behind GBP at the start of the new week:

Emmanuel Ng at OCBC Bank hints at the downside potential behind GBP at the start of the new week:

"Look for the GBP-USD to remain top heavy in the current global landscape and with the implicit support from positive UK data releases wearing thin of late. If the support at 1.5940 gives way, subsequent supports are expected on approach of 1.5900, with little of consequence thereafter till 1.5800."

09:10: Light on the data; focus on the technicals

There is no data due out of the UK today, but we get the release of the latest inflation figures tomorrow, thus trading should be relatively light.

Markets will therefore position themselves along technical lines over the next 24 hours.

We will explore where the important levels over the course of today.