The Pound-to-Australian Dollar Rate in the Week Ahead: Uptrend Alive

© Filipe Frazao, Adobe Stock

- GBP/AUD is rising strongly after three up-weeks as trade tensions weigh on AUD

- The trend higher is expected to extend in the coming week

- The main event for the Pound is the meeting of the Bank of England and for the Aussie it is labour data

The Pound-to-Australian Dollar rate ended last week trading at 1.8164 on the interbank market, after rising over a cent and a half from a previous week's spot close of 1.8007.

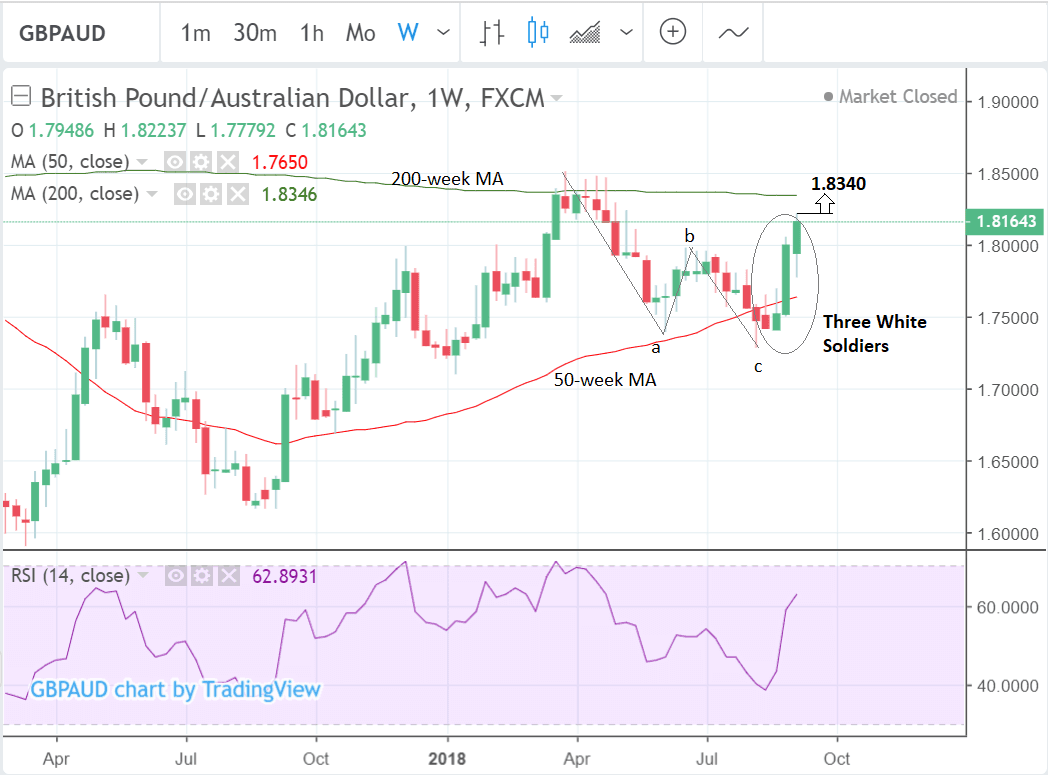

From a technical perspective the pair is now in a more established short-term trend after finishing an abc correction and rising strongly over the last month.

The pair has witnessed three up-weeks in a row since the 1.7410 lows resulting in the formation of a three white soldiers bullish Japanese candlestick pattern, which is a strong indication of a reversal in the trend.

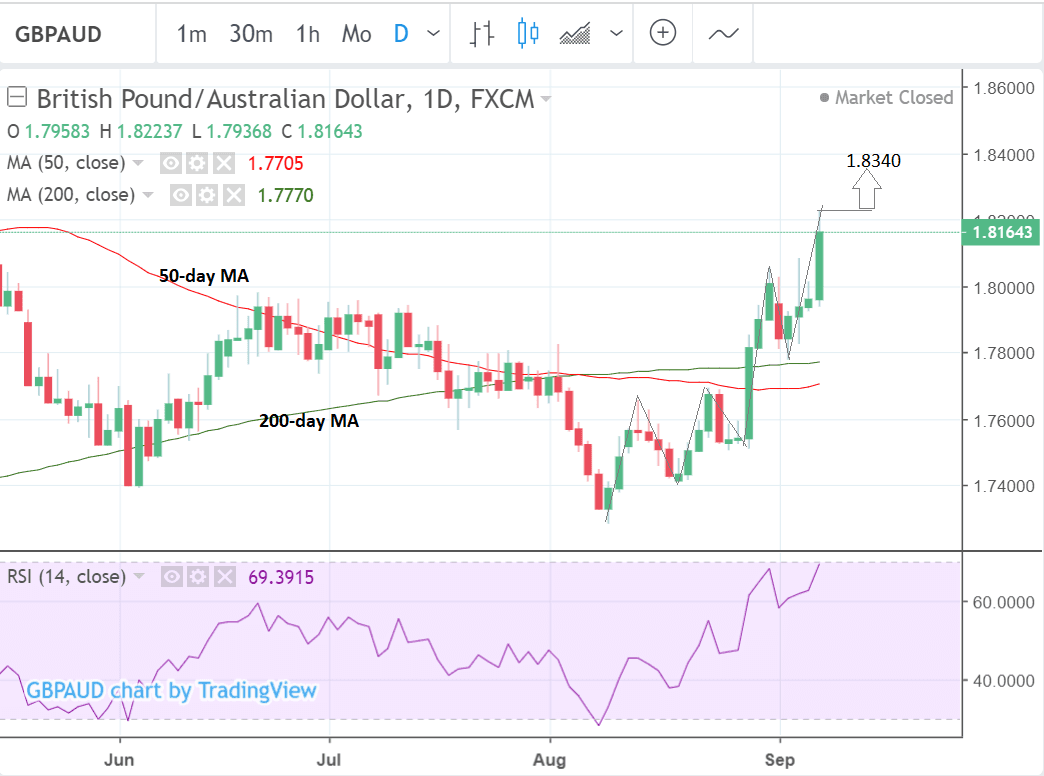

The pair is now forecast to continue rising to the next major resistance zone which lies at the level of the 200-day moving average (MA) at 1.8346, with our target just under at 1.8340.

Large moving averages tend to act as tough obstacles to trending prices which often stall, pull-back or even reverse after meeting them.

Confirmation of further upside to the target would come from a break above the 1.8224 highs.

The daily chart shows how the pair has now broken clearly above the 50 and 200-day moving averages and has formed a bullish sequence of higher highs and higher lows which establishes the short-term trend as up.

Although momentum has almost reached overbought extremes it is not yet quite over 70, nevertheless, it is a sign traders should operate with caution if considering opening any new long trades.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

The main data release in the week ahead is Australian employment data which is forecast to show a 15k rise in August and an unemployment rate of 5.4% when it is released on Thursday at 2.30 B.S.T.

Better-than-expected employment data could help spur the Australian Dollar higher as a strengthening labour market should ultimately deliver better pay growth in the future.

And higher pay makes for higher inflation expectations which could push the Reserve Bank of Australia into bringing forward an interest rate hike. Higher interest rates tend to support currencies as global investors will channel their capital to where returns are better, or are expected to improve in the future.

The other main release is the NAB Business Confidence gauge in August which if forecast to show a balance of 5 from 7 previously when it is released at 2.30 on Tuesday.

Despite strong economic growth indicators the Australian Dollar keeps weakening - partly due to trade war fears pressuring commodity prices lower (of which Australia is a major exporter) but also because the Reserve Bank of Australia is reluctant to raise interest rates - one of the main drivers of currencies - because of subdued inflation expectations.

The RBA held policy steady at its September meeting and suggested rate increases were unlikely for quite some time, it also acknowledged the recent strengthening in Australian economic growth.

Indeed, data released earlier this week showed real GDP rose 3.4% year-over-year in Q2.

That represents the quickest annual growth rate since 2012.

"But with inflation stuck near the bottom of the central bank’s target range, there seems to be no urgency to raise interest rates anytime soon," say Wells Fargo Securities in their latest assessment of RBA policy.

Until markets start betting the date for the next interest rate rise is actually moving closer we doubt the Aussie Dollar will find much support from the all-important interest rate channel.

The Pound: What to Watch

It is a busy week for UK data with several key data releases, and the Bank of England (BOE) meeting scheduled to finish on Thursday at 12.00 B.S.T.

The BOE raised interest rates by 0.25% at their August meeting but they are not expected to continue raising them in September.

Brexit uncertainty remains a key risk factor preventing them from going ahead - unless a deal is struck by Thursday, which seems a little unlikely even under the most optimistic scenarios.

"As for the BoE, which is scheduled to announce policy on Thursday of next week, we do not expect many new developments. The BoE raised its Bank Rate 25 bps to 0.75% at its August meeting, and further increases seem unlikely to be considered unless or until Brexit uncertainty is resolved," say Wells Fargo Securities.

The September meeting does not include a press conference or quarterly inflation report further reducing the chances they will use it to announce any changes in policy.

"The BoE last raised interest rates in August, lifting them above 0.50% for the first time since 2009. It is widely anticipated to hold rates unchanged at 0.75% next week. With no press conference and quarterly inflation report at the September meeting, the Pound may struggle to get much reaction from the BoE’s decision," say brokers XM in a preview of the event.

Another key event for the Pound in the week ahead is wage data which is scheduled for release at 9.30 B.S.T. on Tuesday, September 11.

Wages are leading indicator of growth and inflation pressures and a higher-than-expected increase would probably result in a rise in the Pound as it would increase the probability of the BOE raising interest rates.

Consensus expectations are for wages to rise by 2.5% in July from 2.4% previously (plus bonus). The Unemployment rate is forecast to remain unchanged at 4.0%.

Industrial and manufacturing production figures for July are out at 9.30 on Monday and are both forecast to show 0.2% growth from the previous month.

"Among the key releases will be industrial output figures, which will likely be closely watched for any clues that Brexit uncertainty is affecting manufacturing sentiment," say Wells Fargo.

Trade data is also out in the week ahead with the trade balance forecast to show a marginal widening to 11.75bn July, and Non-EU balance to show an increase to -3.30bn from -2.94bn previously, when the data is released at 9.30 on Monday.

Monthly GDP data at 9.30 and The National Institute of Economic and Social Research (NIESR) GDP mates at 14.00 are also out on Monday and could impact on the Pound if they present a negative outlook for growth.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here