Pound-to-Australian Dollar Rate in the Week Ahead: A Continued Downside Bias

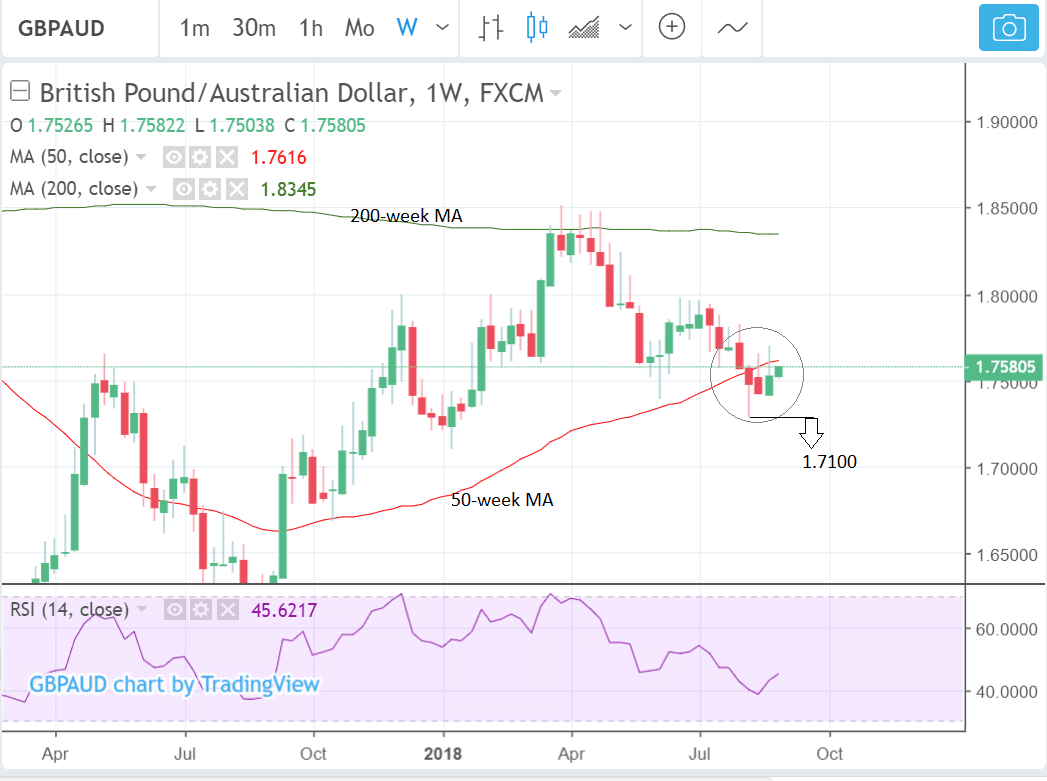

- GBP/AUD is in a short-term downtrend after breaking below the 50-week MA

- Longer-term charts also support more weakness

- Effects on AUD of recent change in Prime Minister remains ambiguous

Sterling suffered a sharp sell-off against the Aussie Dollar at the close of the previous week, and the new week sees the exchange rate trying to recapture some of that lost ground with a small gain being seen on Monday and another small gain being registered at the time of writing on Tuesday.

The GBP/AUD exchange rate is at 1.7571 on the interbank market with quotes on international transfers at high-street bank accounts being seen between 1.7060 and 1.6930 while independent specialists are offering towards 1.7430.

Despite the attempts to recover some of the previous week's losses, the overall trend is down: the pair has broken below the 50-week moving average (MA) which had been containing it and acting as a sort of floor for some time.

The break below the major MA was a bearish cue and strongly indicates deeper declines on the horizon.

The pair formed a bullish hammer candlestick right after breaking below the 50-week MA and has since risen mildly. Although this suggests a potential rebound is underway, the 50-week MA is blocking further upside and acting as a 'ceiling' where once it was a 'floor' - the flip around is quite normal behaviour for major MAs.

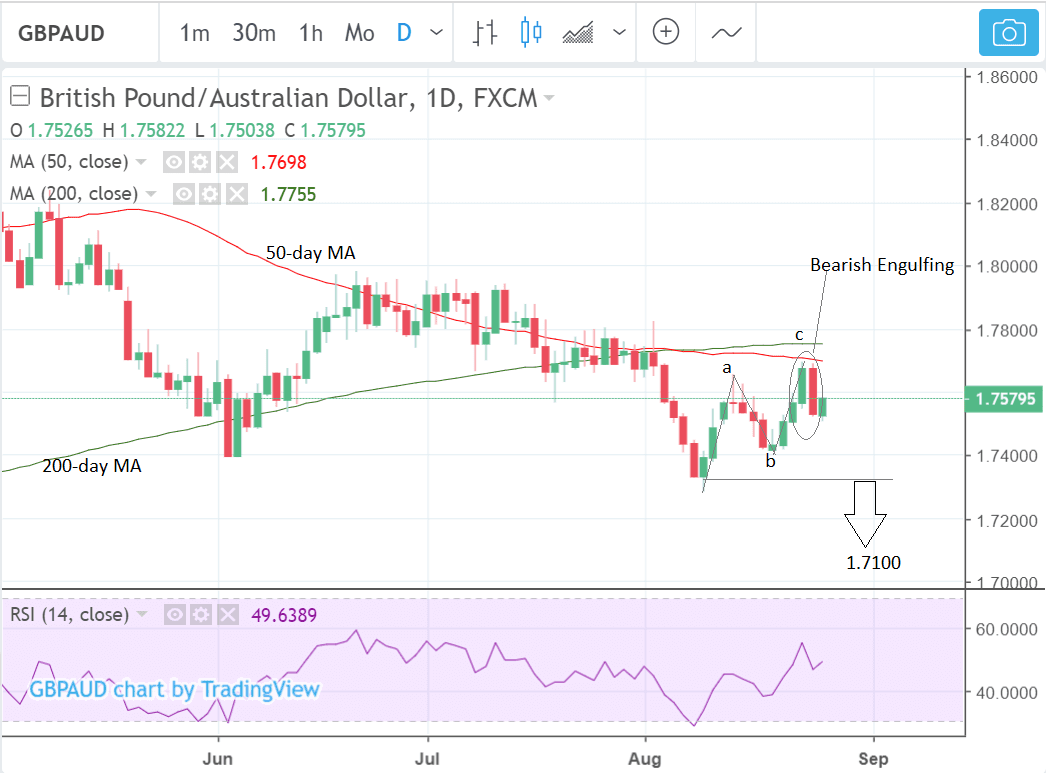

We, therefore, still see a bias for further downside, although would want to see a break below the hammer's lows at 1.7283 for confirmation. After such a move we would expect the pair to continue lower to a target at 1.7100.

The daily chart is showing that the recent recovery has formed a pattern which looks like a three-wave abc correction and is signal that a resumption lower could be about to happen.

The bearish engulfing candlestick pattern which recently formed is further evidence that more declines are about to occur.

The bearish outlook is reinforced by the longer-term charts too.

GBP/AUD has pivoted on the monthly chart after touching the 50-month MA at the April highs. This suggests more downside is on its way.

The pattern of the market from the 2015 highs also vaguely describes the outline of a possible five-wave Elliot wave cycle lower, with a likely end point at the 1.57 lows.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

The Australian Dollar has been subject to politically-induced volatility over recent days with the ouster of Malcolm Turnbull and installation of Scott Morrison as Prime Minister.

Whether or not the developments were behind the Aussie Dollar's strong showing at the end of the previous week, when the news broke, is unclear as there was also a general air of investor optimism on global markets which tends to benefit the Aussie.

Indeed, research from ANZ shows there "there is no clear link between politics and the more important measure of business conditions".

"Volatility in political leadership has been a constant theme in Australia for much of the past decade. The past few weeks have seen another episode, with the Liberal Party tearing itself apart over the leadership. A new Prime Minister is the result. It remains to be seen whether it results in any change in policy," says a note from ANZ on the matter.

Looking at the calendar, there is no one standout data release for the Australian Dollar in the week ahead but there are a lot of tier-two releases.

New Home Sales is out on Wednesday, August 29; the last print showed a -6.1% decline and although it can be a volatile series, a further decline of similar magnitude might weigh on the Aussie as it would start to ring alarm bells for the wider economy.

There is an old saying amongst investors that "housing leads the economy" so it is sometimes seen as a 'canary in the coal mine'. This could especially be the case in Australia where higher-than-average levels of household debt are an ongoing issue.

If it shows an unexpectedly big decline the Aussie could weaken on fears for the economy.

Building approvals data, which shows the number of new projects coming online, is forecast to show a decline of -2.5% in July when it is released at 2.30 on Thursday. This has a similar relationship to the Australian Dollar as new home sales.

Private new capital expenditure is out at the same time as approvals and is forecast to show a 0.6% rise in Q2; it is a growth metric as capital expenditure helps new businesses to set-up and grow. The higher the better for the Aussie Dollar.

On Friday, August 31 at 2.30 private sector credit for July is released with a 0.3% rise forecast. Credit is generally related to growth and a stronger currency, although credit is already stretched in Australia so it may not have the same relationship.

The AIG Manufacturing Purchasing Managers Index (PMI) in August is out at 23.30 on Friday.

The PMI is a sentiment gauge based on survey answers from pivotal purchasing managers in manufacturing firms. Its seen as a leading indicator for growth in the sector. A result above 50 represents expansion; below contraction. Last month it came out at 52.0.

The Pound - What to Watch

Brexit remains the overarching factor driving Sterling values at present with negotiations entering a key phase with markets becoming increasingly weary that the two sides remain too far apart to reach a deal.

After their meeting on Tuesday, August 21 UK Brexit Secretary Dominic Raab and EU chief negotiator Michel Barnier announced that with some key autumn deadlines fast approaching, negotiations will now be ongoing. Raab and Barnier will probably meet again on Tuesday, August 28, so we will be looking for any communications.

Latest developments see Prime Minister Theresa May preparing a "cabinet crisis summit" to prepare for a 'no deal' Brexit, amid fears that a cabinet row between 'Remainers' and 'Brexiteers' will stop Britain going it alone, and undermine her negotiating position with Brussels.

The Prime Minister's office has reportedly ordered cabinet ministers to clear their diaries for September 13 to work on a plan to pump fresh cash into critical areas not yet covered by disaster plans.

Only when markets are convinced that a 'no deal' Brexit will be avoided to we believe the conditions for a sustainable recovery in the Pound will emerge.

On the calendar, there are no stand-out events for the Pound in the week ahead so we comment on them chronologically.

The week for Sterling starts with the continued testimony of Bank of England (BOE) officials before the the Parliamentary treasury select committee on Tuesday, August 28. Any new information on where interest rates in the UK are headed over coming months could well move Sterling.

Few analysts realistically expect the BOE to raise interest rates until the outcome of Brexit is clarified and therefore the next possible move will likely come later in 2019, but there is always an outside chance officials may hint differently on Tuesday.

If it seems more likely interest rates will rise then the Pound will also rise because higher interest rates attract greater inflows of foreign capital, drawn by the promise of higher returns.

The next major release for the Pound is house price data from Nationwide, on Wednesday, at 07.00 B.S.T, which is forecast to shown a 0.1% rise in August from July and 2.6% compared to a year ago. This is unlikely to move Sterling unless it comes out widely different from expectations.

Thursday sees lending data out at 9.30, including BOE Consumer Credit in July, Net Lending to Individuals, Mortgage Lending and Mortgage Approvals also all for July. These may be significant as the gauge consumer's stomach for credit and therefore their ability to spend extra cash. Higher spending generally aids growth and is positive for Sterling.

Friday sees the release of Gfk Consumer Credit data for August, which is expected to come out negative at -10, when it is released at 12.01. This is important in a similar was as the BOE data above.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here