Pound-to-Australian Dollar Week Ahead: Further Gains seen in the Charts, RBA Dominates Outlook

- Technicals suggest GBP/AUD remains supported

- Watch UK PMI data out this week for a flavour as to whether August rate hike is a go

- RBA decision on Tuesday, July 3 forms focus for AUD this week

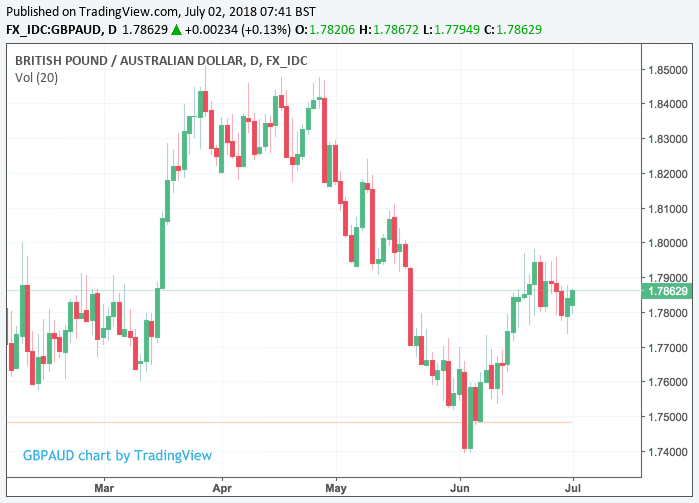

Pound Sterling opens the new week against the Australian Dollar at 1.7860, a recovery from the previous week's low of 1.7737.

GBP/AUD has been under pressure over recent days, in line with broad-based GBP weakness which in turn stems from ongoing concerns about the state of Brexit negotiations.

However, the weakness should not be overstated and could be viewed as being a period of consolidation as the short-term trend remains positive. June was a good month for Sterling against the Aussie Dollar with the exchange rate moving from a June 1 low at 1.7542 to a June 21 high at 1.7980.

The short-term trend is therefore higher and this week we will be looking for progress towards the June 21 highs at 1.980 where market resistance lies should the consolidate period indeed come to an end.

Analysis from Trading Central - an independent technical analysis provider - shows a bias for more gains in the exchange rate, provided the exchange rate remains above 1.7813 support.

"The RSI is above 50. The MACD is above its signal line and positive. The configuration is positive. Moreover, the pair is trading above both its 20 and 50 MAs (respectively at 1.7833 and 1.7820)," say Trading Central in a note dated July 2.

An upside target is identified at 1.7933.

Image courtesy of Trading Central.

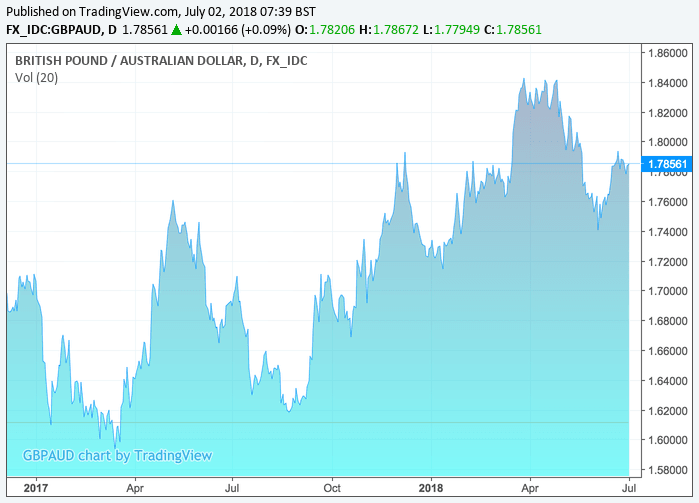

Indeed, the Long-term trend for this exchange rate remains higher, with the Bank of England providing Sterling support via higher interest rates while the Reserve Bank of Australia continues to sit on current policy settings creating a divergence in policy that favours GBP.

Furthermore, a gradual injection of clarity into the Brexit debate is also seen aiding the UK currency back towards pre-EU referendum levels.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Australian Dollar: Waiting for the RBA

The Australian Dollar staged a decent recovery on the final day of the month thanks to the atmosphere of generalised Dollar weakness, however the currency is largely flat at the start of the new month.

Data out today was largely disappointing, ANZ Australian Job Advertisements fell 1.7% in June, reversing the 1.4% gain recorded last month. This was the fourth monthly decline in six months of data released for 2018, though these falls do follow the very strong rise in January.

On an annual basis, growth slowed from 11.5% in May to 6.9% in June. This is the weakest annual growth since the second half of 2016.

Markets are likely to sit on AUD ahead of Tuesday's Reserve Bank of Australia meeting with markets getting an update on the Bank's thinking on interest rates at 05:30 B.S.T.

No interest rate rise is expected but the RBA's views on developments and the jobs markets will give a strong hint at the confidence at the RBA and in turn drive market pricing for the future of interest rates which are widely expected to go up again at some point in 2019.

Any new notes of caution inserted into the RBA's guidance will surely push that pricing out and contribute towards any potential AUD weakness.

"The Australian Dollar has been hit hard over the past several weeks, most recently sinking below the 2017 low. The risk correlated commodity currency is staring at a less stable outlook on the back of US protectionism, favourable US Dollar yield differentials, declining metals prices and a reduction in investor appetite for equities. There has been some demand into the new week, with Aussie following the Euro higher after word spread of the migrant deal," says a client briefing from LMAX Exchange at the head of the new week.

Economic Data and Events to Watch for the Pound

The Week Ahead in the UK sees the economic data calendar return to life following a seven-day period in which the few releases of note were all concentrated in the final session of the week.

IHS Markit will release the latest surveys of purchasing managers across the manufacturing, construction and services industries over the first half of the week while a speech from Bank of England governor Mark Carney caps off the week's data on Thursday.

The PMI data is important as it will give markets a sense of whether or not the UK economy is progressing in a manner consistent with an August interest rate rises from the Bank of England in August. If the answer is yes, then expect Sterling to find support, all else being equal.

Markets are looking for the IHS Markit Manufacturing PMI, due at 09:30 am on Monday, to slip from 54.4 in May to 54.1 for the month of June.

Consensus suggests the construction PMI will rise from 52.5 to 52.6 and that the all-important services PMI should remain steady at 54 when the data are released at 09:30 on Tuesday and Wednesday respectively.

Economists and traders will watch all of these releases closely for an early steer on the likely condition of the UK economy during the final month of the second-quarter. While imperfect as a gauge of overall economic growth, the surveys do provide insight into activity levels within three of the UK's most important economic sectors.

Currency markets care about growth because it has a direct bearing on inflation and it is changes in consumer price pressures that central banks are attempting to manipulate when they tinker with interest rates, which are themselves the raison d'être for most swings in exchange rates. Changes in rates, or hints of them being in the cards, impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

The UK economy slowed sharply in the first-quarter so policymakers and economists have been watching for signs as to whether this was a seasonal blip or the beginning of a more protracted slowdown. Thursday Bank of England governor Carney will give an as-yet unspecified speech in Newcastle, England so markets will listen closely for clues as to his latest take on the economy, as well as the outlook for UK interest rates.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.