Bullish RBA Prompts Australian Dollar Higher, Markets Price in March 2019 Rate Rise

The Australian Dollar has struggled over recent months but the prospect of higher interest rates at the Reserve Bank of Australia in 2018 could prove supportive.

The Australian Dollar was seen higher on Tuesday, December 5 as markets responded to the latest monetary policy statement from the Reserve Bank of Australia, which saw traders bet an interest rate rise could be delivered by the Bank in March 2019.

This matters for the Australian Dollar, which has been one of the worst performing global currencies over recent months owing to a decline in Australia's interest rate advantage over other nations, because Australia's high basic interest rate has for years underpinned the currency's strength.

But hints of higher interest rates in Australia in the near-future could once again afford the currency more support.

Australia's central bank left the cash rate unchanged at 1.5% for the 16th month in a row Tuesday, although the latest statement stood out for its bullishness on the Australian and global economies.

The RBA noted a further improvement in the outlook for non-mining business investment and flagged that the Australian economy grew at its “trend rate” during the year to the September quarter.

It sounded slightly more positive on the economy, with their forecasts suggesting GDP is expected to rise by around 3% annually over the coming years and, with the unemployment rate already down over the course of 2017, the labour market is seen tightening further during the coming quarters.

“The employment market outlook is quite positive with the leading indicators pointing to solid growth over coming quarters. There are some reports of labour market scarcity. However, wages growth remains low. The RBA expects a gradual lift in wages growth as labour market conditions tighten,” says Michael Workman, an economist at Commonwealth Bank of Australia.

This could have important implications for the elusive inflation pressures that many of the world’s central banks are chasing. Importantly for markets, the RBA flagged recent reports of labour scarcity, with some employers now finding it difficult to hire skilled workers.

Higher inflation = higher interest rates and ultimately = a stronger currency.

Notably for the Aussie Dollar, the RBA appeared to dial-down its language on the currency, stating in the latest report that the "Australian dollar remains within the range that it has been in over the past two years."

While the RBA noted that a further appreciation could result in a slower-than-expected pickup in growth and inflation, the statement marked a departure from the RBA’s earlier lamentation of Australian Dollar strength.

“We suggested last month that the ‘perfect storm’ of economic and political issues pressuring the AUD could feasibly abate and allow the currency to recover its footing,” says Neil Mellor, a senior currency strategist at BNY Mellon.

"This appears to be what has happened and today, assisted by some positive Australian and Chinese data, the RBA’s slightly curtailed assessment of the AUD’s impact has perhaps persuaded some that the Bank is more comfortable with current levels (0.75-0.76)."

Above: AUD/USD shown at hourly intervals.

Bond Yields are King to the Dollar

The Australian Dollar was quoted 0.56% higher at 0.7645 against the US Dollar during early trading Tuesday while the Pound-to-Australian-Dollar rate was marked 1.06% lower at 1.7531.

Australia’s currency has spent much of the recent months under pressure from domestic economic and political uncertainty, waning expectations for an RBA rate rise in the near future and price action in fixed income markets.

“It should be noted that the AUD’s (5%) slide against the USD since September began as Aussie/UST yield spreads topped out in the autumn, since which time they have ceded 40-60 bps across the curve, taking them to levels not seen since the turn of the millennium,” BNY’s Mellor adds.

What happens next for the Dollar will depend as much on the direction of US Treasury yields as it will on developments within the Australian economy and Australian interest rates.

“The two year yield spread has all but vanished, whilst the Aussie ten year offers only 20bp over USTs. Put another way, the higher yielding status of the AUD, which has served the currency so well in recent years, is no longer applicable,” says Mellor.

With lawmakers in Washington on course to sign off on President Donald Trump’s tax reforms, the danger for the Aussie Dollar is that US yields rise further over the course of December.

This could eliminate the additional yield offered to investors holding Australian 10 year bonds over US ten year bonds and, for all of the RBA’s bullishness Tuesday, could still undermine the Australian Dollar even further during the weeks ahead.

Above: Pound-to-Australian-Dollar rate at hourly intervals.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

About Interest Rates and the RBA

The faceless race of financiers referred to in the financial media by the ubiquitous label 'international investors' is, in fact, a select group of money managers who control vast sums of capital.

They manage and move this capital like a game of risk - but with money rather than counters - investing here, pulling out there, re-investing, purchasing - property, gold, equities, bonds..or simply just staying in cash.

The important thing for us is that their actions have a profound effect on foreign exchange markets, because of the international dimension to their dealings.

If they particularly like the assets of a country, they will pour billions into it, creating a demand bump for that country's currency, which then rises. Another major draw for international investors is interest rates.

If they can get a higher interest rate on their money in one country compared to another, at no extra risk, then they will move their money to where it can earn the most interest.

This, of course, has implications for the exchange rate which rises for the country with the higher interest rates, as increased demand pumps up its currency.

By way of a long preamble, this explains why interest rates are such a big driver of FX, and therefore why the meeting of the Reserve Bank of Australia - to set Australian interest rates - is so significant for the Aussie Dollar.

The central bank sets interest rates according to inflationary pressures, raising them to combat rising inflation or lowering them to stimulate growth and inflation.

Inflationary pressures in Australia currently, however, remain modest, so the RBA is widely expected to keep the cash rate at its present 1.5% level for the foreseeable future.

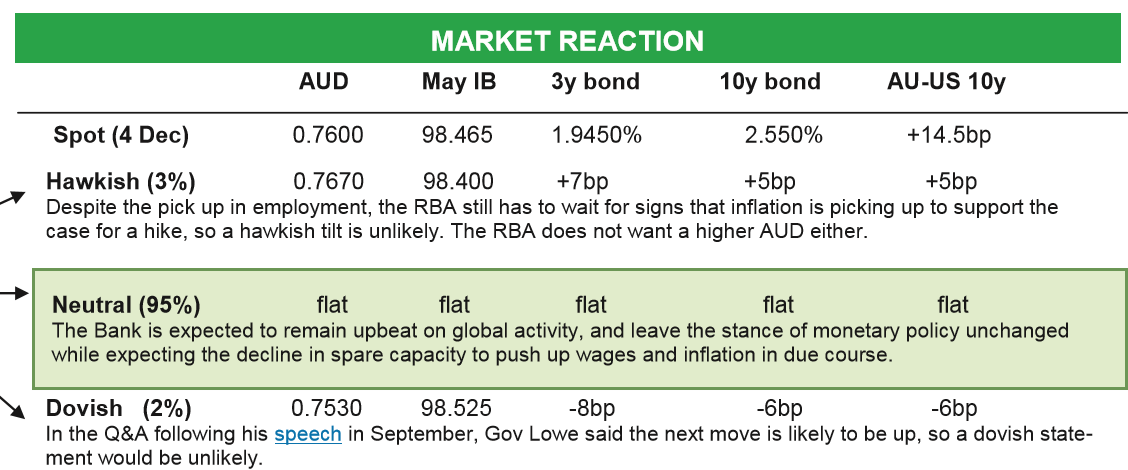

Canadian investment bank TD Securities produced a useful guide to how they saw the RBA decision unfolding Tuesday, which readers might find helpful when considering what the bank might do in future.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.