Pound / Australian Dollar Buoyed by Bulk Metal Price Slippage

The ongoing decline in global bulk commodity prices continues to allow Sterling to remain in touching distance of recent highs.

The Pound to Australian Dollar exchange rate is seen at 1.7427 having been as low as 1.7141 in mid-week trade.

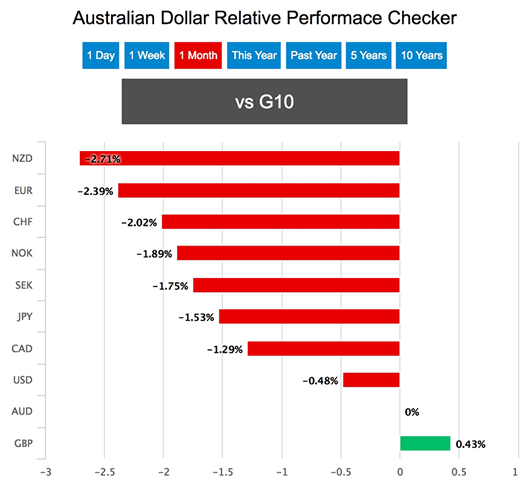

The move higher comes amidst broad-based Australian Dollar under-performance, indeed AUD is the second-worst performing G10 currency with only Norway’s oil-linked Krone doing worse.

Domestically, the Australian economy continues to tick along at a relatively uninspiring pace leaving the currency exposed to external drivers.

With coal and iron exports making up the majority of the country’s foreign exchange earnings basket it should come as no surprises that recent fluctuations in global commodity prices are weighing on AUD:

- Iron ore 62% Fe spot (cfr Tianjin) US$54.9/t today vs US$57.9/t yesterday

- Chinese steel rebar 25mm US$585.4/t today vs US$587.2/t yesterday

- Thermal coal (1st year forward cif ARA) US$66.7/t today vs US$68.0/t yesterday

- Premium hard coking coal Aus fob US$149.2/t today vs US$149.6/t yesterday

Market nerves were shaken this week when the Caixin purchasing managers index fell to 49.6 from 50.3, the lowest reading since June 2016.

“China’s crackdown on emissions and pollution in general is causing some disruption in commodity markets,” says John Meyer, an analyst with brokers SP Angel.

Clearly the country is taking a hit to activity just as US President Donald Trump takes the US out of the Paris Agreement on climate change.

Trump accused the pact as being a back-door attempt by countries such as China to gain a competitive advantage over the US.

Evidence suggests China is however experiencing pain, and Australian exports are caught in the cross-fire.

“Softer growth in output reflected a relatively muted increase in total new orders during May," report Caixin and IHS Markit.

Furthermore, growth in new order books was also the slowest seen since the current upturn began in July 2016.

Data indicated that customer demand was relatively subdued both at home and overseas, with new export sales rising at a similarly marginal pace.

Expect sentiment towards AUD to remain soft in this environment.