Australian Dollar Ignores RBA Minutes But Weakens on Devaluation of Iron Ore

The Australian Dollar rose in the five minutes following the release of the Reserve Bank of Australia (RBA) April meeting minutes on Tuesday, April 18.

This came as a surprise to market-watchers as the minutes reflected the broadly pessimistic view of the economy voiced at the original April 4 meeting.

The Financial Times insisted the Aussie Dollar had weakened after the announcement despite evidence to the contrary and began its piece devoted to the minutes saying: “The Australian dollar took a tumble after the country’s central bank warned that the domestic labour and housing markets warranted “careful monitoring” over coming months.”

Whilst a decline in the Australian Dollar versus the US Dollar did occur, it did so 21 minutes after the release of the minutes, and saw the exchange rate fall from 0.7590 to 0.7530 over the next nine hours, though whether this was a direct consequence of the minutes is debatable, as a sharp fall in Iron Ore prices also occurred around the same time and may equally have been the catalyst for the drop.

Iron ore is Australia’s largest export and its price impacts substantially on the aggregate demand for the currency.

The drop this morning saw the spot price of Iron Ore fall over 5.0% to below $65 per tonne, according to the Steel Index.

This contrasts with the price of over $90 a tonne only three months ago.

Data since Minutes Has Altered View

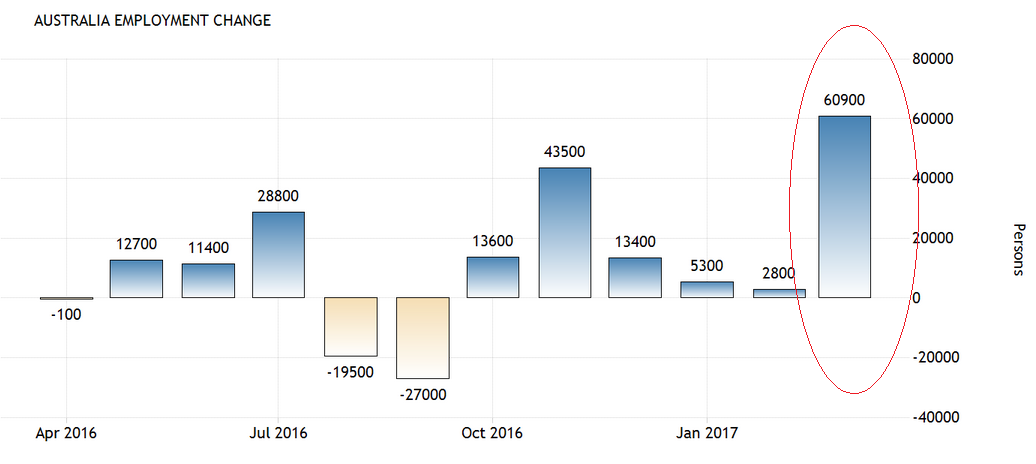

The RBA’s minutes noted a weakening in the national labour market, however, recent data painted a more optimistic picture.

Labour market data released on April 13 showed a massive rise in the number of people joining the workforce in March, of 60k, which easily beat consensus forecasts of 20k, whilst the Participation Rate also rose two basis points and the share of part-time workers fell.

The positive news around the labour market helped assuage the RBA’s fears on the sector.

Another major concern of the RBA mentioned in the minutes was housing, which has seen house prices growing at a pace which has outstripped incomes.

“Growth in housing credit continued to outpace growth in household incomes, suggesting that the risks associated with the housing market and household balance sheets had been rising,” said the RBA in their minutes.

However elsewhere in the minute the RBA offered a more nuanced view saying the problem varied across regions.

“Conditions in the established housing market had continued to vary significantly by region. Housing price growth had been strongest in detached housing markets in Sydney and Melbourne and some indicators for the established housing markets in these cities had picked up in the preceding couple of months. In contrast, housing market conditions in Perth had remained weak, although there were signs that prices there may be stabilising.”

Nevertheless, the bottom line remains that house price growth remains a financial stability risk in the eyes of the RBA:

“Risks related to household debt and the housing market more generally had increased over the preceding six months.

However, the nature of those risks differed across the country, according to the varying conditions and activity in local markets. Although credit to the household sector had been growing modestly relative to history, growth had been faster than income growth and the aggregate debt-to-income ratio for households had increased.”

Minutes Point to Unchanging Policy Outlook for RBA

“The RBA minutes reinforced our view that the RBA is likely to keep the Official Cash Rate (OCR) unchanged this year,” said Abn Strategist Roy Teo in a note following the release of the Minutes.

The risk to financial stability posed by unfettered house price growth which is outstripping the ability of workers to afford it, is a concern for Abn’s Teo, and makes it highly unlikely the RBA will lower interest rates any further as this would increase lending even more.

“Given ongoing concerns that housing credit is expanding at a faster pace than household income, the scope for more monetary stimulus remain limited, in our view. In addition, underlying inflation has troughed and is expected to rise gradually. Finally, the RBA has preliminary assessed that the overall impact on consumer prices and domestic growth was not expected to be large following Cyclone Debbie in Queensland and floods in Northern New South Wales,” said Teo.

Teo thinks that the AUD/USD pair’s low volatility is likely to persist.

Volatility over the last month has declined to the lowest level since late 2014.

Markets are pricing in via options that the AUD is likely to trade approximately within a 3 percent range of 0.74-0.77 against the USD over the next one month.

Teo thinks this is, “probably a reflection that financial markets expect the RBA to keep the OCR unchanged this year and that the US Federal Reserve is unlikely to tighten monetary policy in the next FOMC meeting on 3 May.”

As far as the US Dollar goes, Teo see’s upside now as problematic, given the difficulty with which Trump may have to realise his election promises.

Trump has also been busy talking down the Dollar and a cheaper unit would be a preferable starting point for his protectionist trade agenda which is likely to push up the Dollar in itself.

Although the Dollar rose a little overnight after US Treasury Secretary Mnuchin said that dollar strength is good over long periods of time, its upside is likely to be curtailed longer-term as US Democrats seem “unwilling to cooperate on any rewriting of the tax code unless US President Trump release his tax returns.”

Indeed Mnuchin acknowledged that the goal of getting the tax plan signed by August this year was, “not realistic at this point,” said Teo.

Conclusion: Weaker AUD to Come

“Looking further ahead, we expect a slightly weaker AUD given that iron ore futures have declined by almost 30% since hitting a peak earlier this year in February,” said Abn’s Teo.

The Fed is also not likely to increase interest rates in June as had been expected for a while.

Fed funds futures are pricing only a 50% chance of a 25bp rise in June, and investors may have to wait until September for the next interest rate rise.

.